The short-term rental industry enjoys multiple conferences yearly, some of which Yes Consulting attends and often presents at. We participated at the following European shows: Scale UK in London, Scale Italy in Florence-Italy, VRWS in Porto-Portugal, the PASCUK manager forum and Air Success in London from HCH. These conferences always give insights into the industry and its trajectory: headwinds, opportunities, players, investments, and undercurrents of how the industry is fairing at all levels with owners’ and managers’ mental health!

This year is no different, and the presentations are available on request. Add your email below for copies of the Autumn Presentations. You will need to opt-in and confirm your email, and then you will receive a link.

Below are our summary takeaways that we believe will affect many within the industry in the next 12 months.

1. Artificial Intelligence (AI) | The Big One

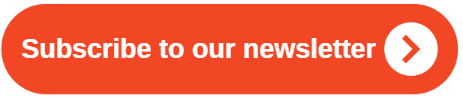

We may all have AI news fatigue, but it is a fundamental part of the future of all hospitality industries. The graph below shows the global expectation of investment, and this is significant; there is no disguising this. Link for the image below

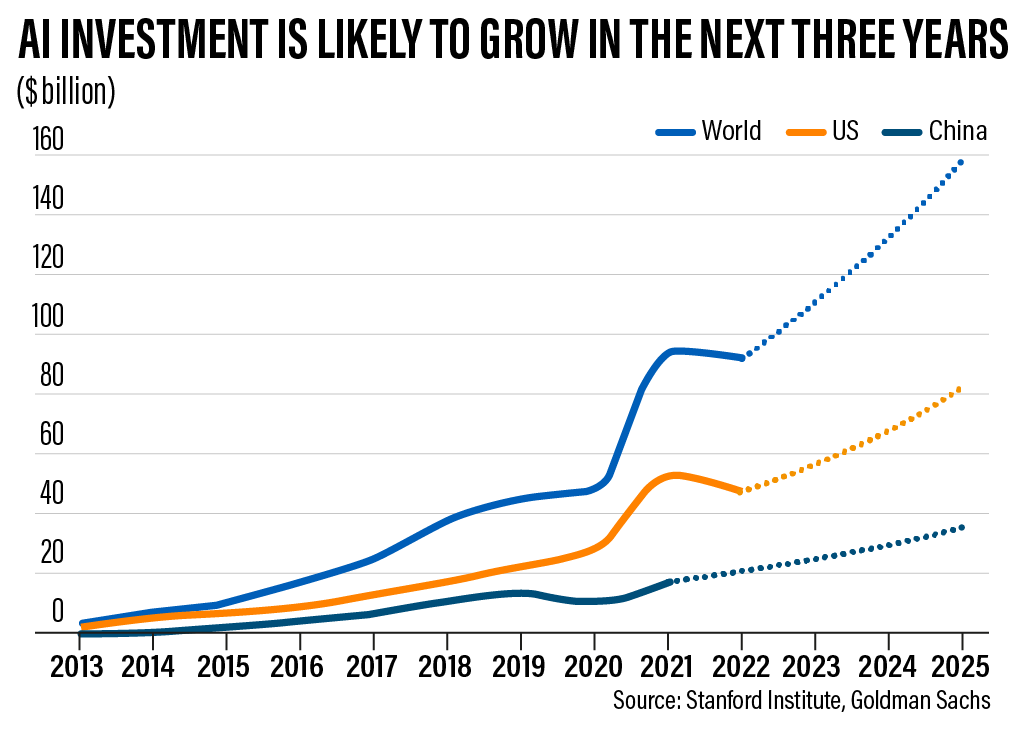

But where will this feature in travel? As always, the guest comes first (ask an OTA). Embedded within this is the opportunity to replace people with tech, allowing 24/7/365 support, increasing margin and, in theory, improving service. Below is an excellent representation of the benefits overall. Image weblink

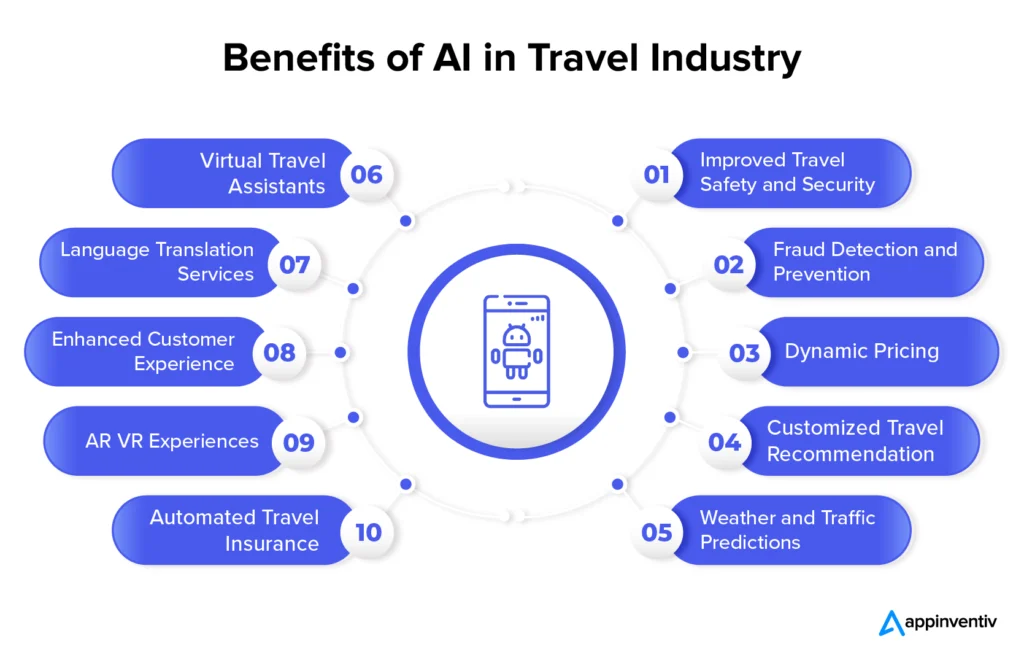

But how will it affect the supply of short-term rentals and other types of niche accommodation and how they operate? A helicopter view of the industry is needed to understand our ecosystem and how the fragmented nature at all levels will drive the tech industry to a more linear and scaled supply chain. This graphic from AJL Consulting illustrates the vast number of technology companies active in the market, and this is not the whole list, which is now estimated at 600+ suppliers.

Many of these tech suppliers are now focused on developing AI tools to support their specific functions. Imagine 600 AI agents all just focussed on their own product niche.

AI Chaos, Increased Cost, Confusion

The issue with such an abundance of tech businesses noted above, plus a developing torrent of AI-connected tools, means all opportunities to improve efficiencies across a single company ecosystem are lost. An AI agent needs data from all sources within a single source structure to prove useful, to continually learn, and to provide comprehensive business intelligence.

Using multiple connected tools, each with its own AI model, is nonsensical. An AI system will become the brain of operations, build communication flows, provide financial modelling and integrate external market data to offer improved business intelligence. As you can see from the AI travel benefits schema above, guests can access efficiencies provided the source has wide-ranging data. The STR market is famous for its multiple touch points that ensure a successful business model.

For example, suppose a prospective guest calls after office hours to book the next day. In that case, an AI agent picks it up and negotiates a price for the arrival the next day, incorporating the owners’ occupancy and ADR wishes and offering a selection of suitable properties matching the request. This could be the number of people, property type, proximity to events, etc.

The agent also organises an early clean and a fix of the AC unit scheduled earlier than anticipated. The guest has been charged, communications have been sent out, and the agent will also follow up pre-in and post-stay. Any review issues or guest problems are recorded and analysed, forming part of the process, including staff performance metrics. Plus, the booking data forms part of an ongoing marketing opportunity and financial and property assessments that are valuable to the company and the owner.

This is just scraping the surface of its potential, but it is acting like a 24/7/365 human capable of accessing data much faster and with the necessary skills. This requires digital training, SOPs and more, but so do humans, and they get sick and have holidays. An unspoken outcome of this is that VAs are under threat when their activities rely on interacting with guests, with responses solely generated from an FAQ system or remote database access. The same will also apply to accounting, basic legal processes, supplier orders, payments, pricing and formalised protocols as time progresses.

The narrative will change and is already edging into the industry. Instead of a PMS with “dynamic pricing, guest app, owner app, guest ID, operation management software, local and international reporting software, chatbots, CRMs, email agents, accounting tools etc.”,. all connected via APIs we will see big tech’s evolution. One stack does it all, and AI is the bloodstream, with data flowing across the whole architecture, connecting all the business organs, as illustrated above by BoomNow at the Air Success show in London.

2. Data | Increasingly important

Over the last few years, we have been heading toward a more data-aligned industry. Data businesses such as AirDNA and SeeTransparent (now within The Lighthouse) have been acquired, and others, such as Key Data Dashboard, have seen investment as they connect to more sources of truth (read PMS). We are also willing to bet we will see more rollups in this sector as we have seen in other sectors! Lighthouse (former OTA insight) has just raised $370m and has already made several acquisitions.

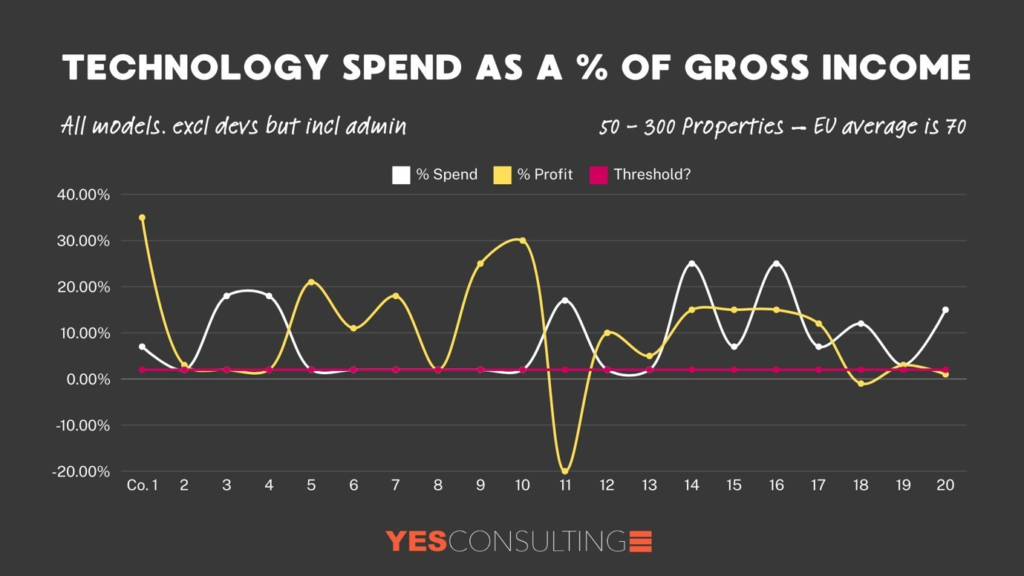

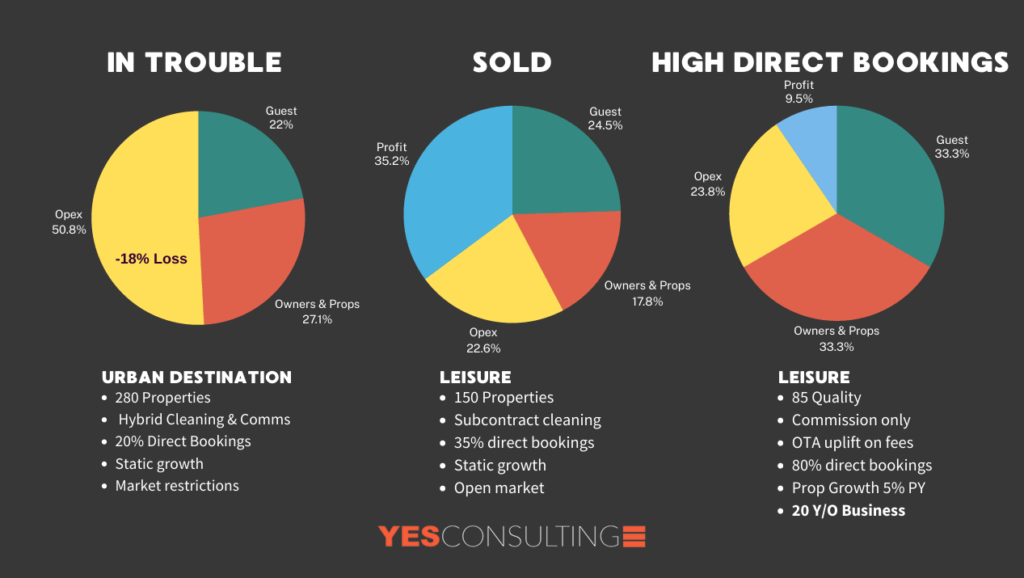

As a company, we have often been asked about ideal company metrics in terms of performance. This has become even more critical as costs rise, OTAs plunder the market, oversupply, and legislation push company profitability. Margins have never been high but are increasingly under pressure.

We presented comparative company metrics from 20+ businesses at the VRWS, showing a wide discrepancy. The variation of business modelling certainly affects net profit, a significant exit factor, as demonstrated by these three businesses below.

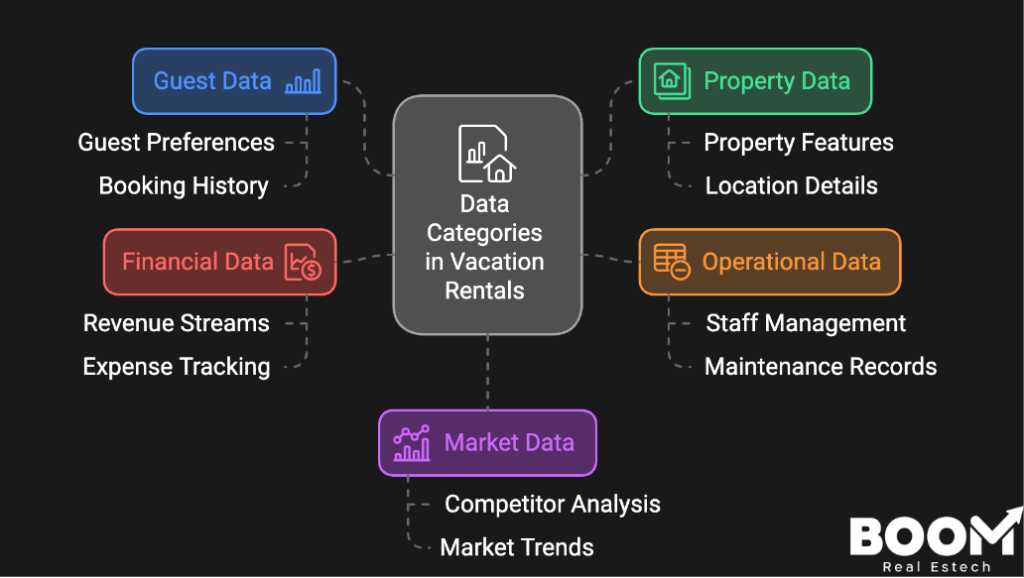

Every business will need to become far more attuned to data, and this is not just scraped pricing information; pan company data is rapidly becoming the deciding factor of success and failure. Consider all the data requirements related to your business. Here are a few:-

- ADR, Occupancy, RevPAR

- Reviews on properties

- Staff metrics

- Detailed company finances

- Dept splits by cost centres for marketing and distribution

- Distribution and payment data

- Technology costs (hardware/software)

- Cost of acquisitions (CAC) guest and owner

- Lifetime values

- Local and national market competition at property and marketing levels

Suppliers of external pricing and occupancy data are on the increase. It is not always 100% correct, especially if scraped, and sometimes insufficient if there is limited source data. Use it carefully and combine it with your local knowledge. Build your local metrics, too, from online and offline research. Use AI and deep reporting tools to analyse your company’s performance. Ensure you have the data and make time to analyse it!

Thanks to AirDNA and KeyData Dashboard for all their help this year on data.

3. Legislation | Affects all markets

We rarely say: “Hooray, more legislation”, and the same applies to recent developments in the European and UK markets. There have been two significant developments:-

a) ViDA, VAT in the Digital Age:

November 2024: -The EU Council has agreed on a new VAT reform package to modernise digital economy tax rules. Key changes include mandatory electronic invoicing and real-time VAT reporting for cross-border transactions, making it easier to detect tax fraud. Online platforms will be required to collect and remit VAT for short-term accommodation and transport services when providers do not. The package also expands the VAT one-stop-shop system, simplifying compliance for businesses operating across member states. The new rules will fully digitize VAT reporting by 2030, with interoperability across national systems by 2035, streamlining tax obligations and boosting competitiveness in the EU.

What does this mean?

It sounds so innocent. It required ratification from all 27 EU states, which eventually happened despite one state (Estonia) holding back for some months but eventually conceding. The kernel of the changes are:

From 1 July 2028 (at the earliest), a key proposal is that a taxable person who facilitates, through the use of an electronic interface, the supply of short-term accommodation rental (maximum 30 nights):

- the underlying service provider communicates to the platform their local VAT ID or the ID number allocated under a particular scheme and

- declares that they will charge any VAT due on that supply.

Member States will be required to apply the rules from 1 January 2030 at the latest (meaning that a long lead-in time exists), and special schemes for small enterprises and travel agents are excluded. Platforms can also leave it to underlying sellers to collect VAT. Not all platforms will be caught, and there will be carve-outs for platforms that process payments, list or advertise or merely redirect customers, although this is unclear. Given the substantial differences between the original EC proposal and the compromise text, the European Parliament must be reconsidered through a simplified written procedure. This approval should be forthcoming because the start dates are well into the future, and the compromise text reflects a balance of factors.

If you are in the UK, we are unaware of any changes or implications on platform booking outside the EU; however, the jurisdiction for the charge is the property’s location.

b) UK FHL changes & Registration

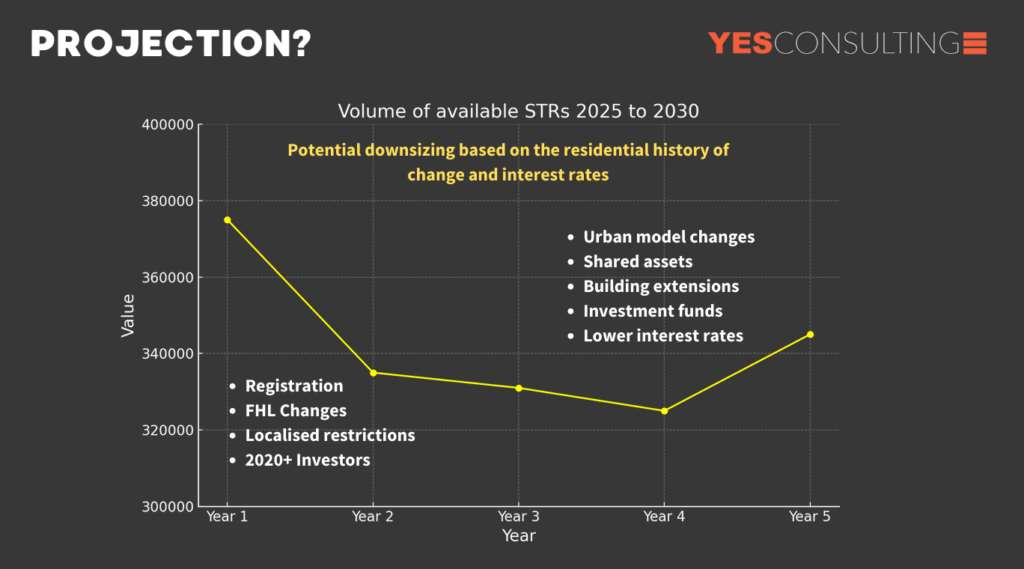

The UK conservative Government announced abolishing the Furnished Holiday Letting scheme in the Spring Budget, which provides capital allowance benefits, capital gains advantages, and interest payment relief. The Labour government has followed through; however, it has not listened to anyone, and it will come into law in the next tax year (2025). Will it raise much tax? No. Will it provide many more homes for the demand made by a lack of housebuilding? No. The numbers are insignificant compared to empty homes and residential lets under a Renters Reform Bill. Will it damage local economies if we see less tourism due to less accommodation? Possibly, and needs research.

Enforced registration is generally well accepted and will ensure bad actors and freeloaders are identified. Exposure will result in a reduction in numbers, as will the incapacity to net off interest payments and hence the increase in the number of properties currently for sale, hoping to sell before April 2025 and benefit from a 10% capital gain benefit.

At the Scale UK show, we presented data on “buy-to-let” loans, inventory increases, ADR, and occupancy changes. We predicted the volume of inventory across the UK, assuming all the promised changes happen.

c) Sustainability

This may seem an odd section under “legislation,” but with so little actual work being done by our industry — and let’s face it, it is tough — we can expect to see sustainability legislated in the future. Add in B Corp, the preference to work with similarly qualified businesses and the writing is on the wall. Some distance away, but every business must look over the horizon and start the transition.

ENVIRORENTAL: A shout-out for their presentations and total dedication to the cause! As they say, Being green is good for the planet AND your business. But we get it: You probably don’t have the time to sift through all the data out there—the information, news, tools, services, case studies, and so much more. So we have done it for you—everything that you will need to start or progress your sustainability journey.

QALIA: This company has set a number of criteria designed for the gradual implementation of sustainable and transformative practices without compromising the essence of luxury hospitality. This approach can empower both property owners and guests to adopt a more conscious mindset or conscious luxury, which leads to more meaningful experiences and impacts.

4. Revenue Management | A common request

Of all the discussions, questions, and growth sectors this year, RM sees a groundswell of need and a common question. “Do you know any good revenue managers?” However, before commenting further, these points all want and need consideration:-

- Not all owners want 24/7/365 bookings and may be very circumspect

- Not all locations have the same demographics, seasons, stay times

- Levels and quality of competition differ

- Over and undersupply are vital factors

- Booking periods can vary wildly

- Not all systems are equal

- OTAs want maximum numbers of bookings, not necessarily the best prices

- Reviews are a key metric

- AI is increasingly in the game

- Not all blocked calendars are bookings

- Not all blocked calendar bookings are sold at OTA prices

There is also often a misunderstanding between Revenue Management and Dynamic Pricing.

- Dynamic Pricing is a subset of Revenue Management focused on adjusting prices in response to market changes.

- Revenue Management encompasses a broader strategy, including inventory decisions, market segmentation, and long-term demand forecasting.

Key Differences

| Aspect | Dynamic Pricing | Revenue Management |

|---|---|---|

| Scope | Focuses on price adjustments. | Involves pricing, inventory, and sales strategy. |

| Approach | Reactive and algorithm-driven. | Proactive and strategy-driven. |

| Time Horizon | Short-term, real-time adjustments. | Long-term planning and forecasting. |

| Tools | Automated pricing tools (e.g., price optimizers). | Revenue management systems (RMS), data analytics, human expertise. |

| Objective | Maximizing occupancy or short-term profit. | Revenue management systems (RMS), data analytics, and human expertise. |

The Problem

We have many dynamic pricing tools in the industry. However, three are generally quoted: PriceLabs, Wheelhouse, and Beyond. I wish I could quote more, but I have not met a manager who used a different one in 2024. Congratulations on the market penetration!

However, as revenue managers’ need to make sense of the data increases, companies with well-educated and STR-experienced teams supporting customers will win. The average manager does not have the skills or time!

However, the issues that have arisen this year relate to predictive pricing and several complaints about underselling and non-booked properties. Each of these requires deep investigation, of course. However, a private survey showed that 60% of users were unhappy with their suppliers’ performance, and anecdotally, it was those who put the systems on autopilot. Expectations may be too great, but fewer managers are prepared to let the tools run their pricing automatically. It only takes one grumpy owner to highlight the problem for a manager to worry about the entire portfolio.

The consensus is that, as shown above, dynamic pricing tools are reactive and algorithm-driven, relying on other data or their own in the same locations. Market fluctuations due to one of many events may drastically affect prices. Previous records may be of little value if inventory has grown substantially or there have been local disasters, fewer public events, or closures of major attractions.

Does everyone need a Revenue Manager?

Certainly, it’s clear that letting dynamic pricing tools run on autopilot, especially in lower density, higher value, and less OTA-driven locations, causes more problems. It is also evident that local knowledge, deep property knowledge, and a good understanding of industry direction will improve income and booking opportunities. People are expensive, but can you grow without internal or contracted skills to get ahead of the game? AI will also enter this space, as it has done with OTAs.

The OTA influence

OTAs want bookings, and (although not in print too often) keeping the booking flywheel running rather than trying to achieve the maximum price per booking is preferable to shareholders. OTAs have a simple approach to life online:-

- Great properties

- Great reviews

- Low prices

- Free cancellations

- No support calls or emails

- In the most popular destinations

- Available 24/7365

- Min one stay stays

- Upsells themselves

- New properties get an immediate fillip to get them to commit and engage

They will, of course, rank properties according to their rules, and there are also subcategories of ranking:

- Content

- Photos

- Amenities

- Regular attention to the listing.

With millions of listings on OTAs, competition for bookings is fierce, and more intelligent tools are needed. We are including two companies we have been super impressed with and are new players in the market:

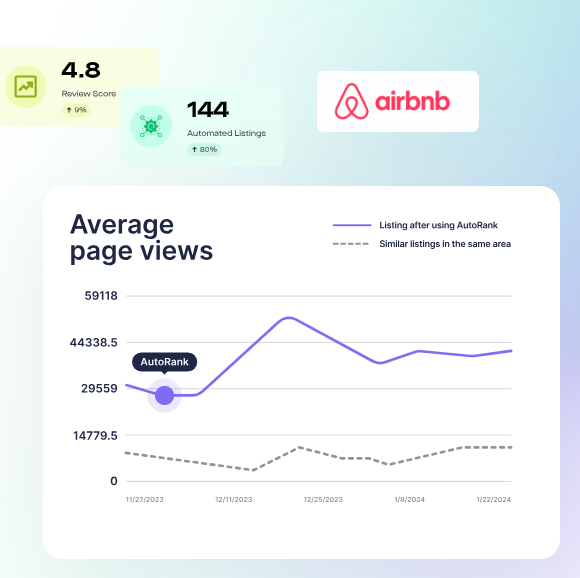

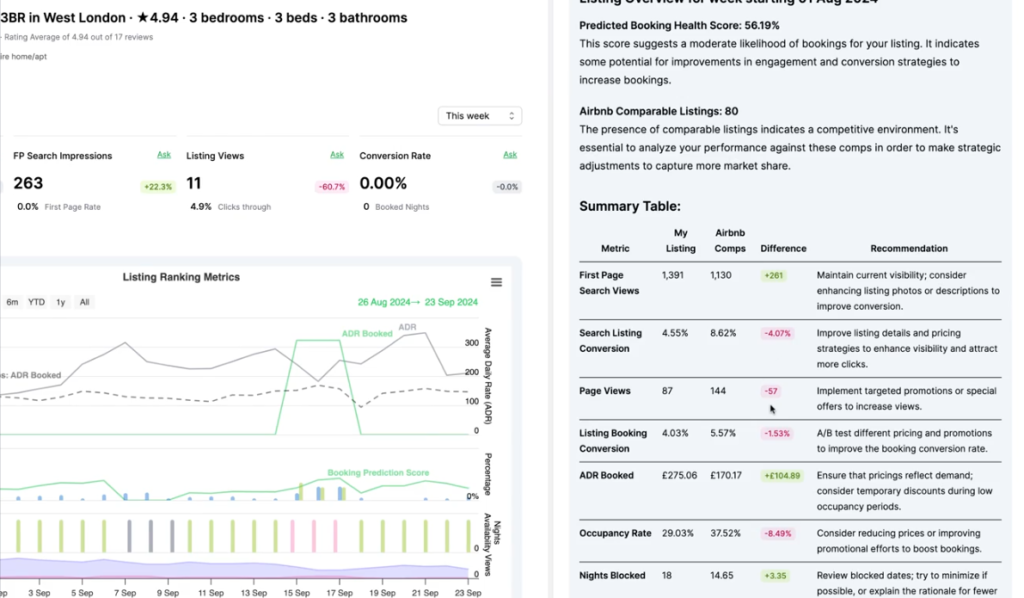

Otamiser (inc Autorank) focused on ensuring that listings perform and rank well and will soon launch a revenue management service for short-term rentals in 2025. This gives the option of a DIY approach or an elevated service that takes away the trials and tribulations of managing prices, which is increasingly becoming a concern for all managers.

MyDataValue is even newer to the market and is a Revenue Management Assistant. Check them out!

5. Upselling | In general

One for 2025 as increasing numbers of managers seek extra margin. With Airbnb threatening to revolutionise experiences in 2025, this PR and industry noise may add energy and awareness of the opportunities. Local managers are best placed to advise, add a personal touch, and add more recognition to their micro-brands. With tech making this more accessible, we will see more companies chasing the extra margins made from their local partners on commission.

Commissions are tough to increase, and often, booking fees, insurance, and damage waivers are already embedded. Increasingly bespoke and tech-enabled businesses are being connected such as:-

- Additional Services:

- Spa treatments

- Airport transfers

- Guided tours or local experiences

- Grocery delivery or fully stocked fridges

- Family-friendly kits and kid-specific amenities

- Pet-friendly amenities

- Chef services (increasingly being used)

- Seasonal or Location-Based Activities:

- Equipment rentals (e.g., kayaks, bicycles)

- Local event tickets

- Seasonal activities (e.g., winter sports or summer beach setups)

- Wellness and Sustainability:

- Yoga sessions

- Health-conscious meal options

- Eco-friendly practices like bike rentals

- Business-Focused Add-ons:

- High-speed internet

- Workspace setups

- Printing services or meeting room access

Some advice on the approach:

- Timing:

- Introduce upsells before or immediately after booking.

- Avoid intrusive offers during the stay.

- Personalization:

- Use guest segmentation (e.g., families, business travellers) to tailor offerings.

- Base upsell suggestions on guest preferences and booking history.

- Bundling:

- Create appealing packages (e.g., spa + dinner).

- Offer small discounts for bundled services.

- Exclusive Offers:

- Promote limited-time or unique upsell options to create urgency.

- Visual Presentation:

- Use high-quality images and engaging descriptions to showcase upsell value.

Communication Strategies:

- Highlight the added value and benefits of upsells.

- Avoid overwhelming guests with too many options at once.

- Use friendly, guest-focused language to present offers as enhancements, not just sales.

How:

- Property Management Systems (PMS):

- Automate upsells during the booking and check-in process.

- Avoid setting up multiple rate plans for added services.

- Booking Platforms:

- Use built-in upsell functionality (e.g., Airbnb, Booking.com).

- Automated Messaging:

- Use email and SMS campaigns tailored to guest categories.

- Tools like Upstay or Charge Automation can integrate upsells during booking and follow-ups.

Then, there are full-blown personal concierge services for those who want less tech, more tailored, and more organised for their experiences. Two shout outs here:

Mount: An is an award-winning business that allows managers to monetise experiences and activities. Thousands are available, and the process is easy to engage with.

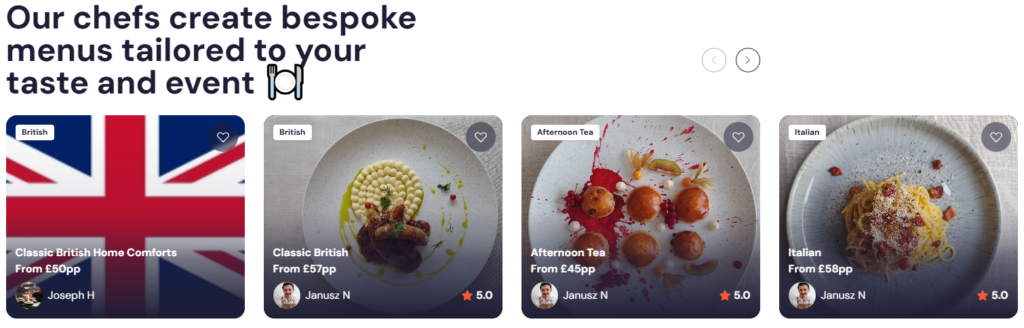

yhangry: A platform that solves the problems of finding chefs and makes it easy for managers and their guests to do the same. It’s great for chefs, and it’s great for guests! See below.

Add margin, control, sustainability and data | Resicentral

It looks like a winning combination, and we can’t find any issues that would prevent this product from becoming a global winner. Resicentral offers a rich selection of monitoring tools aligned to market needs and underlying real estate and sustainability demands. There is no need to have multiple suppliers and build an even more unstable and complex hardware and software stack!

Understanding more about the Resicentral product shows that it is way ahead of competitors and offers a wide variety of monitoring tools all in one space. Imagine adding this product to an established operational system for entry, cleaning, and maintenance. This toolset completes the circle of owner benefits and helps the planet, too!

- Energy Control

- Sound & noise levels

- Heating Controls + Temperature monitoring, humidity levels

- Humidity + Indoor air quality +aspirated particulate sensor

- Occupancy detection

- Ambient light levels

Link: Visit Resicentral

Chef Services | Experiences and Income

As featured on Dragon’s Den, Yhangry redefines private dining, offering a premium platform to hire top-tier chefs across the UK. Your guests may be looking for Michelin-level mastery, MasterChef alumni, or relaxed dining professionals; Yhangry connects you with over 1,000 talented chefs, including renowned names from popular restaurants and TV shows.

The selected chef handles every detail, from sourcing fresh ingredients to cooking, serving, and even tidying up afterwards, so your guests sit back, relax, and enjoy the experience worry-free.

Guests can work with a chosen chef to design a custom menu tailored to their preferences, ensuring every dish reflects their favourite flavours and accommodates their dietary needs. Beautifully designed printed menus, available at no additional cost, can add an extra-special touch to the event, elevating the atmosphere and delighting everyone involved.

With increasing numbers of people using externally delivered meals and a drop in overall cooking skills, added to an ageing demographic, with “baby boomer funds”, we are seeing more celebrations, anniversaries and get-togethers! This is an ideal upsell!

Crowd Funding Now

If you are in the market for a small punt, here are some stats and a link:

- Over 100k+ guests served

- 💰over £5M+ paid to chefs

- 🏡 100+ partnerships in the booming short-term rental market

- 🏛️ we are 1 in 10 startups selected by UK government’s Department for Business and Trade High Growth Initiative 2024

- 🤝 Incredible investors joining this round include: Michael Seibel (Ex-Y Combinator President and founder of Twitch) & Tamara Lohan MBE (Founder of Mr & Mrs Smith)

Link: Visit Yhangry Website

6. M&A | Ramping up for 2025

Almost last but certainly not least, it only relates to a modest number of conference attendees. How modest? It depends on how the question is phrased.

Are you thinking of selling soon or perhaps in the process? or…

Are you organising your business with options to sell or benefit in othe ways financially, in the future?

You may be surprised by the answer to both, as a consolidated number was well over 30% of companies with more than 50 properties. The larger they were, the more focused and knowledgeable they were. 30% didn’t have an opinion, and 30% looked askew and wondered about the motive!

Reading between the lines and hearing about the increased challenges, I see that the trend is an increasing need for awareness, positioning their businesses correctly, and keeping aware of the market changes in previous years.

With some of the big acquirers back in play, there is an opportunity for companies to acquire or merge in southern Europe despite the legislative noise. There are even some discussions on companies working together to save costs, align brands and use increased size to leverage larger multiples.

Several new players, too, are building sustainable businesses and seeking smaller companies that are often overlooked by international concerns. If you want to sell at some point or are wondering about prepping for it, get the free December M&A 2024 report in preparation right now.

7. Associations | The time has come!

In an era where governments often impose legislation with little clarity or consistency, vacation rental companies face significant challenges navigating regulatory landscapes. Short-term rental policies can vary dramatically and are usually influenced by numerous external pressures, such as housing, climate, over-tourism, crime, etc. Joining a professional association offers significant advantages. These organizations serve as a collective voice, advocating for fair and transparent regulations that protect businesses while addressing broader social concerns.

Associations provide members with a collective voice and a unified platform to engage with policymakers, ensuring that legislation is informed by industry expertise rather than unilateral decisions, even if sometimes they don’t listen. When governments implement ambiguous rules or fail to establish clear guidelines, associations can negotiate on behalf of their members, working toward practical solutions that align with compliance and operational feasibility. By pooling resources, members gain access to legal counsel, best practices, crucial updates on policy developments, and how to add their voices.

Moreover, membership in an association signals a commitment to professionalism and ethical standards, which can enhance credibility with regulators, partners, and customers. It highlights bad actors and drives the industry in the correct direction. Never has this been needed more when entry to short-term rentals has such a low bar. In times of legislative uncertainty and we are in one right now, being part of a well-organized, influential body can mean the difference between thriving in a challenging environment and facing costly disruptions.

Please consider joining and supporting these organisations and some shoutouts below:

- England and Wales, join PASCUK now with thousands of members, both independent and agencies, and thank you for the sterling work on all aspects of FHL, H&S, and the never-ending rules and regulations.

- In Scotland, the ASSC is now a strategic partner to PASCUK on all matters in the UK.

- In Europe, head off to EHHA and select the appropriate country. Congratulations to ALEP on their Portuguese successes.

- For South Africa, head off to SASTRA, a new but necessary association

- For Bulgaria, head off to BESCO. Again, it’s new but necessary, and congrats on the recent news.

8. Booking.com vs Airbnb & VRBO | Winners & Losers

We are told VRBO is getting back on track after its Expedia tech integration and marketing hold. Now, it is entering the urban market with its loyalty program:- “Onekey and has transferred 1 million short-term rental listings from the Expedia brand to Vrbo, adding more variety to the vacation rental business and a stronger focus on urban stays.

Airbnb has announced much the same as in previous years on increasing experiences (upsell yourself; don’t lose control of this one, as it will eat further into your business!). Airbnb has also announced the EU expansion of their Co-Host approach for 2025. Take note of this; it undermines managers, even if Co-Hosts can be considered “managers.”

BOOM have offered up a great LinkedIn newsletter article on this subject.; Airbnb and property managers: a love-hate relationship

They bicker, they banter, they can’t live with each other, they can’t live without each other. And just when we think they’ve finally settled into domestic bliss, along comes a new plot twist to spice things up. Enter Airbnb’s latest curveball – the Co-Host Network, a shake-up that has the tongues wagging throughout the entire short-term rental sector.

Boomnow – LinkedIn bi-weekly newsletter

It is also not a great message to politicians, especially given the global backlash against oversupply and housing crises in specific tourist destinations.

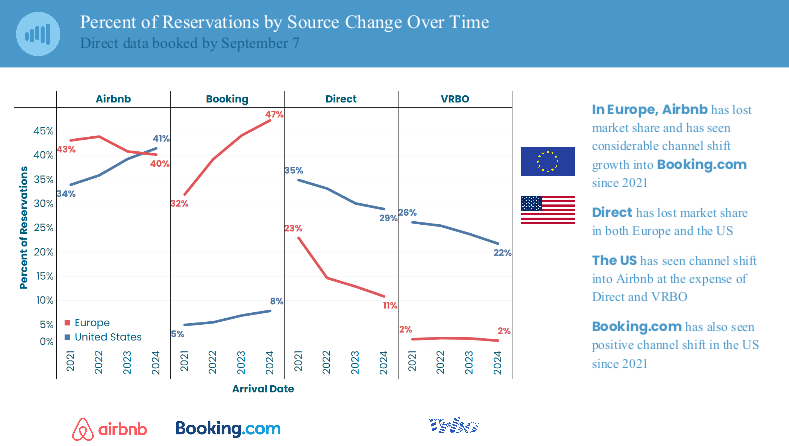

Booking.com, my personal share focus last January, seems to be taking more of Airbnb and VRBOs’ market share or breaking new ground at the expense of direct bookings, too, according to the Key Data Dashboard as shown below.

Slide provided by Key Data Dashboard

We will be following up on this subject of OTAs early next year! Stay tuned.

9. Marketing | Even more specialised

It is increasingly clear that marketing is becoming more confusing for the average business owner. What was once the go-to for all managers, such as link-building, rich content for sites, and attention to site SEO, supported by core social media platforms, is now more demanding. Videos, webinars, and podcasts have, without doubt, become central to brand awareness now, combined with Instagram and TikTok, all depending on where you sit in the real estate and booking ecosystem. We have added videos and a link below!

Add Chatgpt and Searchgpt, Google Gemini, and other LLMs, and we know that search engines and search habits are changing. The jury is out on how this will affect the high-ranking organically placed websites, but it is putting many at risk. When direct booking is part of the strategy, then it’s well worth following the expert narratives to be found online.

These are two of Google’s AI answers when questioned:

- AI-generated summaries: Google may start displaying AI-generated summaries of web pages directly in search results, potentially reducing the need to click through to the original content.

- Need for differentiation: To stand out, organic content will need to offer unique value propositions, such as in-depth analysis, expert opinions, or creative perspectives.

Chatgpt, when given Google’s reply, offered up a lot of advice, but these standouts:

- Content diversification: Experiment with formats like videos, podcasts, and interactive content that LLMs can’t fully replicate.

- What to do: Invest in structured, authoritative, and verifiable content that can prove its value through citations, transparency, and relevance. Use schema markup to make your content easier for AI to understand and rank appropriately.

- What to do: Build a brand voice and focus on unique, actionable insights. Incorporate personal anecdotes, case studies, and proprietary data to create compelling value propositions.

- What to do: Create content hubs or resources that dive deeper than the surface-level answers, establishing your content as the “next step” for curious users.

We had several conversations around the subject and some standout people and businesses at the shows:

- AbodePR – Abode, as usual, offered some great presentations in the Autumn series and did some sterling work with their principles. Although not Autumn, the summer Short Stay Summit conference and some intelligent people answered some market questions on video.

- Alex & Annie Podcasts: this one was at the Scaleshow in Italy, talking to many sponsors.

“Think Like Stefan”

At the Air Success show, the day after Scale UK, there were a few moments of clarity in the Wild West of rentals in many locations globally. The future of short-term rentals and the people developing the industry depends on their professionalism, capacity to provide an authentic hospitality experience, work with local regulations and build a business on solid foundations. I was super impressed with Stefan Hoffelner’s narrative on stage and approach to business. So much so, we may well coin a new phrase to cover great advice and how to run a business and focus on all elements that challenge many daily.” Think Like Stefan”.

Below is a link to familiarise yourself with his thinking and advice for London STRs!

Disclaimer: The author is a board advisor to BoomNow. There are no affiliate links or income-generating referral agreements on products recommended or highlighted above.

Article by Richard Vaughton, Yes.Consulting