2025 will be the year where data becomes very important to professional companies as they work to maximise margins and use this to create stronger foundations as other pressures build. There are significant problems, however, and we discuss them below to weed out the issues and discuss how to avoid the continual fluctuation of results. Data covers all elements of the STR business, and we will cover all of this over the coming year, revealing anonymised collective company statistics and attempting to create financial industry metrics.

In this first analysis, we are concentrating on the most critical managers or hosts’ challenges they are most concerned about when filling the sales funnel:

Is there a problem?

Dynamic pricing is a tactical tool in revenue management that involves adjusting prices in real-time or near-real-time based on supply, demand, competitor pricing, and other variables. Generally speaking, data reliability depends on the customer of a dynamic pricing tool, location, inventory size, business ethos and industry purpose. The STR sector should always be split into three market segments to review your challenges, as each has increasing data collection challenges.

- Truly urban

- Leisure/Urban (LU)

- Pure vacation rentals (VC)

The answer is yes, and from speaking with many managers across all three sectors that there are issues with automated pricing, which is measured by two major factors:

- reduced occupancy

- Visibly incorrect pricing (high or low) affects a) or offering up far too low prices and suffering bookings that affect an owner’s income and company reputation.

Is this a long-term issue or a short-term problem?

We need to understand how dynamic pricing companies work and uncover the magic that has seen many companies raise substantial amounts of money.

Scraping OTAs involves using automated tools to extract publicly accessible data from online travel platforms like Airbnb or Booking.com. The primary reasons for scraping this data are not just for dynamic pricing reasons. They can include market research, competitor analysis, performance benchmarking, and gaining customer insights. Property developers will use this data to analyse best income returns, growth, etc., and others will use it to measure the growth of STR competitors and their use of OTAs in the marketing mix,

Technical methods for scraping include web crawlers, which navigate and extract data from web pages. Proxies and IP rotation help avoid detection while handling dynamic content, often requiring JavaScript rendering tools.

In recent years, OTAs have become more resilient to scraping and have moved from adding friction on guests (captcha, etc) to more automated approaches. Bot mitigation approaches identify bad bots through improvements in detecting abnormal or suspicious behaviours. One of the toughest challenges for state-of-the-art bots is replicating the unpredictability of actual human behaviour. Take cursor movements, for instance: human patterns rarely follow perfectly straight lines, whereas bots often default to them. Analysing key presses and mouse movements makes a difference,e and its no wonder all OTAs push hard to logins and member accounts. Don’t forget that OTAs also probably scrape each other. AI will make scraping easier and harder as the AI tools defend against it!

Is it legal to scrape data?

If you are interested, it is best to ask a copyright lawyer. Still, the consensus is that web scraping is not inherently illegal, but the methods used and the purpose of the data’s use can raise legal and ethical issues. Scraping copyrighted material, collecting personal data without consent, or disrupting a website’s normal operations may cross legal boundaries.

The legality of web scraping varies based on jurisdiction and specific circumstances. In the United States, web scraping is generally permissible if it does not violate the Computer Fraud and Abuse Act (CFAA), the Digital Millennium Copyright Act (DMCA), or breach a website’s terms of service. LinkedIn vs. hiQ Labs (2019) is a landmark case in this area, where the Supreme Court ruled that scraping publicly accessible online data is legal. This decision set an important precedent with significant implications for the future of web scraping.

Whatever the position on the legal niceties, it is happening, and if you use a dynamic pricing tool, the likelihood is that you are using scraped data.

What is scraped?

The simple answer is “as much as possible”. STR properties have basic comparative amenities and features. They can be identified by the filters all these systems use: type of property, location, prices, availability, number of bedrooms, bathrooms, amenities, reviews, etc.

Why is the data not always correct?

Timing: OTAs often display dynamic pricing and availability that change based on demand, location, user behaviour, or even the time of the day. Scraped data might only capture a snapshot, which could quickly become outdated. Most scraping companies will only scrape every 24 hours. PMSs and their pricing tools and partners will determine the pricing, but when OTAs can manage pricing automatically, this causes challenges. The timing of system updates by PMS and dynamic pricing tools are also factors. Many OTAs also personalise search results based on cookies, browsing history, or location.

This all makes the data highly variable depending on the conditions under which it is accessed. Prices, availability, and listing details can vary based on the user’s IP address or location, termed geo-fencing. The results may not reflect complete or accurate data if the scraper is not configured to account for regional variations. Some vital metadata, such as policies, discounts, or additional fees, might not be correctly scraped if stored in pop-ups, tooltips, or separate API calls. Variations in how data is displayed across listings can lead to errors in parsing or structuring the data. Prices shown might exclude specific fees or taxes, or currency conversions might be overlooked, leading to inaccurate comparisons. Some scraped listings might have already been updated, booked, or removed from the OTA platform but still appear in the scraper’s output. Errors in the scraping code can result in faulty data extraction or formatting.

Supply OTA management. The post-Covid domestic booking boom best represents this. In this period, domestic demand was substantial, and there was a much higher opportunity to make direct and profitable bookings. In this period, companies, particularly the larger ones with powerful direct marketing, blocked or raised prices even more on OTAs. Although an exceptional example, this happens yearly in VR and LU destinations and can affect data assumptions. This is especially true if larger companies are a significant part of the scraped data. The scraping companies can and will adjust for it, but is not necessarily correct.

Owners, maintenance and tech: The higher the property booking value, the more rural and hyper-seasonal the property is, and the more we witness inaccurate pricing. Why is this? Firstly, value properties often require much more personal interaction and are higher priced, meaning they are less commonly booked on OTAs as a percentage. If they are, the prices are often raised substantially to push even more referrals to direct bookings. There are also a smaller number of these higher value properties. Secondly, these properties are often used for extended periods by owners or are closed out of season. Add in the fact that many higher quality properties are booked outside OTAs, and tech is less important; they are often unavailable to be presented on OTAs. In summary, there are lower numbers and questionable booking dates and prices.

Managers pricing and policies: Loyalty and parity are not words often used in the same breath as OTAs. In years gone by, some companies, namely Booking.com, had price parity clauses and price parity police. On September 19th 2024, Europe’s top court ruled against Booking.com’s use of parity clauses in their hotel agreements. While the OTA giant already removed these clauses in the EU in July and had not enforced this for some years, this ruling means that these changes will likely stick around for the long run. It may also discourage others from attempting this.

Unfair practises: Some readers will have noticed that some OTAs offer prices that don’t match the ones presented and may even be cheaper than the base price set, regardless of whether you receive the same money. Some have raised prices and offered discounts to the base level pricing in the past, which is somewhat of a guest con!

Distribution mix: Properties are often distributed across multiple channels and not always at the same prices. Scraping data from different sources and matching the property means there has to be some innovative algorithm to compensate, but what is the actual cost? In addition, the use of PMS and iCAls allows blocking on some and not others, and this may be dependent on guest type, seasons, or the fact that some inventory has been accrued exclusively by a third-party marketing agency or travel agent.

There are innumerable challenges when scraping data from multiple sources, not least the technical aspects, the lack of standardisation on listing and presentation, and second-guessing many of the issues above and dealing with them.

There is a potential solution: “Source of Truth” data.

It is called “source of truth data” but relies on several factors:

- Access to this information, where accurate bookings and real owner blockouts are recorded, and all the relevant information about properties is stored.

- Sufficient information in a specific location to ensure statistically reliable information.

- It is practical to use

- It is simple to interpret.

The gatekeepers to this data are PMS systems; no surprises here, and accessing this information means:

- API integrations

- PMSs with sufficient data in a particular region

- Paying the gatekeeper for access

A company such as Key Data Dashboard is rapidly expanding its connections to PMS companies, and this approach is the only real solution to accurate data. A PMS, of course, can also provide data if it is big enough.

Scraping companies will buy in or have reciprocal data agreements with the source of truth companies. Channel managers have real-time pricing and availability but not direct booking information or owner blockouts. They are also slowly sidelined on connections to the major OTAs, and data will be less relevant. Larger companies and those with self-developed PMS systems are also not offering up information unless they are connected to a funnel of composite data they can use themselves. This large amount of “source of truth” data gathered directly from property managers or owners is added to a collective pool, aggregated and anonymised to maintain confidentiality.

How vital is comparative data?

To some, it is hugely important. To others, it is irrelevant. The larger the company, the more diverse its portfolio in type and geo-distribution, and the more critical data become. Part of the issue is that there is adoption by an increasing number of companies in the market, with dynamic pricing tools and hands-on revenue management now being needed more often.

This trend means data changes quickly as companies push for early occupancy, tailored pricing, deals and offers, and targeted marketing. In most markets, it is no longer good enough to stand still and tinker with prices every few months.

In many destinations, we see oversupply, which means being extremely proactive about filling calendars. However, some destinations have limited and regulated supply and heavy travel demand, making the data and pricing management concerns less imperative but still necessary.

What you may not know!

As an operator, manager, or agency, you are often approached or marketed to by data companies striving to accrue saleable data and business intelligence. Scraping companies that provide market data to real estate developers increases the market awareness and flywheel effect the STR has witnessed. DMOs and local authorities use the information, often incorrectly, to develop their strategies.

Some of the most innovative data scientists work for these companies, trying to make sense of huge numbers. Now, considering that the vast amount of data is scraped, OTAs aren’t keen on it and put barriers in their way. With possibly a million properties in professional PMS repositories, it is only 10% of the available source of truth data, and much of this data is still not harnessed. However, to work effectively, all data supply companies will compare and contrast their own data AND share data between them! There are commercial arrangements that are no doubt tailored to the benefit of any source of truth companies.

The very large management businesses (think Vacasa, Sykes, Awaze, etc.) have huge datasets and will dominate some hyperlocal areas. It makes sense for these businesses to share, but the cynical suggestion may be that this gives opportunities to massage the market, especially with periodic 24-hour data updates!

Revenue Management (yield management)

Dynamic pricing, as mentioned above, is a part of revenue management, and it’s essential to understand the differences, although there is always a crossover. If dynamic pricing tools could automate the vast number of variables even with the source of truth data, then the industry may be a lot simpler. So much more data and even “gut” feelings are needed to achieve great results.

This may explain why we have recently seen a significant increase in “Revenue Management” companies.

Revenue Management is a skill and covers many tasks, for example, parameters for setting seasonal strategies, LOS restrictions, or events.

- Adjusting rates for an event weekend or low demand.

- Strategic (long and short-term focus, includes multiple levers).

- Tactical (short-term focus, adjusts pricing).

- Maximizing overall revenue across all facets.

- Optimizing individual property rates for demand.

- It can include manual strategies alongside tools.

- Often highly automated and algorithm-driven.

- Average Daily Rate (ADR): Ensuring pricing aligns with market expectations.

- Occupancy Rates: Adjusting prices to fill gaps during off-peak periods.

- Revenue per Available Room (RevPAR): Tracking profitability per unit.

Market Trends: Identifying emerging high-demand neighborhoods or types of properties. Example: A revenue manager might lower prices during weekdays to boost occupancy while keeping higher weekend rates to ensure profitability.

Booking Windows and Lead Times: Analyzing historical booking lead times (how far in advance guests book) using PMS-integrated analytics tools.

Focus Areas: Direct bookings vs. OTAs. Guest segments (business travellers, families, solo travellers).

Event-Based and Seasonal Pricing: Revenue managers use event calendars and demand forecasting tools to prepare for spikes in demand.

Long-Term Revenue Strategies: Focusing on Total Revenue Management, Including upsells (e.g., spa packages, tours) and ancillary services (e.g., cleaning fees). Offering promotions for extended stays during low-demand seasons.

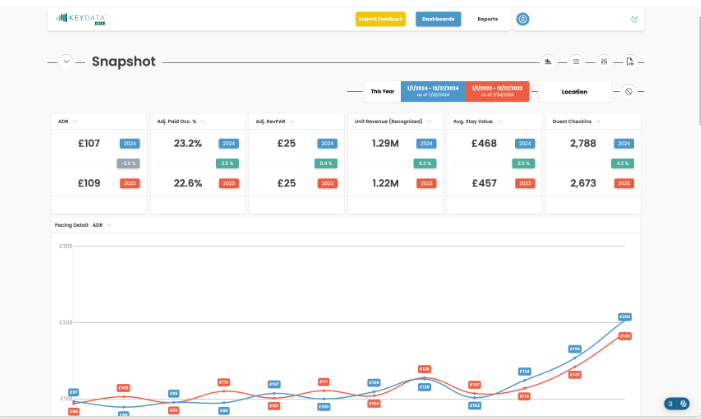

Performance Analytics: Revenue managers review past performance metrics via dashboards like Key Data Dashboard or STR Global.

Experimentation and A/B Testing: Running tests with different price points and promotional offers to determine what drives the best results.

Its not that simple!

One of the most noticeable revenue management movements is aligning RM and marketing strategies with a common goal in a more integrated manner.Simple structured data, both sources of truth and scraped, are only part of the equation, as we can see, and many of the analyses above will depend on access to rich information, but it goes much deeper than this and is increasingly complex.

Aligning Revenue Management with CRM systems and social media strategies also neds addressing within the organization and demands a more holistic approach. This allows profit optimization by recognizing customer lifetime value and reputation impacts. Reputation-led pricing strategies all positively influenced RM decision-making capability through a better understanding of customer behavior, customer value and customer relationships

As you can witness, we are only scraping the surface of RM. This is a very specialist subject and one we can expect to see developed and AI enter as a 24/7 analysis and recommendation tool.

The Rulers of Big Data

Just to put this in context there are three levels of scraping businesses such as individual property managers or small firms who scrape a few hundred to a few thousand listings per day. Then mid-sized companies that monitor competitor pricing for dynamic pricing tools (e.g., PriceLabs, Beyond, Wheelhouse) who might scrape millions of listings daily across multiple regions. Then there are the large- scale scrapers who focus on large travel metasearch engines (e.g., Google Travel, Trivago, Kayak) and OTA aggregators scrape tens of millions of listings daily to compare prices across multiple sources.

Data rules all our lives. Each time you engage digitally, browsing, memberships, likes, dislikes, purchases, habits and more are the essence of future income. Information related to travel, weather, health, fashion, sport, economics, public sentiment, big and small businesses, and countless others has data attached to them.

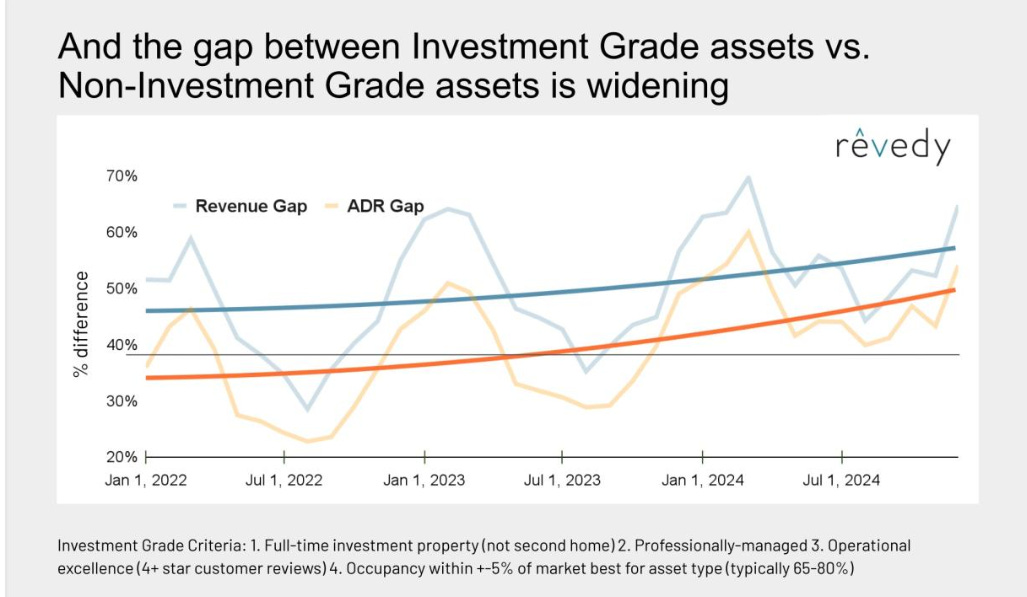

This is no different in STRs, and we may forget that many of these tools do not just target STR owners and managers. Investors, & developer platforms built on this type of data (e.g.Revedy) and DMOs or local authorities and government bodies also tap into this data for target acquisitions, legislation, tourism numbers and more. Combining all these data sets and making rational decisions is the goal of the travel industry. We have some way to go!

The leading companies in the STR space are the businesses we most often encounter across the sector.

Key Data Dashboard: Key Data Dashboard was founded in 2016 and is headquartered in Santa Rosa Beach, Florida. In July 2024, Key Data Dashboard secured an investment from Pamlico Capital, a private equity firm specializing in information services. This partnership aims to support Key Data’s growth and enhance its data solutions for the hospitality sector. In June 2024, the company launched a significant update to its platform. It introduced a fully customizable interface, an AI Assistant, and powerful new features designed to help property managers make quicker, better-informed decisions that boost revenue, drive profitability, and enhance owner retention.

Beyond: Formerly known as Beyond Pricing, Beyond serves over 300,000+ listings in more than 7,500 locations globally. Beyond integrates directly with platforms like Airbnb and Vrbo and property management systems such as Guesty, Smoobu, Escapia, and Hostfully. Beyond quotes a charge of a 1% fee on all bookings. The company was co-founded in 2013 by David Kelso and Ian McHenry. Seed funding was in March 2015, raising $1.5 million in a seed funding round with participation from Resolute Ventures, QueensBridge Venture Partners, and others. Then, a Series A funding was given in September 2019, securing $42.5 million in a Series A funding round led by Bessemer Venture Partners.

All a little quiet since?

PriceLabs: Launched in 2014, PriceLabs is trusted by over 5,000 hosts and considerably more properties. PriceLabs integrates with multiple property management systems, including Lodgify, Airbnb, and Vrbo. After a 30-day free trial, it charges a flat monthly rate based on the number of units connected.PriceLabs is a US-based company founded in 2014 by Richie Khandelwal and Anurag Verma, who had experience designing and improving airline revenue management algorithms and systems. PriceLabs secured a $30 million minority growth investment from Summit Partners. PriceLabs powers over 150,000 listings (2022) in more than 100 countries.

Wheelhouse: Wheelhouse analyzes market and competitor data, updating rate recommendations daily. It integrates directly with Airbnb, Tripadvisor, and property management systems like Guesty and BookingSync. Wheelhouse offers a free plan with limited functionality; the whole suite is available for a 1% fee or a flat monthly rate per listing.

This company Is worth a trip back in time to Covid and the challenge to leased portfolios; in mid-2020, short-term rental startup Lyric Hospitality shuttered most of its locations in what was widely viewed as another pandemic casualty. Spinning out the software side of its business, including a pricing tool for accommodation, Wheelhouse raised $16 million in funding (2022). Highgate Ventures and NEA co-led the round for Wheelhouse, including participation from Fifth Wall, Certares, RXR, SignalFire and PAR Capital, among others. Wheelhouse was co-founded by Andrew Kitchell, who serves as the company’s CEO. Under his leadership, the team transitioned from Lyric’s original business model to concentrate on its current data tool offering and a developing Revenue Management arm.

If you are a manager interested in a course/bog a few years old but still applicable, try this one from Wheelhouse.

AirDNA, a reputable short-term rental market data company, offers Smart Rates, a rate recommendation product. Users input their Airbnb listing link and create a competitive set of at least five properties. Users can input minimum and maximum rates and customize discounts for orphan days. AirDNA’s tools are available with a monthly subscription fee, increasing based on the number of listings in your market. The company was established in 2014 by Scott Shatford in Denver, Colorado. In March 2022, AirDNA was acquired by Alpine Investors, a private equity firm specializing in software and services businesses. This partnership aimed to enhance AirDNA’s growth and expand its tools for hospitality and real estate industries through its MarketMinder platform and enterprise data packages. In July 2023, AirDNA acquired Arrivalist, a location intelligence platform, and in January 2024, it acquired Uplisting, a property management and channel management software company.

Transparent: Acquired by OTA Insight and not under the umbrella of Lighthouse, providing vacation rental data insights to owners, hotels, and enterprises. The platform processes millions of properties listed on Airbnb, Booking.com, TripAdvisor, HomeAway, and Vrbo, offering market analysis with occupancy, demand, and availability filters. Lighthouse: is a major player and one to watch with such extensive data reach, formerly known as OTA Insight. The company offers a product suite to assist revenue managers, commercial leaders, and accommodation owners in driving incremental bookings, streamlining operations, and enhancing guest experiences. Their proprietary technology processes over 400 terabytes of travel and market data daily, utilizing artificial intelligence to provide real-time insights for more efficient operational decisions. In the STR industry, it acquired Transparent (see above). In November 2024, Lighthouse secured an approximately $370 million growth investment led by global investment firm KKR. Lighthouse has a strong reputation for customer satisfaction, boasting an industry-leading Net Promoter Score (NPS) of over 70 and is trusted by more than 70,000 hospitality providers worldwide, ranging from global chains to independent properties across 185 countries.

These are the most dominant and recognised across the STR industry, but others are available.

- https://airbtics.com/

- https://revenue-iq.intellihost.co/

- https://www.alltherooms.com

- https://www.mashvisor.com/

We should not forget that OTAs like to control the space if possible, too, and outside of professional managers, the likes of Airbnb have their tools, aka Airbnb Smart Pricing: This tool is available to all Airbnb hosts with at least one live listing. Once activated, Airbnb’s algorithm adjusts your rates based on demand and market trends. Hosts can set minimum nightly rates and manually override Smart Pricing anytime.

Revenue Managers. The Human Touch

The personal human touch is becoming increasingly important as data, marketing, and sales overpromise and underdeliver. It is not surprising that this is the case. The need for human intervention is also apparent when the owners of properties make demands on length of stay, arrival and departure days and still expect remarkable booking and income. This all despite the fact the market is in flux continuously, closer to arrival bookings, and 7 day arrival and departures with shorter stays. The good thing about historic revenue management and data access is that a manager can prove what they say is true, or close to the truth at that moment. As much a sales tool as a pricing mechanism!

Twenty years ago, pricing a property was as simple as gathering local property pricing, especially in leisure destinations; this was listed as weekly prices grouped, visibly tabled and with little e-commerce or Web2 functionality. A personal judgement was made on the comparison between properties, and pricing was set accordingly and generally left to represent the year plan. Guests could see different prices throughout the year and often see availability as the price groups would be blocked out.

The move to e-commerce was inevitable, and from a significant data perspective, it allows platforms to collect location search, date, price, and other details. It also gives the “hidden” ability to modify prices based on the collected data. OTAs are restricted by supply modifying prices through API connections unless their systems are selected.

A manager may have 200 properties, but surprisingly, they collect this data in real-time from their own websites and use it to their best advantage. Retrospectively, data is collected on traffic from Google Analytics and other tools and used to help pricing and property focus, but it is inefficient.

As inventory has increased, competition is fiercer and pressure to improve margins has become increasingly important. The public’s awareness of Airbnb, tech and marketing platform investments, OTA and hotel evolution to adopt STRs has created wealth. It has permeated the industry—no longer a cottage industry, now a professional sector.

Revenue managers provide invaluable services based on experience, knowledge, local information, previous property performance, property quality, location, refined amenity assessment, and presentation. Even with AI, Scraping of OTAs is not yet capable of identifying and assessing these important elements that the guest naturally absorbs.

Taking this a step further, OTAs push toward logins and identifying guest demographics, previous bookings, etc and even without pre-identification, track site flow and adjust the product offering. The issue is that the OTA has no control over a fixed supply API feed that is updated every 24 hours and presents what it can. It is an inferior model and very dysfunctional. Direct bookings using an OTA tech approach are the best, but not one we have witnessed in the tech stacks for sale.

OTAs will evaluate images and content at an industrial scale and list properties according to reviews, guest web tracking, and more, but they are still hampered by supply.

Dynamic pricing needs AI image and comparison interpretation, content analysis, alignment to expected and targeted guest demographic, knowing the local geography, considering local restaurant and pub quality, attraction and more.

Even ChatGPT can choose between properties based on photographs and descriptions, so with a lot more added data, more local information real historical data and competitive information, dynamic pricing could do better, but right now, and largely down to which system, where, and how it’s used, there is more of a need for that human touch!

Where do you find a good revenue manager? Now that is a problem as there appears to be no consolidated revenue manager directories with a global list or reviews of their services, skills, and experience! We are working on this and will keep you updated, otherwise email us and we can refer you.

Horizon Gazing

Looking over the horizon, we can see significant trends and milestone events across the industry. The manager market is without doubt professionalising. The backwater industry pre-2000 is now a global phenomenon andis being legislated, taxed and governed.

Hotels entered the market long ago, and technology is a necessity. Most importantly, guests’ expectations are significantly higher across all transactions, accommodations, and experiences since COVID-19 in particular.

Growing and fragmented markets attract investment, STRs are not unique in that fact, and we have seen many investments in tech and scaling of management companies. Please check out the M&A report for 2024 here.

We have witnessed a perfect storm: Internet, ec-comm, the 2008 property crash, Airbnb and an avalanche of tech, noise and travel. This process always creates “bubbles” leading to a flattening, governance and professionalisation.

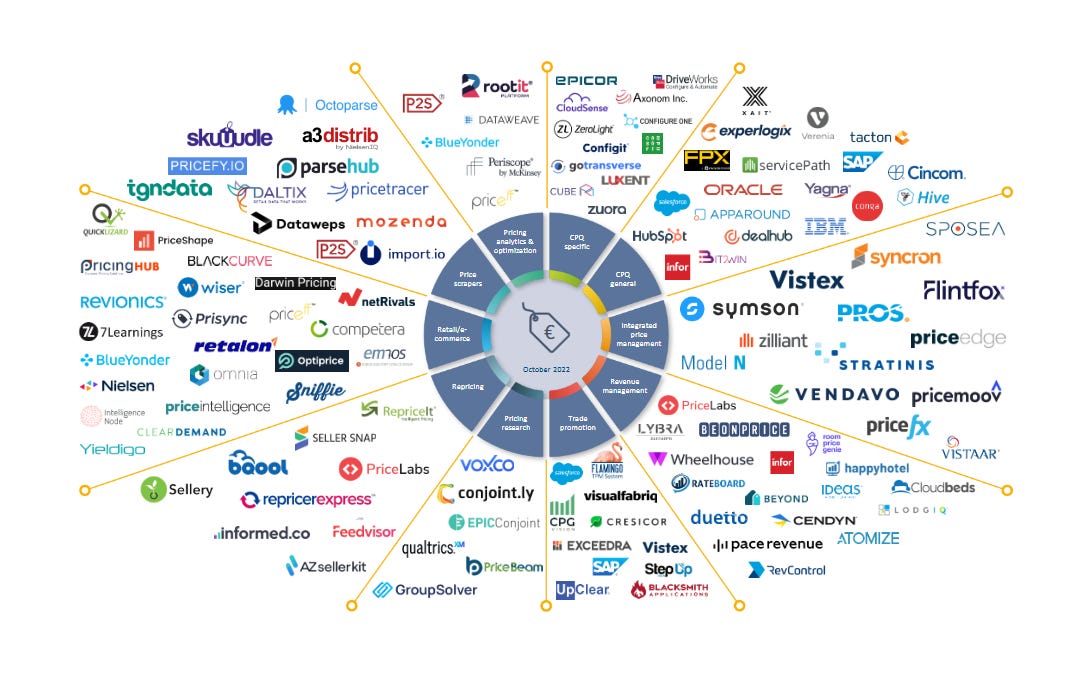

An increasingly complex data ecosystem

Dynamic Pricing and Revenue Management all form part of a much larger ecosystem. This graphic below illustrates the numbers of businesses and various market sectors focussed on specific functions, few are relevant to STR, but as the sector swells expect to see more entering the sector sich as repricing platforms and optimisation based on analytics.

- Pricing Analytics and Optimisation Tools:

- CPQ or Configure, Price, Quote Tools. Perhaps one for upsells in the future.

- Integrated Price Management: Think big companies

- Revenue Management: Pricelabs and Wheelhouse are included below.

- Trade Promotion Management (mainly consumer industry)

- Pricing Research Tools: Determining customer choice, features and surveys

- Repricing Platforms: These tools can track competitor prices, demand trends, and even weather patterns to recommend price adjustments. Similar to DP.

- Retail/eCommerce Specific Pricing Management Tools: Designed for eCommerce sector, these tools help manage pricing across various platforms (such as an online store, Amazon, eBay, etc.).We are awaiting the Amazon move into STR and hotels!

- Price Scraping Tools: These tools collect pricing data from competitor websites or other online sources.

It is not one to worry about yet, but it indicates the attention placed on pricing and online data access, guest assessment and competitive pricing.

Is your company facing pricing challenges or struggling with Revenue Management? Is there a solution?

Imperfect, and you are not alone.

The challenges are growing; data is increasingly siloed and becoming more expensive. AI is not yet doing the mundane tasks so well, although the Ai “Operator” looks to have real potential in this situation.

What are others doing? They are subscribing to data sets and doing local research to marry this data and check validity. They are taking revenue management courses and contracting with experienced individuals to assist them.

There are Revenue Management companies with teams to support managers, the question with these is one of their own businesses requirements is to scale, which means automation or sub contracting out of the experience zone into cheaper labour and less category and local expereience.

The best suggestion is to trial and test individuals, techniques and train internally. We have found a few resources online to help the search.

- This list of individuals from Wheelhouse may offer up some resources. STRs specfically

- Qualifications and training – Hospa

- University of Surrey

- Udemy.com where many courses can be found

There is no perfect solution, but “Source of Truth” data makes sense, and so does keeping an eye on AI automation, as this at a hyperlocal level may well be the best solution in the not-too-distant future!