How OTAs Are Undermining Local Economies and Industry Sustainability

PLEASE NOTE that this article is written for commercial managers, not independent or small portfolio owners, particularly those based in urban areas.

However, we do recognise that there is still a significant and historic pushback in many leisure destinations globally, even for small property portfolios or independents. Therefore, this article may be appreciated (or not) by this particular cohort.

The latest round of platform-led changes from Airbnb and the silence that followed have made one thing painfully clear: many OTAs have lost sight of who their real stakeholders are. For years, short-term rental platforms have expanded aggressively, prioritising top-line growth and shareholder returns over long-term sustainability. Have the gatekeepers hijacked you?

However, as they increasingly encroach on host and manager economics, the strains are becoming apparent. What was once a partnership is beginning to resemble “digital feudalism” (thank you, Humphrey Bowles), centralised control, opaque decision-making, and diminishing returns for those doing the real work.

Airbnb’s Latest Moves: The Breaking Point?

In a move that caught many off guard, Airbnb recently introduced two significant changes:

Commercialisation of guest relationships – Platforms are now monetising guest stays by selling services, even when they don’t own the property. Consent? Optional. The default? Opt-in!. These were predictions made in a recent article in Yes Consulting in terms of their strategy: “Airbnb’s long term strategy”

“Book Now, Pay Later” and more relaxed cancellation terms – Designed to drive demand, these changes heighten financial risk for hosts and strip away the few remaining controls they had.

These initiatives might make strategic sense in a two-sided, shareholder-driven marketplace model. They do, however, come at a steep cost for suppliers, especially those operating in businesses with thin margins and high fixed costs, as well as those with seasonal fluctuations. The OTA playbook is clear: chase guests, optimise conversion, and let supply adapt (or fail).

This is not new. Hotels were the first to feel the squeeze years ago, but they at least sell fractional nights, and occupancy can be tempered by demand and pricing mechanisms across a spectrum of rooms. For independent owners and managers, every lost booking is often irreplaceable.

Devon, UK: A Microcosm of the Problem

Take Devon, a UK county renowned for its reliance on tourism and local hospitality. Our analysis, using various data sources and conservative estimates, shows:

– 14,000 short-term leisure rental properties

– £1,292 average guest spend per trip (Sykes Cottages report)

– £24,000 average annual income per property(Sykes Cottages report)

Assuming a 25% OTA booking rate among managers and 75% among independent owners, the total OTA commission loss exceeds £26 million per year in this one county alone. That’s nearly £1,900 per property, money that could otherwise be circulating in the local economy.

Nationally, the picture is even starker. With 169,000 recognised holiday lets across England and Wales (PASCUK), the annual outflow to overseas OTA platforms easily exceeds £300 million, a figure that doesn’t include city-based rentals or hotel commissions, which are even more OTA-dependent and will contribute substantially more losses.

These lost funds could support 10,000 additional jobs, pay for 15 million casual meals, or £3,000 per UK restaurant, as real economic activity is drained offshore.

Who Owns the Guest?

A key point of contention: control of the guest relationship. OTAs maintain that they are not parties to the rental contract; Airbnb, Booking.com, and others explicitly state this in their Terms and Conditions. They nonetheless retain guest data, direct communications, and transaction control. This creates a grey zone: hosts bear legal responsibility but have no direct access to their customers until after booking.

Guests Are Paying More, Not Less

Let’s be clear: these platforms are not making holidays cheaper. OTA commissions, averaging 15–18%, are generally baked into guest prices. Hosts and managers, unable to absorb these fees, pass them on. Guests pay more, yet local businesses receive less. The platforms justify their margins with scale and marketing reach. But are they delivering value or extracting it?

Digital Services Tax: An Irony in Motion

The UK’s 2% Digital Services Tax (DST), designed to claw back some value from tech giants, has inadvertently exacerbated the problem. Expedia (the owner of Vrbo) admitted in written evidence (in 2022) that larger platforms pass the cost on to suppliers, who, in turn, pass it on to guests.

In effect, small operators are paying the tax twice, once through OTA fees and again through higher guest-facing prices. Meanwhile, OTAs preserve their margins and continue repatriating profits offshore.

Risk Tolerance: Where Do You Stand?

The narrative is shifting. Once, OTAs were considered a reliable source of growth and part of a mixed marketing opportunity. The OTAs themselves have been competing with each other, and now we witness the big three, which are dominated in Europe, at least by Airbnb and Booking.com.

Now, they pose a strategic risk and create barriers to commerce at a local level. Where do you sit in the eco-system?

- Low Risk: Less than 25% of bookings from OTAs. Strong brand, repeat guests, flexible pricing.

- Medium Risk: 25–75% OTA dependence. A direct strategy is in place, but it remains vulnerable.

- High Risk: 75%+ OTA dependence. No direct channel, no guest data, no control. Is this you?

Businesses in the high-risk category are even more exposed to policy changes, fee hikes, algorithmic shifts, and de-platforming, all of which are beyond their control.

Back to the Future: The Aggregator Trap

We’ve been here before. In the early days of HomeAway, co-founder Brian Sharples openly discussed the tight margins in the property management industry. A £15,000 rental return might yield a net £2,650 for a manager after a $350 subscription fee. You may want to watch this video and reminisce about how the industry allows all to flourish, before the control vectorisation of the industry. Note that Brian Sharples doesn’t mention where it’s going, but promotes the idea of how good a subscription is!

Move forward a few years, and after adopting a commission-based approach, similar to Airbnb, the income drops to £750. It’s a fragile model, and it hasn’t shown any improvement. Commercial owner representation and management is a thin-margin business.

Airbnb’s shift from guest-paid fees to host-side commissions only made things murkier, removing price transparency and encouraging price inflation to compensate. The result? Guests pay more, while occupancy and profitability decline. Guests are generally ignorant of the background mechanisms and bear traps that are set to empty their wallets unnecessarily.

The net effect is less money spent locally and fewer taxes paid to support local government. As prices increase, the trips become more expensive, driving travellers to less expensive destinations, often further afield.

Enter AI Agents: A Disruptor to the Disruptors?

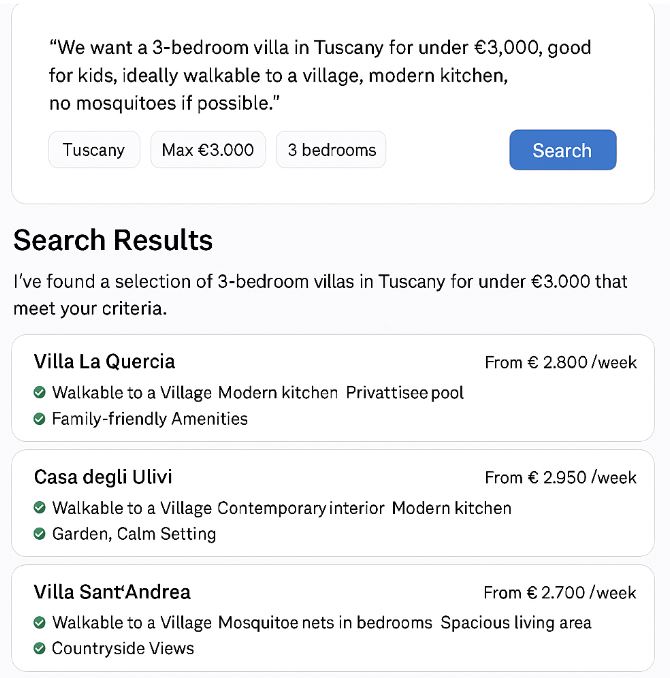

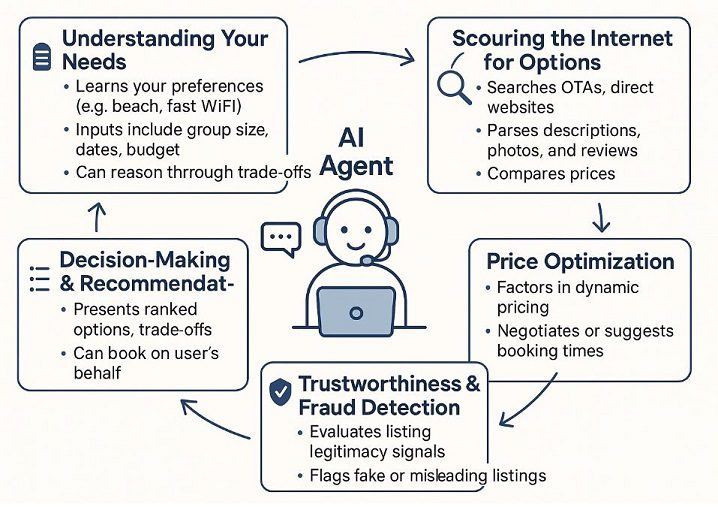

Just as platforms tightened their grip, AI may loosen it. Emerging AI-powered travel agents can:

- Scrape listings from OTAs and direct channels alike

- Evaluate genuine reviews, images, and pricing

- Detect fraud and fake listings

- Personalise results based on actual user intent

- Even negotiate or book on behalf of the guest

If AI tools become the new interface for travel decisions, the traditional OTA advantage, with its brand visibility, user experience, and price comparison across thousands of properties, may erode. Gartner predicts a 25% drop in traditional search traffic by 2026. Early signs indicate that SEO-based businesses are already facing challenges. AI may offer an escape hatch from the centralised aggregator model if suppliers are ready to plug in.

A Call for Strategic Realignment

OTAs have created a system and supply has been compliant where:

- Local economies are drained

- Small businesses carry a disproportionate risk

- Guests are overpaying

- Data and brand equity are handed to third parties.

The industry’s answer cannot be more dependent. It must be diversification, ownership, and reinvestment in the guest relationship. OTAs will remain part of the landscape, but they should not control it. Hosts and managers need tools, allies, and strategies that help them regain leverage. Because when supply becomes interchangeable, it’s only a matter of time before it becomes disposable.

Expect More Challenges: The OTA Revenue Playbook

For any growing property management business, it’s critical to understand how platforms like Airbnb and Booking.com boost their income because much of that growth comes at your expense.

Here’s how an OTA can increase its booking revenue, often without lifting a finger on marketing:

Increase the Margin Per Booking:

- Raise commission rates either across the board or via tiered performance schemes.

- Introduce “positioning fees”: pay-to-play visibility boosts for hosts chasing bookings.

- Modify the payment model: shifting to split payments, instalments, or delayed payouts (with hosts carrying the risk).

- Bundle taxes and service fees: hiding the actual cost of OTA involvement inside the final guest price.

- Increase the Number of Bookings: Relax cancellation terms – creating guest confidence while increasing host risk and calendar churn. Offer “Book Now, Pay Later” schemes – attractive to guests but potentially cash-flow-disruptive for hosts.

- Sell ancillary products and services: experiences, travel insurance, and transport, all booked by the guest and monetised by the platform.

- Capture more of the guest journey from discovery to post-checkout upsells, all without involving the host.

Sound familiar? These aren’t hypothetical levers. They’re active, deliberate, and designed to grow OTA income, even when your margins remain flat or shrink. Understanding this playbook is essential for any professional operator seeking to incorporate resilience into their model.

What can you do?

Doing nothing is not an option. We are producing an article that will detail the necessary steps and provide the tools you can adopt to build conversions using OTA advertising, leading to higher direct bookings and increased independence. Many companies adopted strategies early in the days of Internet search, and these opportunities are appearing again. It requires action and forethought.

Websites need a rethink, and we are entering a new era of web technology and data-driven, results-oriented changes. Branding, expertise, and authority in your location and business will become increasingly important. Relevance, focus and attention to every element of your business will give you the edge. Platforms have to be generic and standardised, but you don’t.

Humans are lazy, and part of the reason OTAs succeed. It’s akin to shopping in a supermarket. Additionally, Amazon’s success is primarily due to its ease of use, which enables customers to select items, click a button, and have them delivered.

STRs are not relatively so easy. Questions often need answering, and no two “products” are the same. Prices are usually cheaper when purchased directly and frequently come with added benefits. The OTAs are a barrier to communication, control the money flow and charge for that privilege.

Computers don’t need to sleep and can automate all the functions that a human would undertake if they had the time, were willing, and possessed industry-specific knowledge. AI agents can handle the hard work of searching OTAs and seeking the source of truth as AI search rapidly transitions to a more semantic and intent-based approach. A few keywords are still the primary method of finding information, but this looks to be fast disappearing.

OTAs succeed through choice, trust, being frictionless and leveraging big data. Search is not going away, but AI agents will offer a broad spectrum of supply; hence, your transactional platform needs to convert as well as an OTA. Trust messaging, secure systems, insurance, loyalty programs, direct deals, and streamlined checkouts are all integral to this execution. Expand reach across hyperlocal and companies that are less interested in an IPO and more focused on local communities.

Implementation of all these levers is now at your fingertips, and the time is right to push for change and push back on the OTAs at scale.

If you are not subscribed and want to read the next “How to Succeed in the World of AI Agents”, subscribe below. We will cover:

- Websites: Not your usual, “let me sell you a website and get instant direct bookings!” sales pitch.

- Trust building

- SEO and its trajectory, content and delivery

- Adding qualitative value through DMOs & listing sites

- Tactics to use on OTA listings

“Use OTA tactics, not their leash.”

Sign up to get advice on how to de-risk and build your brand real estate.

Article by Richard Vaughton, Yes.Consulting