Welcome to the Yes Consulting vacation rentals newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

Welcome to the Yes Consulting vacation rentals newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

This article has been published late August 2022. Since then, apart from my commentary below I recommend everyone read this article from Jarvis ML which keeps a great insight into the issue covered below:-

ADR’S UP, PROFITS ARE UP, GUESTS ARE PAYING MORE…..

Are the good time over and if so, why?

All the tariff prices shown below are based on a stay in mid-October for 1 week and are quoted from mid-sized management companies (250-1000 properties) in leisure destinations with direct booking values over EU1,500 per week.

The three numbers represent an average of 3 different properties from 3 different managers from 3 different regions listed on 3 or 4 OTAs (VBRO, Airbnb, Booking.com and TripAdvisor). Maybe by chance (but very unlikely), I did not find any properties on the first 9 listings chosen which were close to being the same as the direct price available from the manager’s own website. Nine properties from millions are not statistically significant, but 9 from the first 9 probably are and would do well on the roulette wheel if we gambled.

[wpdatatable id=1]

18%+ and more

The results below if averaged equates to just over 18% uplift on an OTA (Airbnb quotes 13%). This percentage applied to a EU/$/£2000 booking for example would represent EU/$/£360 which is not insubstantial when the price increases on car rental, cost of living, pending recessions, plus racing inflation and interest rate hikes are all brought to the family holiday budget. On the few properties checked, some sites were over 30% more expensive.

The question is: “Is this sustainable?”

Limited margins and search dominance

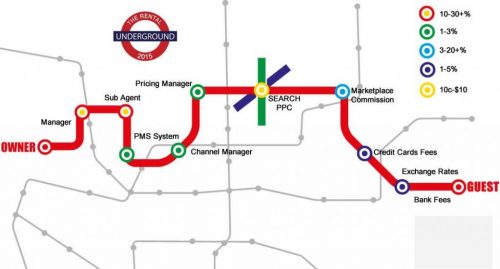

Last months newsletter the increasing costs a manager encounters whilst managing their business, which are too numerous to mention.

The net effect is that if a manager charges an owner 25% commission on marketing, guest and money management, complaints etc (not to mention running a company with staff) then absorbing a 15%+ OTA commission without recourse to an uplift of prices will not only see insufficient funds to grow or operate their business but probably increase OTA dependency, a spiral of risk.

The OTA commission (and associated card fees if applied plus VAT elements) are increasingly being added to the tariff within a PMS or channel. OTAs are aware of this price increase challenge to their competitiveness. Price parity aka the old Booking.com model is outlawed now (literally), so challenging to put across to customers. OTAs can of course rank by price, reviews, interest, guest demographics and in-site activity, with machine learning and AI now part of the mix to maximise opportunity. With such a high level of PM inventory on OTAs and also individual owners witnessing and emulating these particular inflated prices the guest is definitely not getting the best deal possible and OTAs are seeing “leakage”. There is no doubt a guest will pay modestly more on an OTA if they are a) lazy b) to be theoretically more secure in a booking c) Not attuned to the fact that OTAs are purely marketing platforms servicing guests and owners with no legal liability to either in the booking contract.

What trends are we seeing right now?

I subscribe to PASUK, an absolutely awesome newsletter. A few weeks ago it included this paragraph:

“As the weather cools it’s clear that demand is also softening for many. More are reporting gaps in August than we can remember. This is particularly worrying when we are seeing so many of the costs of running a self-catering business continuing to rise. One of the most common questions is how to price for 2023?”

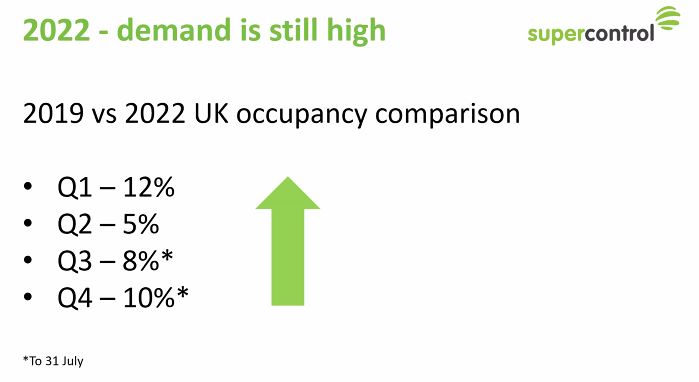

However as the summer comes to a close, SuperControl produced this slide from a webinar this week with occupancy comparisons.

This does illustrate that each market is different to a degree and even within a market segment.

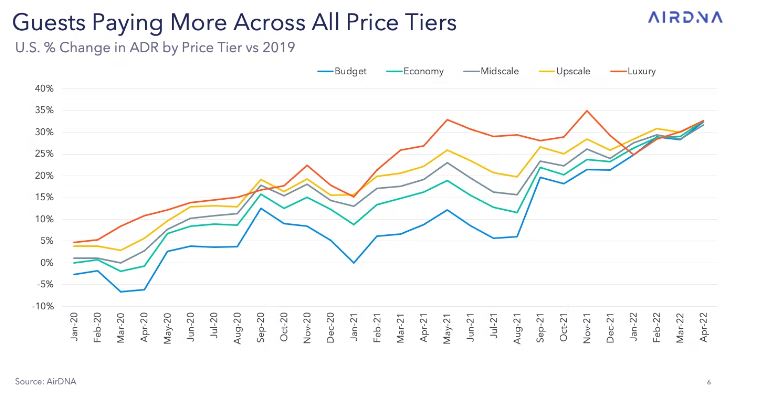

The US is the single biggest country market and we may be seeing a levelling of occupancy vs demand as this AirDNA report shows below. One, two or even three years of data is insufficient at the present time, due to Covid, but this trend may be the pivotal point in growth vs income.

Consider this recent report by AirDNA in the US and it evidences the increasing ADR since early 2020 which was just pre-Covid. How much of this is based on managers and owners’ uplifting prices (which AirDNA cannot see) and therefore higher “Guest Service Fees” (as explained here in 2016!!!) on raised tariffs?

Airbnb Qrt2 Results 2022

Of all the information supplied on their continuing success(!) the part related to the price per night quotes. Great news for owners, managers and Airbnb and hotels (who can compete more effectively), but terrible news for guests and we all know that guests are the most important part of the industry (sorry, couldn’t resist).

ADR averaged $164 in Q2 2022, representing a 40% increase compared to the same period in 2019

Anecdotally from conversations with both EU and UK managers for this newsletter, the year to date has been good, but demand is sloping away and last-minute and mid-week bookings are more the expected norm as noted by Booking.com. With great choice comes less of an imperative to book early and as inventory grows, presumably this trend will continue.

These last-minute or closer-to-arrival bookings add operational stress and the desire for mid-week bookings often compounds the problem, especially in markets depleted of manual workers, who are seeing better income elsewhere and those who do work in the industry are commanding higher cleaning fees, adding to the trend of higher tariffs we see across the industry. Again hotels are better placed to manage this.

Look over the horizon

If inventory increases as we continue to see, occupancy and RevPAR will decline if demand declines. Demand will decline even further when accommodation is over-priced compounding the issue. The better priced and presented properties will see more interest and the smaller, less well furnished, poorly located and those lacking amenities will lose out.

Guests are already beginning to expect hotel-level service and many guests are new to the rental market. Again anecdotally we see increasing numbers of complaints about putting the rubbish out and doing the washing before departing, not to mention the “outlandish” cleaning fees. The whole value proposition of a holiday home is based on a value price per person occupying a larger space, offering up the capacity to cook, relax in a more family-style environment and enjoy the comforts of home, which now need to be at least on par, but generally better!

Does this open up greater occupancy and marketing opportunities for hotels? Certainly hotel prices are beginning to look more competitive, especially considering the numerous challenges of entering and occupying a badly managed Airbnb! This Hilton advert takes advantage of travellers’ concerns about the unexpected! Do not discount the hotel’s fightbacks on strategy and offers, especially when ADR’s start converging.

Scale Counts

Small companies often cannot amortise costs effectively and managers have a lot of challenges, often with insufficient resources. The tendency is to rental fatigue and a feeling of hospitality hell especially as the world becomes more connected, more aware and often less considerate. With Airbnb’s new AirCover for guests allowing for post-arrival refund and cancellation latitude, it’s clear that it will become difficult for lower quality rentals, but also opens an opportunity for abuse by guests and if arbitration is required, who controls that?

Without the extra margin smaller companies are not as nimble in marketing, adoption of new tech, increased integrations, staff management or financial buffering. The oil tanker change of direction analogy of the larger companies does not apply here, they can compete more effectively provided they are well managed.

OTAs are a permanent part of the marketing mix and they have scale, technology, and smart people and are simply very focused transactional marketplaces (or “neutral venues”, remember that?). OTAs rely on volume inventory for traveller choice but also need quality and compliance from hosts according to their guidelines, which if a vote were taken by PMs, may not be pretty. The latest Airbnb “AirCover” announcement on cancellations and guest refunds etc has not gone down too well but is an indication of a) their brand strength and need to improve their PR and service to guests and b) their need for greater shareholder value. This will continue and pressure applied as they push for market dominance. Their Achilles heel is price and one of the most important factors in accommodation selection.

Time for a #BookDirect Show plug. Although this may have been a backwater of promotion and considered by Boards of corporations to be insignificant, all indications are that it’s going to continue to grow. Bolt in distributed and smart tech and the challenge increases.

In contrast to the independence and mixed marketing approach of ~Bookdirect, the OTAs challenge is to adopt micro managers or owners and dilute professional managers who game the pricing and availability. In their ideal world owners would be loyal to their specific OTA as a single marketing channel. In this scenario, gaming prices will not be as frequent, plus obeying the cancellation and terms and conditions will be the norm. A large % of managers is needed however as the OTA guest demand is high and there is often insufficient quality inventory available which is what many managers target. In the summer of 2021, a number of the OTAs simply did not have enough inventory in hotspot destinations as managers throttled the distribution as direct bookings were so easy due to domestic demand.

Owners who “do and clean”, do not often allocate this labour cost to themselves and hence their tariffs could be lower than that of a manager who pays staff, but often isn’t as the owners compare prices with managers, who have elevated them via channel management. The guest is paying more than necessary, stimulated by Internet search positions dominated by increasingly larger players, whether it’s called a Guest Service Fee or bundled in the price!

The marketing fee on an OTA although painful for an individual owner or urban micro manager is a necessity as direct booking exposure is very hard. Managers on the other hand run businesses, pay taxes and staff and deal with volumes of problems and need to charge commissions to run owners’ properties.

OTAs are a victim of their own success in this situation, dominant on search, invested in tech and have shareholders to satisfy, which means increasing fees or thinking up ways to add volume bookings or upsell. This approach however is not aligned to the profit margins in the management companies. So unless all owners self-manage, and management companies disappear this price problem will not go away and only get worse.

Are we headed to a price crisis?

Statistics show that pre-Covid, stay times, in general, were shrinking and statistically heavily influenced by urban traffic and its growth in rentals. Leisure destinations pre-Covid had seen shrinkage but were very modest. Shorter stays, still have the same management issues and costs of course, but can be charged at a higher rate for the privilege, conversely, they need an elevated number of bookings, which is increasingly more difficult in a market with more properties and as guests seek farther and wider for experiences.

Energy prices, inflation and rises in interest rates add pressure to milking assets. Will people still go on holiday? The answer is yes, but they will become much more circumspect on price and value for money. OTAs are not providing the best value and the more expensive the accommodation the more the penalty increases. A family celebration of £10,000 in a 10-bedroom villa, may cost £2,000 more than direct from the actual management company. This would seem to indicate that the consumer will look further and wider.

How will OTAs react? Provided regional management businesses continue to increase prices based on the commission charges, OTAs will find it hard to raise their commissions further and will need to rely on the other consumer weaknesses: Trust and cancellation policies. They will also need to find new ways to take more from the guest on bundling services.

Does dynamic pricing play a part?

Does dynamic pricing have any effect on prices? The answer is obviously yes, otherwise, it would be pointless using the tools but as adoption continues will it artificially cause issues? If anyone does not know how dynamic pricing works, then this short video from Pricelabs shows the basics.

OTHER DYNAMIC PRICING TOOLS ARE AVAILABLE OF COURSE:-

Dynamic pricing can only work from localised data and this is obtained from two spaces: PMS systems of owners and managers in that location and scraping listing platform pricing.

Managers who use dynamic pricing will set base levels which include the OTA uplift. As increasing numbers of individual owners use a pricing tool then it is likely that their own prices will align to the managers inflated prices provided the guest demand is present, but will also have an inflated base level price. The internal pricing tools from the likes of Airbnb are notorious in advising on lower than this market pricing, but will also be affected by this trend and be raised by their systems too.

What these systems often cannot see is the hundreds of thousands of non-OTA bookings substantially below OTA prices, which tends to make a mockery of global statistics and hence the realistic market prices paid by guests. Companies such as KeyData which harvest from multiple PMS systems and managers have a more accurate representation of what is actually being paid.

They are no doubt a part of the ecosystem but are also a cost centre. The question is what happens if there is:

- A change to the rental marketing eco-system that allows bookings at a fraction of the OTA cost? Imagine a charity OTA for example (honest) that has virtually no fees or a company like HiChee becoming mainstream and seeing mass host and guest adoption.

- An increase of tariffs due to elevated costs or charges may well see the guest value proposition collapse, especially in the pending economic climate.

Which are the best markets to be in, to avoid potential price Armageddon:

- Luxury:

The sale of a mass market product above market price is a sure way to ensure its failure. In contrast, if you target an affluent audience with a luxury item such as expensive jewellery or a sports car, you can overprice. For such an audience, the price often determines value. You can earn much better margins if your products have a higher price range since they are perceived as having greater value.

- Valuable Brands

It will be almost impossible for a start-up to justify the high prices it charges for its products to consumers. It is possible, however, for a company that has been around for a long time and is known for its superior products and services to overprice and still generate sales. This isn’t Airbnb it’s more Marriott hotels (not necessarily Homes & Villas as they are only third-party managed).

- Situational and time-sensitive locations

Some rental companies provide guests with the perfect platform to manage prices. A situation such as this typically involves higher than normal demand location with exclusive and limited accommodation or a limited-time, location event e.g. concert, surf championships etc

How to maintain the price and even add more margin?

This is an OTA dilemma too. If anyone wants a really good read on hotel revenue management and dynamic pricing with the developmental history of increasing data and future opportunity, then click this link and allocate 30 minutes of concentration. I will however take you to the conclusion of this excellent paper. This is a hotel analysis and rentals aren’t fractional building stays and do not see the same levels of repeat business or use, yet.

“The development of OP (open pricing) is moving towards the concept of one-to-one pricing. Conceptually, one-to-one pricing integrates each individual customer’s buying pattern and preferences into pricing. By doing so, hotels can offer a personalized price based on how valuable the customer is for the business. Therefore, one-to-one pricing involves a more strategic and customer-centric view than OP. From the customer perspective, prices resulting from one-to-one pricing are closer to their individual willingness to pay (customer value-based). From the business perspective, one-to-one pricing accounts for the customer’s lifetime value, which promotes long-lasting relationships with the customer. Optimizing RM according to the customer lifetime value instead of revenue triggers a more strategic and long-run approach to pricing that can boost customer loyalty.

This is not new and hyper-personalisation although challenged with privacy issues is possible, but only realistically from super large companies. Small PMs would need third-party tools and API connections to access guest data stores, which Airbnb and OTAs no doubt have in spades. The issue is that the source: the suppliers & their PMS controls the price, with owner expectations, not the OTAs! The only companies that could achieve this currently are super managers with hyper-local profiles. Perhaps OTAs will offer up an intelligent API-based tool that offers up guests that meet specifications and are close to budget requirements and the supplier offers latitude on the sales price to an OTA. Hard to imagine.

Apart from the above, there is one very simple and often ignored approach, especially in hospitality! Personal service!

https://www.superoffice.com/blog/customer-experience-statistics/

International travel is back in places

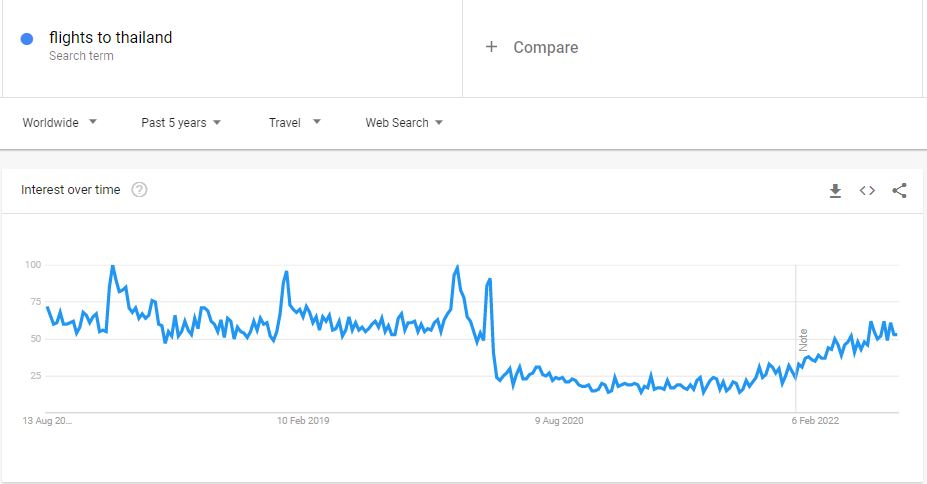

Domestic markets have been the benefits of post-Covid travel but will likely not last or be as popular with greater choice and attractive deals. International travel and long haul are coming back online after a disastrous few years. At the extreme Asia and Thailand have suffered badly but is representative of travel and holidays that have been taken elsewhere.

The more opportunity to travel, the greater the choice of accommodation and hence demand is affected and once the demand is not there, then prices will fall. If automated systems are involved such as dynamic pricing, will these systems start to outcompete each other and create a cascade effect of pricing downwards? Unlikely as long as base stop prices are involved and OTA uplifts are still implemented. This does mean however that the value proposition compared to a direct booking or a packaged deal may not be so attractive.

Then there is Google

If there ever was a question on Google’s ambitions in travel, it has to be where, why and how will it position itself. Google and its capacity to manage data are light years ahead of even the OTAs who feed it daily with information. Google knows that price is important as are many other trends.

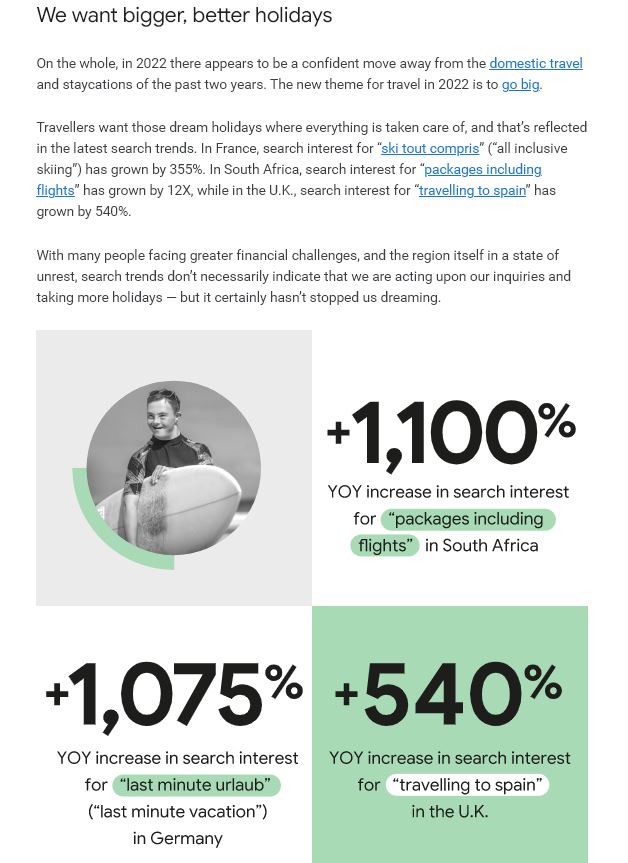

If we needed any confirmation that a state of normality is returning then “thinkwithgoogle” is always a good place to start. This screenshot confirms overseas travel, and changes in approach (despite evidence that short-term domestic travel is still buoyant currently).

As a UK resident, the rush to hit the Spanish beaches and cities has never been so demanding as we can see from the above. Once the airports and ports have sorted themselves this will continue unabated. This will see rental tariffs lowered in the UK and raised in Spain if the world is truly round. Germans on the other hand are very last minute!

Google knows OTAs are increasingly expensive and OTAs are pushing to their apps to avoid Google and other paid search, so what is the outcome of Google stepping into the arena? Markets have a tendency to consolidate and rentals are no different. OTAs have become larger, managers are acquiring more businesses, which we can expect to continue. With size comes power and the opportunity to build brands and market more directly at volume. Google started with a zillion small companies online, a brave new world of opportunity for all, but transpires it is now dominated by corporate behemoths. Neither are the suppliers’ friends or as it turns out Google’s in the future.

Google needs great searches to direct people to informative and slick interactive sales and conversions, preferably with strong niche brands. Sadly lacking in the rental world still being geographically fragmented and with little experience of online commerce and conversions. Google can provide the traffic but it needs to secure engagement.

SUMMARY

What goes up must come down is a common phrase and we may well see a reset to pre-2019, even 2016/17 prices. Commissions, tech fees, payment processors, owners, managers and Uncle Tom Cobley and all will be challenged. Inventory may stabilise, the marketing polarise into more cost-effective specialist niches plus:-

- Online shopfront development to make the bookings slicker, the experience faster and more secure.

- Google pushing hard to dilute their main payment contributors in travel promoting1 above

- We can expect third-party trust tools and governance to expand: Payments, reviews, security damage and deposits to reassure guests.

- More fintech on payment methods and fees

- Open source and subscription systems for data management

- A return to subscriptions on niche listing sites rather than full e-commerce high commissions with less ambitious companies aiming for an IPO

LAST MONTH PMS SUPPLIERS QUESTIONS TO ASK.

This has been published and is in circulation with several hundred downloads and linked here.

On that note Avantio has been acquired and Guesty’s sizeable investment announced.