Welcome to the Yes Consulting vacation rentals newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short-term rental sector.

Welcome to the Yes Consulting vacation rentals newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short-term rental sector.

TWO CONFERENCES IN MAY ARE NOT TO BE MISSED!

VITURSUMMIT IN MALAGA (10/11/12 May)~ A high-quality event attended by major players in the industry. Network with Industry leaders helping shape the future! With so much EU legislation, sustainability, M&A and AI in the eco-system, it’s a conference of the future.

SCALE RENTALS IN BARCELONA (May 17/18) ~ Where managers meet managers as part of a week-long STR event plus “The Exit Door” on the 19th. If you’re looking at your company value or thinking of selling or wanting to see what your competitors are doing, don’t miss it!

SCALE RENTALS IN BARCELONA (May 17/18) ~ Where managers meet managers as part of a week-long STR event plus “The Exit Door” on the 19th. If you’re looking at your company value or thinking of selling or wanting to see what your competitors are doing, don’t miss it!

DATA – IT’S IN YOUR HANDS

Wherever we look these days, data is at the centre of all we do, but to ensure we are talking about the same thing, the definition of data is: “facts and statistics collected together for reference or analysis.”

However, correct data use is another thing as we found out with Cambridge Analytics. The use of recent historical data is helpful to many industries to evaluate and predict the future, as shown by this Deloitte leisure consumer report for 2021, which seems to have made some excellent predictions in our sector. There are, however, lots of ways that data is manipulated to the benefit of the reporter and many ways it can be interpreted. Remember the 2008 crash? It was fueled by insufficient data that overstated how much mortgage-backed securities, collateralized debt obligations, and other derivatives were worth. We know what happened then!

Compared to hotels and other industries, short-term rentals have been behind the gain line. Still, we are rapidly catching up despite having more complex problems requiring specific analysis and implementation approaches. This month is focussed on the importance of data in the short-term rental environment and how it affects decisions we, the guest, the local authorities, the marketing channels and the investors make!

The problem with data is that the more you have, the more complex interpretation is, but the more you have, the more power you potentially have. Can the little guy compete or be part of the product soup for the big corporations to be bled and controlled more efficiently? Most managers sit on a raft of data seldom used or interrogated effectively. We are witnessing more software tools coming to the market to help manage the opportunity. Still, like everything short-term rentals (STR), it’s complicated, and the big corps are way ahead.

This month:

We start with pricing and finish this newsletter with AI. Is the latter the most significant opportunity/threat to marketing and guest traction any STR business can expect to see for the foreseeable future (except pandemics)? We think so. Ignore this at your peril!

A Favour:

I am collating data on PMS systems for publication. I would be very grateful if anybody would like to answer 12 multi-choice questions on their PMS use and challenges! THIS IS THE LINK.

PRICING – Get on board now!

No surprise here. Twenty years ago and even today, many hosts and managers fixed their rates for the year ahead and didn’t change them. The OTAs of the day also published these seasonal lists on the property pages. The guest could see the yearly price range and match it to their budget. These prices were nearly always with fixed turnaround days as well. Technology adoption, development and market growth have significantly changed how property tariffs are managed, as shown below.

- Large volumes of data for scraping on OTAs increasingly show volume comparisons across markets and properties.

- Increased use of PMS systems with stored historical data allows future predictions and seasonal adjustments.

- Increased data points from third-party APIs relating to tourism trends, weather, events and more offer new real-time insights.

- Changes in guest habits, trends and demographics mean that data and automated systems are increasingly important.

- Web platforms became more orientated to data capture and intent.

These days prices are modified almost on-the-fly to squeeze more out of the guest using dynamic pricing tools and revenue management skills. This is a complex subject but is an industry on the rise, especially as the gap between hotels/hotel apartments and rentals narrows.

You don’t have to connect via a PMS to start thinking about pricing, better management, and competitive alignment. You can look at your close competitors on the OTAs and run date searches, but there many cost effective tools that will aggregate all this for you. Links are shown further down this page.

If you are looking for dynamic pricing companies or tools to help price correctly, try these four companies PriceLabs, Wheelhouse, Beyond Pricing and Key Data Dashboard. Another introduced to me today was Abal Consulting. There are many more. If you’re also thinking hotels and how these two accommodation types are converging (PriceLabs is), then there are plenty of businesses with expertise in this area, too, such as OtaInisght.

GUESTS – Compliance

Guest Data

Keeping guest data is becoming tricky and risk-averse companies toe the line. However, those with a less stringent or caring attitude to regulation will be storing, buying or harvesting data that may be illegal! The net effect is the same; whatever data is available can be used to improve business practices. This is why there is a dash to collate and curate guest data through service companies, adoption of CRMs and integration of monitoring software and accommodation hardware.

The four most everyday data elements for guests are:

- Contact details

- Guest demographics

- Guest interests

- Guest preferences

This information can make a significant difference, especially to high repeat destinations, growing businesses and those with active promotional campaigns. It can also highlight gaps in the business model: For example: if there is a big difference between direct bookings and that on OTAs, perhaps it’s a language issue if the booking differential is predominantly Italians, not your native language for example.

When guests make bookings, timings can make a difference for promotions. For example, if you have a significantly high number of bookings on Sunday evenings, this can help with conversions and planning of offers. Or previous customers who purchased upsells can be re-targeted similarly. Perhaps create specific landing pages.

Bookings often come from multiple channels and during different seasons. If you see trends where a channel brings business with a longer LOS, consider the best options to maximise revenue and keep costs to a minimum. Review whether you see a significant trend between the age of your guests and how much they spend, both in ADR and add-ons. Be analytical, not just busy!

What you need to know! GDPR

GDPR

GDPR provides “the protection of natural persons about the processing of personal data and on the free movement of such data.” This means you need to be careful and follow the rules. This is an entire subject by itself, and there are a wealth of experts to help navigate this potentially expensive risk. You will need to plan, audit, and check compliance of suppliers and have written policies and address the following:

- The right to be informed. Companies must specify what data is being collected, why it’s been collected, what it will be used for, and how long it will be stored. Companies must also have clear reasons for storing data for that time.

- The right of access. Individuals can access personal data upon request in an easily readable format.

- The right to rectification. Individuals can review, modify, and correct data companies have on them.

- The right to be forgotten. Individuals can request the deletion of information about them, and companies must balance individual interests with the public good when granting deletion requests.

- The right to restrict processing. Individuals have the right to limit the processing of their data where they have a particular reason for wanting the restriction.

- The right to data portability. Individuals have the right to transfer their data on request.

- The right to object. Companies must get consent from individuals explicitly and offer the option to withdraw that consent while tracking that consent in a centralized location. Individuals also have the right to protest decisions made by automated algorithms.

Get your terms and conditions in orders for bookings, web-use and onward marketing purposes! On a seriously hazardous note, please follow all the rules relating to PCI compliance and check your tech suppliers to see if they process card payments and have compliance certification and sufficient audit checks and measures. Do not write or store card details you get over the phone, as many businesses still seem to do. It wasn’t long ago that Booking.com faxed card details worldwide, and these were printed out and left at the front desk!!! Make sure your data is protected and systems cannot be breached, as this can be very expensive, too, as many companies have found out—even the biggest fail.

Checking your guests out!

Although guests make great use of reviews by other people to select their accommodation, we are seeing more and more hosts and managers checking the guests in the booking process too! Short-term rentals are notorious for parties and for worse. We know it’s only the minority that causes trouble, but one is enough for many hosts. Avoiding that damaging situation for the property or reputation with neighbours is paramount;t Hotels have staff, who defend against the problem guests, simply by being there. Hotels are also generally single buildings or blocks; the only neighbours are other guests. With access to large volumes of personal data, especially as more and more people book and transact everything online, their reputations follow them. Tracking social media, black-listed databases, financial reports, and criminal databases, credit card theft can all be accessed in seconds to determine whether the guests are a risk. Additionally, in-search and display of properties can be modified to avoid showing previously tracked visitors’ accommodations that may fit their unscrupulous needs.

Simple adoption of basic rules helps, of course, and this is common throughout the industry: No single-sex groups, no groups under a certain age, no bookings within 48 hours from local IP addresses and almost a thing of the past: CVV numbers of cards always submitted to make a booking.

Some companies are providing this seamless service and are proving their worth daily; one such is: Superhog, ———- and their new brand, KnowYourGuest.

Guests are checking your business out!

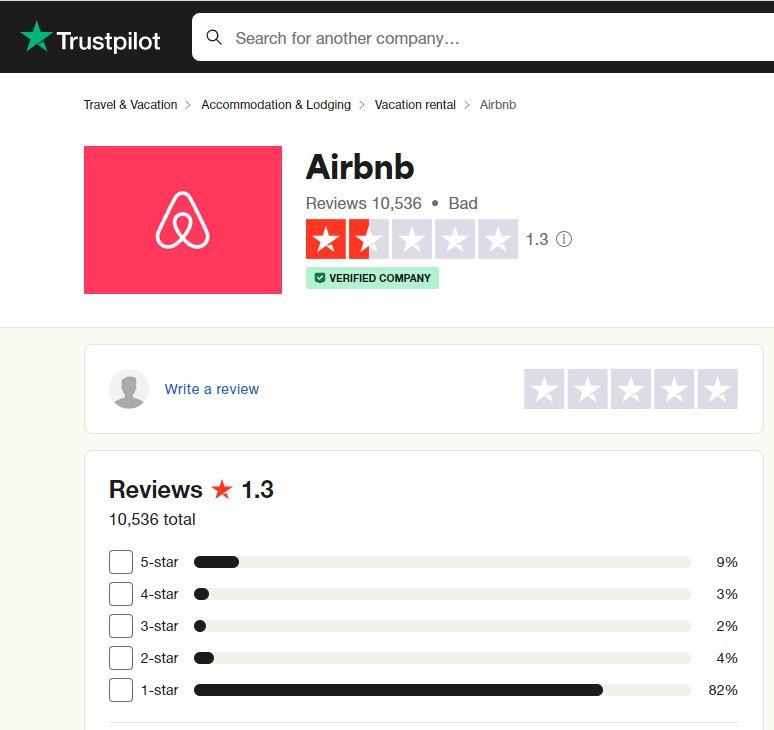

Don’t think that the guest is immune to checking the credentials of a company and its reputation too. Just because a property has excellent reviews, does this mean the company is top notch too? This is the Trustpilot review of Airbnb, and below that, Sykes Cottages. We know that it’s easier to complain than offer congratulations on an excellent business/service. One is global, the other countrywide, and has greater property control, knowledge, and pricing flexibility, with a dedicated guest service team. No surprise then that we have seen Airbnb under the cosh recently as the markets wake up to professional managers. We would expect to see rebuttals to this from its shareholders or analysts who know better than the industry what is happening on AI, Legislation, professionalization and pricing: and they will use “data” to reset their forecasts. They just didn’t know that up to 20% of their stock was more expensive than that elsewhere, especially direct. A bit more data from multiple sources would have revealed that Achilles heel!

So if the data shows such a poor reputation, why is Airbnb’s average score between 4.7 and 4.8 out of 5? Let’s not go there, but the outcome is that data use is complex, affects decision-making, and can be used to your advantage to attract and convert guests.

Several companies will validate companies so guests can be assured of their integrity and stability, such as iPrac or Quality in Tourism/QIAServices. We can also expect this market sector to expand into regulation and licensing management and services.

Investments in Property!

Nearly every one of us has made investments at one time or another, whether that is a business, your home, shares, capital assets etc. The question is, how do you decide on the correct approach? Using scraped and integrated data has allowed potential investors to judge whether acquiring real estate in a specific area is a good short, mid or long-term investment. Capital growth and rental yields are the primary drivers.

We are now in Airbnb goldmine, millionaire territory! Hundreds of Airbnbers have become masters of the rental world (:)) and offer courses on how to grow portfolios, leverage borrowings and repay via Airbnb rental income. I often wonder why they don’t just stick to growing their incredibly successful portfolios. Without being cynical, we have all seen these blogs, “The ten best places to Buy an Airbnb”, and are pushed out regularly as tech and management companies try to lure people into their lairs. Buyer, beware, all rental roads are not paved with gold!

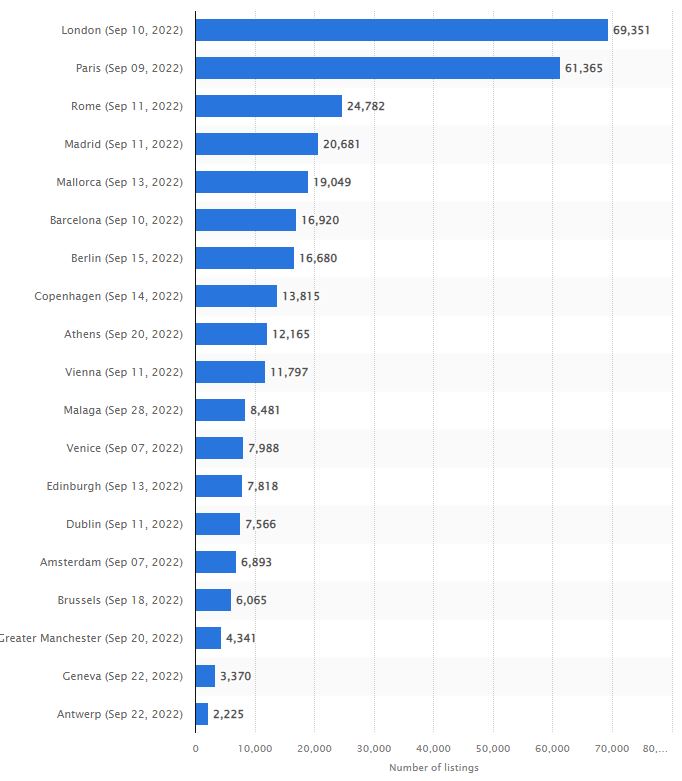

As this article is about data then, imagine you were considering buying a property to let on Airbnb; these figures (above) on initial inspection (from Statista September 2022) may seem a good indicator of success, but as anyone in the industry knows, the majority of cities are now either regulated with licensing or in the process of being so!

This blog by Airbitics shows five great places to buy a rental home (2022), including Funchal in Madeira, a lovely place, but dig a little deeper in 2023, and you can see a significant pushback and all manner of restrictions being imposed as this island is part of Portugal.

Then there is data on occupancy that affects real estate acquisition. You may have found virgin territory for rentals. This seldom lasts, and as more investors and operators pile in, the ADRs go down, as do the occupancy and then profits suffer, and leverage is at risk. Oversupply is an issue! But how do you judge this? Many people use online tools, some listed below, to see trends and opportunities. However, if you want to see what is now called the “Airbnbust” in action, try this article from March 2023 (Insider), which highlights the issue and Phoenix, Arizona, in particular.

Takeaway: Data can be dangerous if interpreted without a complete picture. Ask investors in some recent SPACS.

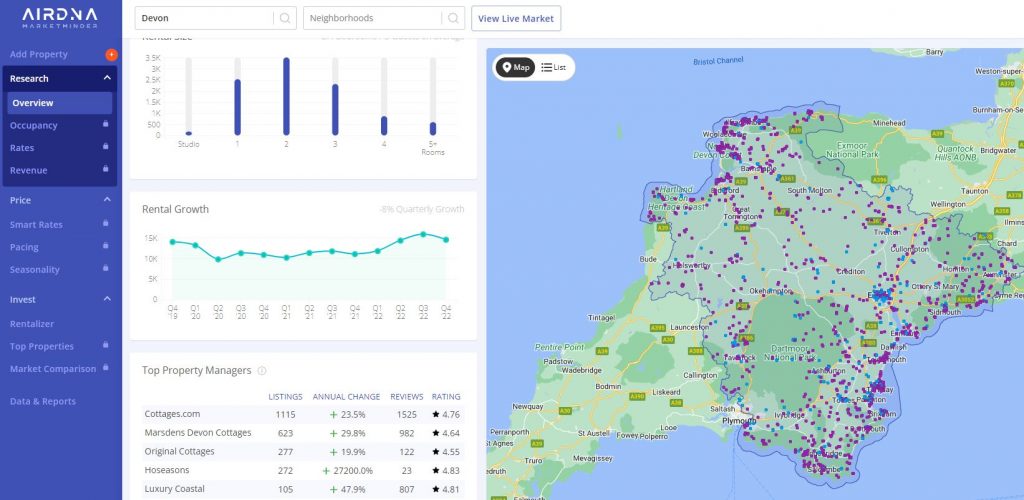

AirDNA is one of the most popular tools for analysing bulk market data on STRs. Still, more are embedded within the dynamic pricing subscriptions of the companies mentioned above, such as the PriceLabs Market Dashboard

LOCAL AUDITS

Who uses the subscription data tools that offer up ADR, occupancy, seasonal variations, cancellation policies, and the number of bedrooms and properties? Potential investors, as we have seen above and hosts and managers who want to see what their competitors are doing, how to set base prices, which types of properties are booking and when.

This is not all, however. There are countless local authorities and individuals concerned about the Airbnb effect. We hear the Airbnbust word constantly, but how do local authorities know how many properties are being let for STR and if this adds pressure to the residential market availability and prices? These organisations and individuals use these sites to garner information in their battle against an oversupply of STR accommodation. This article from 2020 is a good example of Barcelona’s fight to combat Airbnb’s growth, with Airbnb challenging AirDNA.

As a planning tool, where registration and audit are not enforced, or others fly below the radar, e.g. London, these OTA scraping companies (they also scrape Booking and VRBO) are very useful. The issue, as always, is the data’s accuracy and interpretation. It’s easy to say 10,000 listings, but if these are rooms in people’s homes, it’s different from 10,000 complete properties.

Reporting

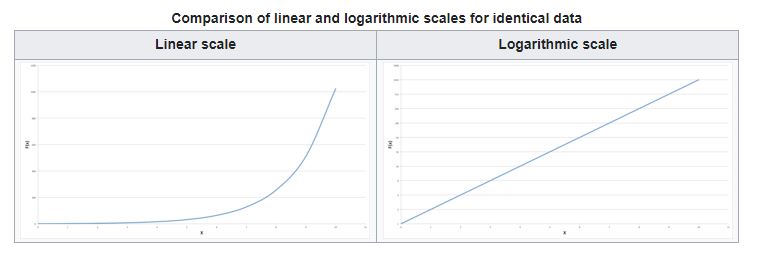

This is a graph copied from an entire article on Wikipedia about misleading charts (well worth a read). As you can see, they are radically different and can be used creatively to show different growth rates. The STR industry has blossomed and seen endless pitch decks and presentations. It’s hard to fool investors on financiers, but imagine an inexperienced member of the public looking to buy a property based on constant income to cover a loan. The income growth presented on a log scale looks good, and you would be earning from day one, but that is not true.

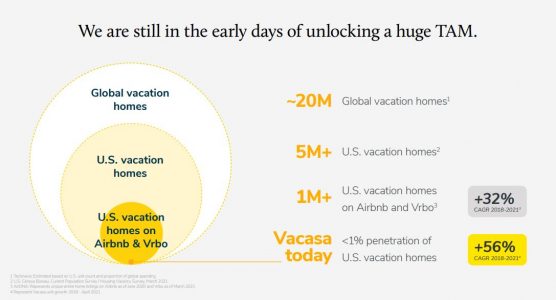

There is a dependency to rely on research by large and small corporations alike, often with interesting representation and third-party data that is trusted. We see these as references on decks, such as this Vacasa one below, pulled from Skift:

Which references to both AirDNA and a Technavio report, the company extrapolates market size from there. Check the report summary yourself, and you’ll see the issues. Very accurate global market data is hard to assimilate when there is little control and regulation. Again buyer, beware.

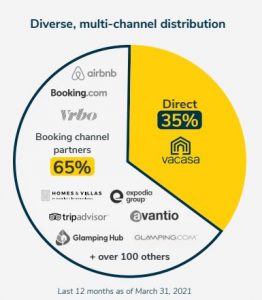

This visual representation of Vacasa direct booking data is also interesting as it highlights slightly more than 1/3rd of bookings are a success, and two-thirds are via partners. Note the yellow “Booking Channel Partners” as an aligned success metric. The same deck (pre-IPO) shows that the gross booking value estimated for 2021 was $1.3bn, which means the booking channels, took over $120m off the bottom line. Looking at this slide, we don’t know the marketing expenditure to create direct bookings, either!

DATA IS NOT ALWAYS REPRESENTATIVE OF HEADLINES

Shown below was a headline, oft regurgitated by other bogs in the STR industry, stimulated from a survey by Evolve to 5,000 travellers in the USA for 2022 booking trends

An overwhelming 86 percent of respondents said they plan to book a vacation rental next year with another 14 percent citing “maybe.” Only 0.3 percent of respondents said they did not plan to use a vacation rental in 2022.

The small problem with this statement is the actual survey and resulting data: “The 2022 survey was sent out to a total population of 100,000 contacts via email, as well as shared on Evolve’s social media channels, with an offer to be entered to win an Evolve Travel Credit of $1,000″. Evolves’ database is focused on previous renters; it was not a general travel survey. The following effect of these headline statements is that they are influential at many levels. Again data is there but used for its purpose and is misleading. These attention-seeking headlines are then recycled, such as the follow-up from Rentals United (and now me!)

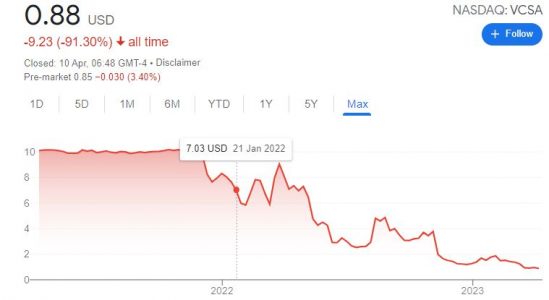

The data for this presentation is full of gloss and promise, and the business became a public company. So was the data and underlying message solid? Did it sufficiently consider market conditions and analyse the business model and performance metrics? This is the share price since flotation. Is there a massive upside? More data to digest!

Trends in data used by managers

There is a definite trend to becoming more data-centric in most management companies and a realisation they may be leaving money on the table or not using the information gained to their best advantage.

Entering the world of acronyms: DDDM ( Data-driven decision making) uses facts, metrics and data to guide strategic business decisions that align with a manager’s goals, objectives and initiatives. At its core, this involves implementing a self-service approach that allows people to access the required data easily, ensuring security and governance are maintained. It also requires training and development opportunities for employees to acquire data skills. The following are trends we see daily and questions being asked about the best tools for the job that allow DDDM.

Step 1 – Identify your business objectives.

Step 2 – Review business teams for key data sources that can be spread and disconnected (a,b,c,d,e,f)

Step 3 – View and explore data: Visualising data is crucial to DDDM (see below)

Step 4 – Develop insights. Discover opportunities or risks that impact success or problem-solving.

Step 5 – Act on and share your insights across the business.

Some data sources managers can access:

a) CMS (Content Management Systems) are primarily used for website management. These are often integrated into PMS systems to deploy listings via API connections or plugins. These systems are becoming increasingly complex as they extend their connections, especially for data collection and upselling ancillary products. Examples are WordPress, Drupal, Magento, Wix, and Squarespace.

b) CRM (Customer Relationship Management) is a software system that helps business owners easily track all communications and nurture relationships with their leads and clients. A CRM replaces many spreadsheets, databases and apps that businesses patch to track client data. This fast-growing sector has hundreds of CRM systems to help interpret and manage data. Still, they are often used to focus campaigns aligned with this interpretation as a key priority. Examples are Hubspot, Zoho, Pipedrive, Salesforce, Creatio etc. Gartner has a good analysis of some of the most popular.

c) PMS (Property Management Systems) is becoming ubiquitous for efficiently operating management businesses. This software type is the primary source of booking data but seldom offers quality CMS, CRM or visual tools well. Our PMS selection questionnaire/document is a popular FAQ download before choosing a system. Typical systems are HostAway, Hostfully, SuperControl, Streamline, Kross Bookings, and Avantio, but there are hundreds.

d) Web Traffic and Activity tools are an absolute must and generally an easy integration. Google Analytics is the most popular tool to track visitors’ activity across the website, with much more interpretation of activity and demographics and tracking PPC activity. Watching how guests interact with the website and what elements are popular or ignored can help develop a richer and more engaging site. Tools such as Hotjar are commonly used.

e) Accounting Systems: Do not ignore your financial data, depending on where the guest and owner’s financial data resides and the cost centres. Cost centres vs marketing and sales ROI can be valuable.

f) Social media accounts: With video becoming more prevalent and ambitious, this and the more text-based social media sites are important and can realise substantial information.

g) Third-party subscriptions: e.g. AirDNA, SeeTransparent , PriceLabs or Key Data Dashboard

h) Third part traffic analysis and keyword tools such as SEMrush to check on competitors and opportunities

Visual Interpretation: This is important from an interpretation perspective. A visual representation can easily identify trends and outliers and offer a much faster and often more straightforward way of seeing the benefits of campaigns and data-driven decisions. One pronounced and widespread use is to identify geographical guest origins, demographics, and seasonal trends. This can be harder to navigate in tabular format, whereas a map of origination and coloured data points can immediately light up historical data and future opportunities. Examples of systems are Tableau, Microsft Power Bi, Trevor.io or the free Looker Studio (previously Data Studio) from Google; This comparison report shows the extent of the market development.

Machine Learning and Artificial Intelligence are Data Sponges

No post these days is free from the need to mention AI and ML. Elon Musk has made several dramatic statements recently, highlighting the need to stop, consider, regulate, and control and this quote sums it up!

“AI will be the best or worst thing ever for humanity.”

Every day we witness new entrants with their AI models, one of which is Bloomberg which has trained its system on 50 years of financial data. Parallel this to the large OTAs and their vast amounts of guest, price, destination and property data. Combine this with the latest architecture implementing their own AI-driven business decisions on listings, loyalty programs and real-time chat, not to mention messaging systems and they are winning the smarts game.

![]()

The challenge is how managers can compete with the industrial-scale intelligence invested in this technology. The bigger a company is, the more data they have, and the greater the opportunity to leverage this to its advantage. As a manager, marketing is increasingly challenging as corporations dominate digital media and the first pages of “Search”. With the advent of AI, such as ChatGpt, the threat that search will become more focused on AI/Natural Language Processing is of enormous concern. $bns have been spent on SEO and organic positioning by small companies: will this be wasted money following Google’s SEO and EAT rules and be substituted even more profitably by AI tools?

Expedia recently announced that it hoped AI would balance the power of Google, a common complaint amongst OTAs. However, if you want to see a company whole heartedly adopting this technology, look no further than Booking.com, which has some comments on current use and intent!

“As with many high-traffic e-commerce websites, Booking.com already makes considerable use of AI. “We essentially deploy AI in every part of the business, ranging from our security teams to customer service, We have a chatbot live for all English-speaking bookers that handle 60% of all requests automatically within seconds. In marketing, most of our marketing spend – probably 97% or so – is driven by data models with learning algorithms behind them. On the website and app – known at Booking.com as the ‘purchase funnel’ – this presence is particularly pronounced. Every pixel you see is essentially somehow touched by machinery. It is everywhere.”

For the growing manager, is there hope on the horizon?

Although the world is becoming more connected and large industries have a head start, businesses are still being established to assist smaller companies, such as AIAdaptive. This company leverages AI/ML based on a company’s data and ad spending to improve ROI. Check out the calculator here.

These businesses are still few and far between as they rely on extensive data and smart tech. Unless there is a massive collaborative inventory effort to defend the margin squeeze soon, focusing on quality, historical and purchased third-party data at a local or niche level is the only solution for managers,

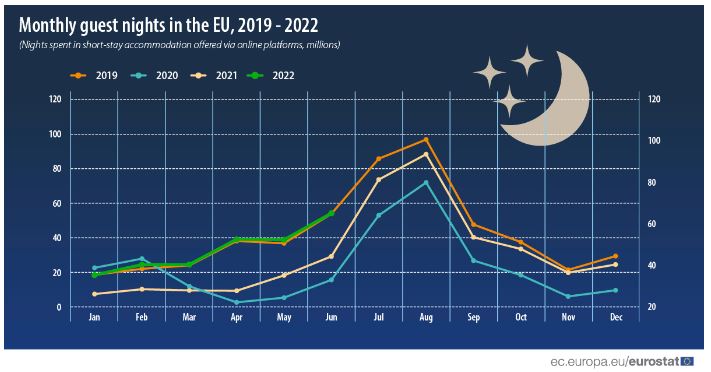

You can check your Government’s or local authorities’ data or that of associations to get a feel for markets and trends and where your business sits in the global ecosystem. Sometimes, these numbers are of little help (data interpretation again) as many STRs are very localised and have varying guests and properties, distances from airports, conurbations, and rules and regulations. Eurostat has mountains of data in Europe, and since late 2019, Airbnb and Expedia have contributed to the pot. This Google search link shows a wealth of mapped data. But as a test, see if this graph (below) and trend match your business stats and use this link to see where the hotspots around Europe are!

More Data and Tools We Found Interesting:

Don’t just shout “Book Direct”; work smarter is this hotel tech message. As you would expect, large hotel tech suppliers are on the ball and ahead of rentals. We recently booked rooms through an Avvivo tech partner and were impressed with the booking journey. Naturally, some research on the tech kicked up Allora.ai (check it out), which is focussed on using the guest journey data, amongst other things.

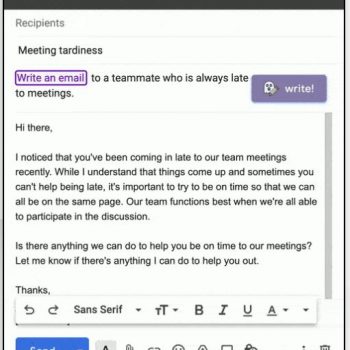

With the whole world crazy about content generation, using GPT, this was a tool recommended to us: Write Sonic

Struggling to write emails. Another GPT tool: Ghost Write a Chrome extension.

Adobe has 30m subscriptions, and Photoshop is among the most popular. So Photopea may come as a useful surprise for those who are not at that top level and need some tools (free)

Almost finally, a favour:

I am collating data on PMS systems for publication. I would be very grateful if anybody would like to answer 12 multi-choice questions on their PMS use and challenges! THIS IS THE LINK. Even now, we see a 500% difference between PMS managers on cost!

And finally: £14 ~ The Airbnb penalty.

This article mentions Airbnb 14 times. In 2023, the number of times I mention this company in print or on stage at conferences will result in £1 being added (starting today, it’s £14). At the end of 2023, a charity of my choice will receive a cheque for this sum. We can escrow any monies and create a collective effort if anybody wants to join the party.

SCALE RENTALS IN BARCELONA (May 17/18) ~

SCALE RENTALS IN BARCELONA (May 17/18) ~