Welcome to the very first Yes Consulting newsletter. Don’t miss a thing! The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

Welcome to the very first Yes Consulting newsletter. Don’t miss a thing! The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

SECTIONS – 1. Big Business – 2. Trends – 3. Data – 4. Tips & Tricks – 5. Technology

BIG BUSINESS:

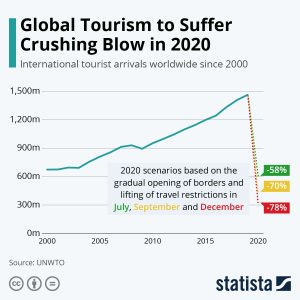

This month we have looked more closely at AirBnB and what it means to you (and them) in light of the massive drop in international travel and ongoing problems.

This month we have looked more closely at AirBnB and what it means to you (and them) in light of the massive drop in international travel and ongoing problems.

It was all going so well for Airbnb: We curate hundreds of news feeds and sector information and without doubt, Airbnb is the leader in brand PR, with thousands of releases weekly that include their company name. These publications have provided free traffic, resulting in less need for PPC and a less sizable marketing budget in relative terms than their immediate competitors. For those of you with a Skift membership then end of 2018 Morgan Stanley and others illustrated a slowdown of growth and shows Booking.com with double Airbnb’s marketing spend. The report also showed major upsides on Airbnb Plus (you can’t believe all you read).

Early Airbnb ambassadors and homeowners making extra cash from sharing also accelerated their growth. Yougov.com in 2016 put them top of their Advocacy rankings above Disney, Universal Studios, Apple, and more. All was going well four years ago. Airbnb also spawned huge numbers of management and tech startups, “Air-everything” (many now COVID dead) with their press, investments, and involvement in the supposed destruction of city living, which seemed to simply add to the growth and local micro-commerce.

Reporters and the general public now use the “Airbnb” term, in their ignorance as a cover-all for a short term rental stay in their clickbait press and articles, also increasing awareness of the company. They also still use the shared space term and this signifies that the general press needs some education.

BUT COMPARE WITH BOOKING.COM

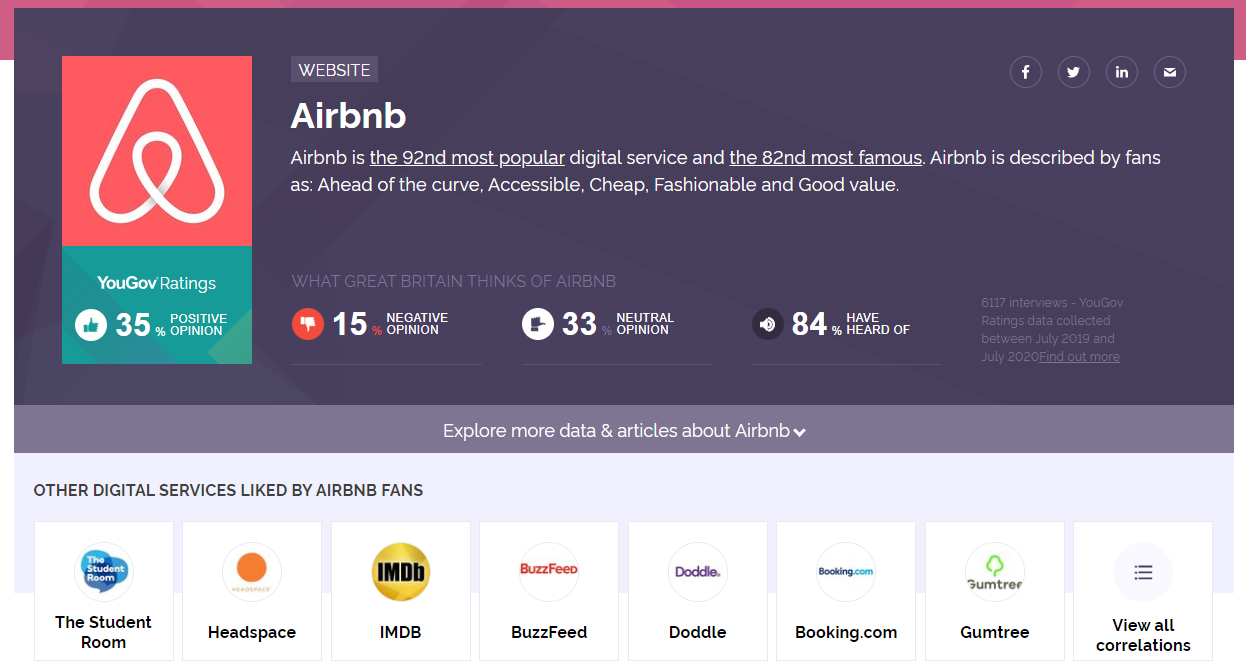

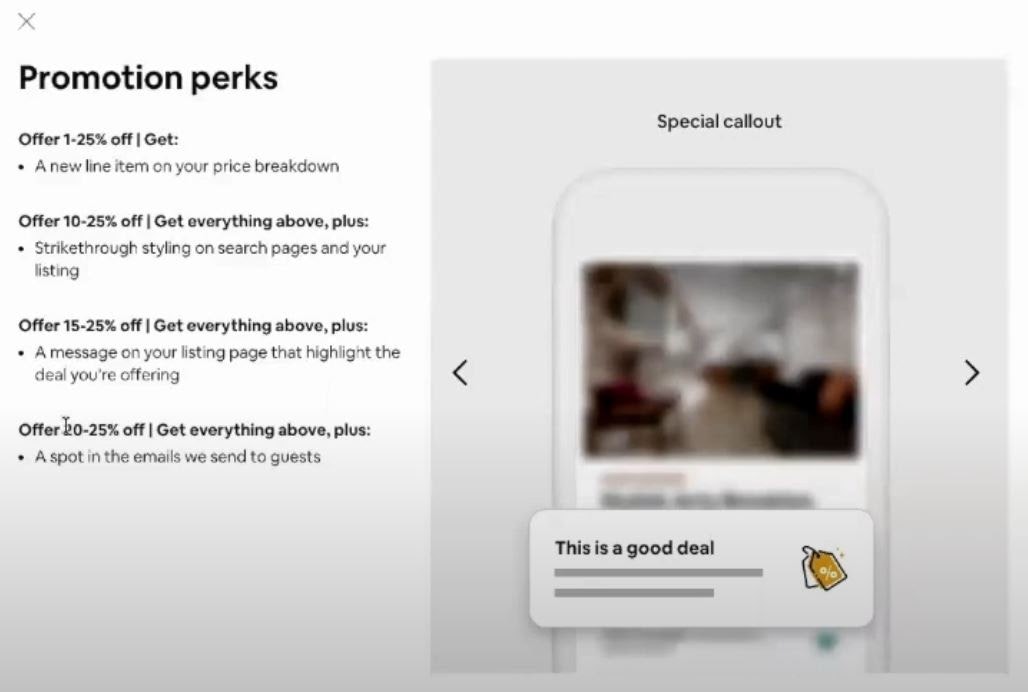

We looked at the Yougov brand ratings and not surprisingly Booking.com (chosen for its urban alignment) comes out ahead of Airbnb in positive opinion as it has a much more developed business within the hotel sector and takes no prisoners on supply, but they never have and this is understood. Hotels are easier to standardize, are sold as fractional spaces, and have well-defined controls and guidelines unlike the wild west of rentals. Booking also penalizes financially not on the overall reputation for failures, unlike Airbnb who is more prominent in its removal of inventory with disregard for an explanation.

We looked at the Yougov brand ratings and not surprisingly Booking.com (chosen for its urban alignment) comes out ahead of Airbnb in positive opinion as it has a much more developed business within the hotel sector and takes no prisoners on supply, but they never have and this is understood. Hotels are easier to standardize, are sold as fractional spaces, and have well-defined controls and guidelines unlike the wild west of rentals. Booking also penalizes financially not on the overall reputation for failures, unlike Airbnb who is more prominent in its removal of inventory with disregard for an explanation.

Traditional rentals are notoriously difficult to book short term, manage and operate and without stricter controls and increased professionalization is unlikely to see improvements quickly especially in the fragmented EU ecosystem. As a company based on booking units however, Booking.com has a better reputation.

Ref: https://yougov.co.uk/topics/technology/explore/website/Airbnb

One of our network members referred to Airbnb as a “Cultural Icon” recently, and we know just how easily an icon can fall from grace, just as Airbnb has recently. Press at this level has not all been positive and despite best efforts is probably increasingly influencing consumer opinion in a negative way. The phrase “any press is good press”, may not be the case any longer.

One of our network members referred to Airbnb as a “Cultural Icon” recently, and we know just how easily an icon can fall from grace, just as Airbnb has recently. Press at this level has not all been positive and despite best efforts is probably increasingly influencing consumer opinion in a negative way. The phrase “any press is good press”, may not be the case any longer.

City councils demanding change, party houses, illegal letting, licensing, registration, taxes, and much more are reported daily. There is even a scary drama now and this ClickBait title by a reporter in WTOP news does not help the industry but backfires on the “Hoover” of the rental space more dramatically. The Rental’ is killer Airbnb horror – Or listen to to the summary

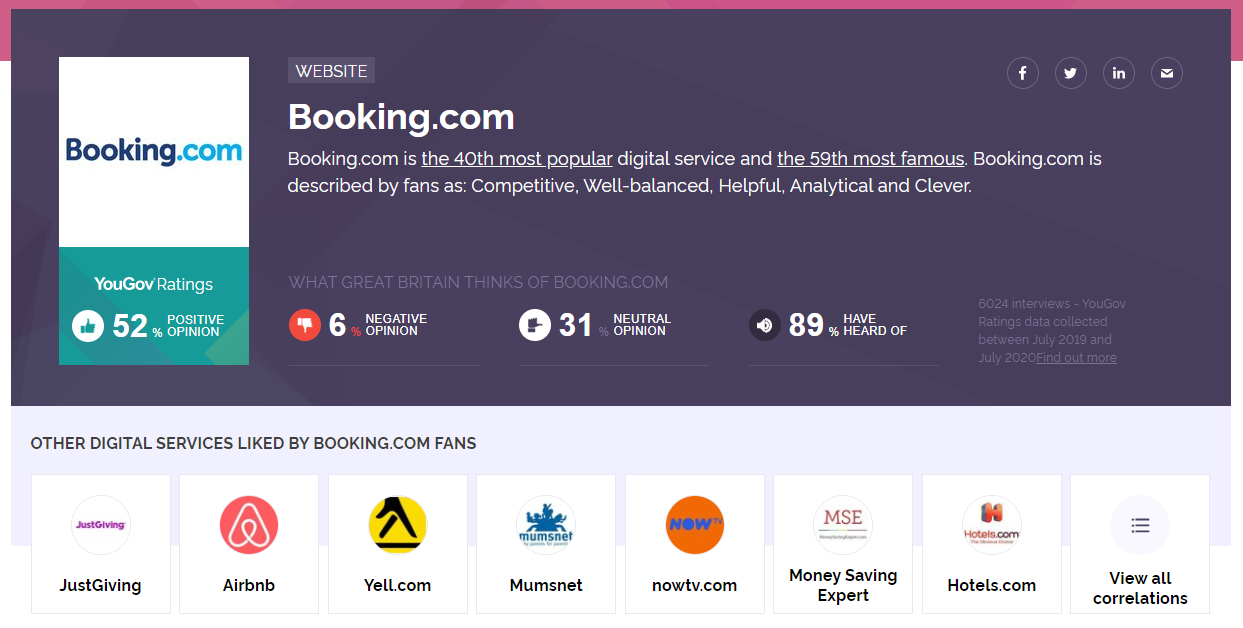

Airbnb has developed such global brand awareness that in Google trends compared to Booking.com, for the actual name search, Airbnb is way ahead (blue line) and illustrates the power of all the press, but is it related to actual bookings? Probably not, it’s more about their own crisis.

Company name search (Last 90 days) Travel Filter compared to Booking.com

So where does Airbnb stand right now?

So where does Airbnb stand right now?

As industry people, you are all probably aware of the damage done at the supply level by giving booking refunds in the COVID crisis without consultation with hosts. It revealed the true nature of oversupply which allows big business to become completely guest-centric. Raising a further $2bn will help, as will cutting 25% of their workforce and the thousands of contractors, but rumoured terms on the loan are not ideal and may be costly.

The tech stack does not look as robust as perhaps it should be with several PMS systems and service suppliers using the API connections falling over regularly. Was the system ever planned to be this successful and were the foundations deep and broad enough. Is part of the $2bn for a rebuild?

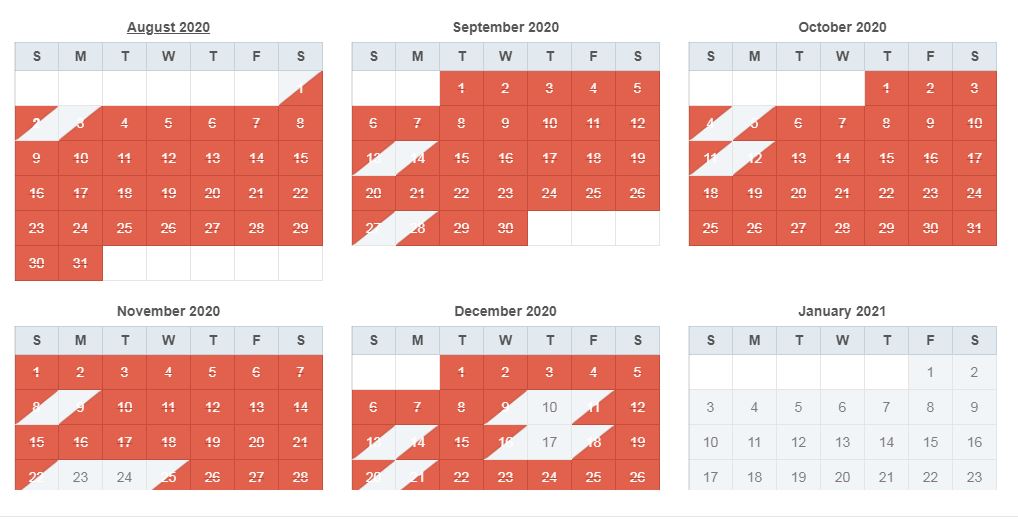

We all witnessed the 1million rooms booked in 1 day as lockdowns were released, on the claimed 7 million properties, plus press that highlighted COVID inventory growth. This number probably reflects 250,000 bookings or 1 in 30 properties. Not huge in the context of the industry itself. An upside is that the bookings are likely higher value as longer staycations rather than city shared or short term booking breaks. With access to large numbers of property calendars, we see an extended summer season happening until late September so time yet to salvage some pride.

The conversations we see are all currently on how managers and hosts can reduce future dependencies. Talk of boycotting is not realistic and better to game a system than to snub it. There are lots of legal opinions and ongoing actions against Airbnb and VRMintel has reported on this

VRBO and Booking may well have benefited as hosts and managers who have relied on Airbnb seek greater distribution and booking traction. VRBO is also likely to have benefited from its years of SEO and search presence with so little PPC in this crisis. The push to remove the “Guest Service Fee” and adopt a direct charge model still seems to be struggling and there is a lot of leakage no doubt as guests who will be worrying about the impending recession seek cheaper deals and hunt direct opportunities with free cancellations negotiated directly.

The big noise made on hygiene by Airbnb and trying to enforce protocols on cleaning and disinfection is not possible without some form of governance or remote audit. A self MOT’d car, or doing your own Homework comes to mind. The 38-page doc was ill-prepared and actioned. Agreeing to the protocol to enhance a listing, seems reminiscent of their reviews process, where everyone just says “yes, all good” and every review is 4.6-4.9. Not doing anything is not possible with the threat of even more litigation but will be adopted as a trust message even if the general public is becoming much savvier these days and even reviews are treated with suspicion.

For how long have we been talking about an Airbnb IPO? No doubt shares are being touted to institutions to test the water, but the feedback from some, we hear, has not been overly positive. Chesky is toning down the approach, but the question must be about his role now. Trips, the idea of Airbnb Plus, which was always a non-starter and the other travel ambitions must surely fall at his door and many are being sidelined or forgotten forever.

Back to basics seems to be the message and Airbnb is too big to go away, but the horse has bolted on previously wild valuations when the world can actually offer its products elsewhere and is actively seeking this. The big danger for Airbnb and the others is Google, the gatekeeper, which can destroy brands in seconds. It has accelerated its Pay Per Stay hotel model. Despite Google’s protestations, as we have said before, if it looks like a duck, quacks like a duck, waddles like a duck, then it’s a duck! Google is an OTA and has more power than any should they wish to wield it!

For those who want Chesky’s view: –Airbnb CEO discusses the possibility of IPO in 2020 (July 24th)

How will all this affect you?

Airbnb is a corporation that wants and needs an IPO for its investors and invested staff. To this end, it will need to ensure a great story, good results, and even greater potential. The upsides are that a decent proportion of the inventory will become more professional (see trends) but the downsides are core cities are witnessing reduced inventory, business activity, and travel from a COVID hangover for many months to come. Its competitors (Booking and Expedia/VRBO) are intent on this sector too and businesses as large as Expedia are thinking up new ways to dampen Airbnb’s spirits, such as the San Diego memorandum of understanding on regulating short term rentals with the Unite Union (6,000 airport, hotel, and restaurant members), which in the last few days has heated up as Airbnb tries to double the licenses to 8,000 from the 4,800 proposed!

The real damage, however, is that people tend to remember bad experiences more often and easily than good experiences. The COVID refund debacle will have left a bad taste in owners’ pockets and mouths and some guests too as the decision making fluctuated out of control with mixed messages.

The net effect of this and the recent loans and investments in Airbnb will require the company to squeeze more margin from hosts and operate on narrower margins themselves. The “Guest Service Fee” is already threatened by a 14% replacement billed to the host or manager. Margins are slim enough already in the agency/manager world, so the guest will pay regardless. How long before a greater number of guests really become aware of the extra costs? If the press takes notice, then this could add even more pressure. How long before the concern pivots to people, not corporations? To read more on the 14% implementation Mark Simpson, (pleased to say is one of our network members) of Boostly has written a piece to help understand and manage the changes

We would anticipate this move being increasingly coerced in creative ways. With price parity made illegal, there is a continual push by supply to cover these fees by increasing prices on all OTAs. They, in turn, drive demand through psychologically determined messaging, price management, discounting, cancellation terms, big PPC spend and more. It’s a battle managed by data systems.

Always remember if you use the 14% arrangement discounting a $1000 booking by 10% leaves you $774. You lose $226. Airbnb loses $14 only (the difference of 14% on $100). Who takes the most pain? That’s over a 23% marketing fee, which is more than many agencies make for handling all the hassle.

With greater costs for cleaning, certifications, insurances, registrations, and more, rental prices will increase and any additional costs will need to be passed on to the guest. This seems to be a common thread and witnessed in PMS systems with their “special OTA management tools” to manage pricing and availability.

Is this market in a massive new pre-disruption stage?

Leakage is always a problem for OTAs, where a guest uses the OTA as a search tool and then finds the property directly and books cheaper. Airbnb is moving toward communication only via its app which reduces this opportunity and keeps all “in-app” and hence more marketing and data opportunities. As Brian Sharples of HomeAway fame once said “You have to distance consumer from the product for eCommerce to really work”

This drive to monetize can only be compounded by increased negative publicity and institutional pressures, which requires an increased defensive PR spend and generation of their own news bites.

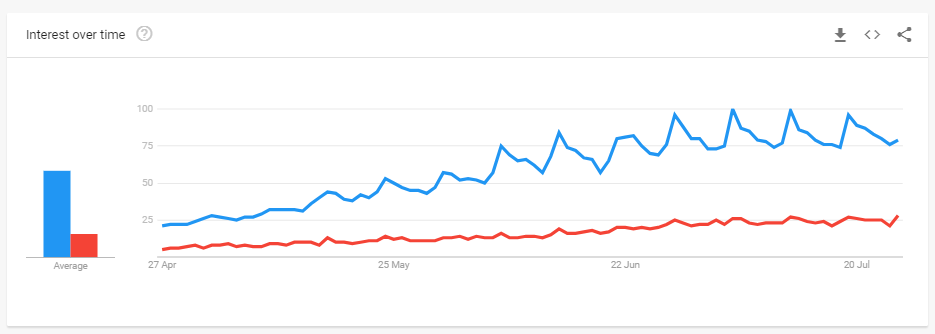

The image seen here is a “merchandising” snapshot to push hosts to discount further and are promoting these tiered offers to guests. The bigger the discount the better the promotion. Rest assured these will be ranked higher, but expect the supply chain to raise prices and then use the tool. The guest pays again!

The image seen here is a “merchandising” snapshot to push hosts to discount further and are promoting these tiered offers to guests. The bigger the discount the better the promotion. Rest assured these will be ranked higher, but expect the supply chain to raise prices and then use the tool. The guest pays again!

NOTE: Big thanks to Rentalscaleup for the image and much deeper reviews and videos which can be accessed from the link. If you are an Airbnb user then we would recommend a dive into this soonest and listen to Thibault’s dialogue.

As we all now know, the guests are much more important than the supply chain. Guests act, like most of us, in predictable ways. Frictionless and swift purchases at great prices and lowest risk if possible. Cancellation policies, on which so much has been printed recently, are irrelevant unless they are enforced. Free cancellation, Booking.com’s killer option, is a potential target, to deliver greater numbers of bookings, but is it possible?

In the true vacation rental market, we do not see this as likely to work in the foreseeable future. However, in urban markets and as rentals gain a greater market share and technology is more firmly embedded, we believe this may see more branded rentals, with volume inventory, adopting a partial strategy. In urban areas, we expect continued pressure to be exerted locally and nationally to increase the local stock of residential accommodation. Lisbon has an interesting approach guaranteeing a rental income, but few takers as the owners hang on for a revival of fortunes. This will be a continual thorn in all urban rentals.

In a nutshell, expect external listing and in particular, Airbnb to become more expensive as a host (and a guest), probably pre-IPO and after IPO? Then it’s all about share price and shareholder value, so expect no quarter to be given and even more to be extracted from the booking chain. Also, expect the Airbnb PR machine to kick into action to send warm and happy messages to hosts and promise never to bite the hand again that supplied the product.

TRENDS

A few mentions: polarity of urban and traditional markets, changes in fees and leases, plus hygiene, niches and DMO’s.

URBAN

COVID-19 has been enzymatic or catalytic depending on your analogy library. Even pre-Xmas 2019 we were already beginning to witness US investments being more circumspect on the Proptech market. Softbank and their losses from investment in WeWork made other investment organizations start to reflect on their own investment metrics and begin to focus on profitability, not just scale.

Then COVID struck an already unstable market where gross margins were being squeezed. This was due to high levels of competition leaving landlords the option to set their own price. COVID wiped thousands of properties off the market, Master lease companies such as Stay Alfred and Lyric (invested by Airbnb) closed their doors and others such as Sonder had their coffers replenished to survive this rental winter. Running costs can be eye-watering in this business and the survivors will be busy changing lease terms and rental models and hoping that both business and leisure travel picks up soon!

Whether this trend will continue is uncertain, but the move to put short term rentals that book 300 nights per year onto the longer-term market with a fixed income happened overnight from thousands of hosts and managers as demonstrated in London.

Airbnb and many smaller companies jumped on the marketing bandwagon and quickly started to work in the 30 days + market where both hospital and Key COVID workers could book accommodation in the crisis. As prices plummeted long term renters could pick up better value rentals for several months in Airbnb saturated cities, such as London.

For certain, a percentage of these properties will never come back to the market as owners become more risk-averse and those businesses who provided rent to rent services disappeared.

Other approaches have been to choose different use cases for accommodation, such as used for offices, large communal spaces for pop up exhibitions, or yoga courses, and so forth.

This report by Rentals United on the new business models is worth reading. Plenty of tech supply advice of course but read the theory on direction too.

What does this mean to you in urban spaces?

This really depends on which space you inhabit and what particular business model you run. No single answer, but if you have the reserves to carry you through, then opportunities may arise as the world returns to normal. However, most operators we have spoken to have agreed on deals with the property landlords and cut all costs wherever possible, plus furloughed staff. It may well be a week by week assessment.

Businesses that work on commissions and not fixed lease terms are in a better position and do not need those tough landlord discussions on liability and we believe that the Master Lease businesses will also start to morph to win/win or lose/lose models with their Landlords, many of whom have seen an opportunity to run the business themselves, adopting software and operational management companies.

They say that fortune favours the bold or brave. Just how brave are you right now?

TRADITIONAL VACATION RENTALS

We won’t go over refunds and how some companies have suffered at the hands of market misunderstandings. Or the fact that most companies in this sector including OTAs ensure the booking is between Owner and Guest and that’s where the liabilities generally sit, except for the Merchant of Record chargeback situation. Even this has been under review for this particular situation and no clarity has been issued. Guests seldom understand the booking contract facts and again this is at the root of all the problems. Perhaps all schools should do a course on renting!

Worldwide agencies have been working hard to sort all the guest/owner complaints and refunds, cutting costs, furloughing staff, and planning for the breakout. The problem has been cash and the fact that most small businesses rely on early year bookings and cash flow to survive until summer (or winter if ski season). These businesses’ balance sheets are traditionally light and reserves do not carry too far and owners may see this as the final straw.

This may result in opportunities for acquisitive companies, Vacasa in the US, and the likes of Sykes in the UK. When there is chum in the water, sharks tend to gather!

What does this mean to you

Most companies we know are planning for the future as they have had plenty of time to think especially for all those risks that have come to haunt them. Insurances, cancellation terms, owner and guest relationship management, and direct marketing to avoid Airbnb refund scenarios and to add more reserves to the balance sheet for future problems.

OTHER TRENDS

Book Direct as we know has been a hot topic over the years and depending on where you sit in the ecosystem may be less important and considered impossible to achieve. A nondescript one-bed apartment in London will be hard to see elevated levels of direct booking, but a second or extended booking is well worth spending some money on to realize and de-risk the future to a degree. Book Direct is also a semi-misnomer as many discussions revolve around how to squeeze more from an OTA booking too and this cannot be ignored either.

Agencies and managers however who have portfolios and see a P&L statement with OTA inscribed on it are aware of the challenges and loss of income. OTAs form part of an important marketing mix but expect the direct booking campaigns and long term planning to continue as COVID effect hits home.

Check out the #Bookdirect show & campaign and website. Several of our members are speaking at this and highlights a major industry trend.

Niche website and businesses are on the increase (again) and these can be specific, e.g. language-based e.g. Dormoa.com or distinctive selection e.g glamping at Canopyandstars.com or membership, e.g. Bidroom.com One of the most ambitious is a full French OTA niche that their Govt is proposing to compete with the OTAs. Forbes has a short article that highlights a few more.

OTAs cannot compete at a niche level with the necessary level of local and specialist information and will see leakage and fragmenting sections of the accommodation sector. Would an eco-warrior expect to find sufficient detailed information on Booking.com for example?

Anecdotally we do see very niche and great location properties now witnessing extended stays. Many have seen this trend for years but in COVID it is now even more apparent.

This Phocuswire article is worth a read. Essentially it illustrates the dysfunctional nature of pulling a complex, seasonal business into a pure eCommerce environment and how other businesses approach their sectors where there is a win-win situation, such as pet sitting or membership sites. Even these have issues due to scale and friction, however.

DMOs also see significant local traffic but shrinking subscription incomes. With destination now a core marketing focus acceptance of performance, income structure is needed. It may take time, but we have no doubt it will happen.

Quality and Hygiene are a significant trend and as predicted all major organizations are tracking this sector, instigating their own processes and approaches and we have no doubt that this will become a marketing necessity and will be used as a powerful visual trust tool. It’s not just about hygiene it’s about bookings! This is one of our previous opinions on the subject.

Airbnb as mentioned above has adopted this approach as shown by rentalscaleup.com who explains it all within their abbreviated and 38-page guidelines:

This article, weaponizing hygiene, recently published predicted this trend and it is being evidenced in multiple API releases.

This is the tip of the iceberg with respect to future trends. Not only does the industry need checks and measures on hygiene but also safety inspections and legal attestation on the whole business and property. Companies such as Quality in Tourism in the UK are focussed on this sector and provide a comprehensive service that actually validates the operation. These businesses are now being underpinned by non-profit organizations, whose membership relies on them to provide guidance and support on many of these issues.

Too often have we heard from hosts: “well who’s going to check anyway and no guest could prove they caught it at my place”. This would signify a certain lack of responsibility and gaming the system and if you are US based, “ambulance chasers” may soon become “Airbnb chasers”. Governance and application will be needed to instill trust in a professionalizing industry.

Boosting the Balance Sheet

Imagine 5000 leased properties, hundreds of staff, admin and support costs, and virtually no income! Then look at the market powerhouses and their massive technical and support infrastructures. All these companies’ balance sheets will have been battered. Some worse than others depending on Govt. furlough schemes and Boardroom decisions. Two examples are Traveloka (an Asian specialist platform) with a $250m top up and Sonder (a Master Lease Business) with a string of recent investments valuing it as Unicorn (and we all know Unicorns are mythical beasts), not forgetting Airbnb’s $2bn. Expect consolidation, liquidation, acquisition, and risk-takers to be the news for the foreseeable future.

It’s not just the big companies though. Small businesses need more margin and with such pipeline pressure, hard decisions will need to be made.

Reimaging Cities

We had to include this great read, a Bloomberg report on re-imagining cities after COVID. It highlights the associated social pressures and changing commercial dynamics and will without a doubt affect the short term rental market.

DATA USE

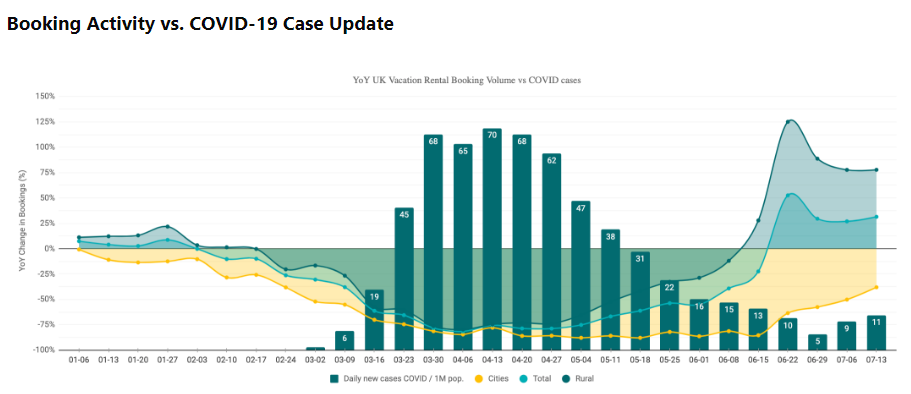

The newswires are alive with data and its often very confusing. This month we pick a couple of reports that show urban vs VR and smart use of dynamic pricing tools.

Never has it been more valuable to get great data and to use it wisely. The whole market was questioning travel in early COVID but we have seen Govt’s relax travel, create air bridges, and allow greater group activities the demand has taken off.

Companies such as AirDNA or Transparent publish regularly as do dynamic pricing companies such as PriceLabs and Beyondpricing. There are wild differences across the globe caused by COVID and the local and national approaches, but overall urban is in the doldrums and VR is seeing a boom in staycations to specific locations, as expected. This is supported by a Phocuswire publication.

https://www.phocuswire.com/str-airdna-hotel-short-term-rental-comparison-data

This excellent report highlights the trends and offers advice on how and where companies are winning and losing the margin game: https://blog.beyondpricing.com/uk-recovery-relief/

What does this mean for you?

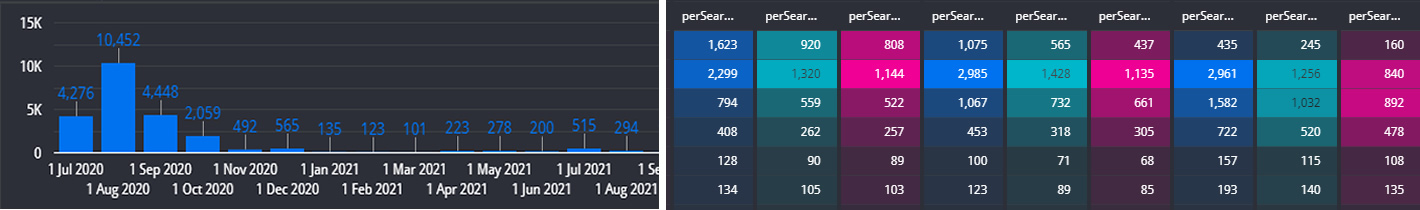

Each agency or owner needs to search out their own data. As direct booking is trending, make sure your web provider or PMS supplier gives you real-time price demand and search data as shown below and review your site traffic, prices, search metrics, record everything going forward in a reusable online format. This allows you to prepare special offers, make sensible pricing decisions, change minimum stay, and much more. This can give you a direct marketing edge.

Data now powers this industry and any insights into your location from local yearly reports to daily price and demand data from toolsets will be of use. There are still significant issues with these toolsets relating to the use of historical data and forecasting, lack of critical mass of properties in specific locations, but they are improving, and combining and comparing data can clear the fog.

ref: https://www.rentivo.com real-time web pricing and search data

ref: https://www.rentivo.com real-time web pricing and search data

TIPS & TRICK(S)

This month its a summary of where all smart marketers and profit-seekers should be hanging their hat.

This month we have taken a big view. Trending is the move to direct booking, cooperative, niche websites, and more as mentioned above. Doing this effectively requires an understanding of how to sell online.

This article explains really well what to look for and look at and next month our key article will pull this apart. The OTAs manage it very well, but it is increasingly easy for smaller businesses to adopt these rules.

https://www.thinkwithgoogle.com/intl/en-gb/navigating-purchase-behavior-and-decision-making/

What does it mean for you?

More control over your business and margins (and some reading).

TECHNOLOGY

We won’t touch on PMS systems or smart hardware this month but something much more fundamental and potentially dangerous to all those big content-driven businesses and SEO challenges.

You may well think this is not relevant to the rental world, but a quick read of this Wired article should set alarm bells ringing and may also see Google change its approach even more dramatically on ranking and organic positioning.

This single line “but this newest iteration would make mass-producing content even easier.” could see an explosion of web content for SEO that costs virtually nothing.

The technology is an AI system GPT-3. This is a machine learning system that has been fed 45TB of text data, an unprecedented amount. All that training allows it to generate sorts of written content: stories, code, legal jargon, all based on just a few input words or sentences.GPT-3 was trained off of 175 billion parameters from across the internet (including Google Books, Wikipedia, and coding tutorials)

Google’s move to more web and mobile use metrics will no doubt affect ranking and as content is used for SEO and freshness/relevance, this type of tool makes a nonsense of the approach. Link building is also fraught with compliance and other ways to determine organic positions will need adding into their mix.

https://www.wired.co.uk/article/gpt-3-openai-examples

AI and ML are already in the rental space and used to develop personal profiles, predict purchasing opportunities, but are generally recognized so far pretty unsuccessful at targeting consumers at least in our sector. This doesn’t mean it will continue that way and as data increases and technology improves the laser sight and not the slingshot may be more appropriate.

If you got this far congratulation, but please feel free to sign up and get the short and linked version.Back to Top

SUMMARY

The thinking caps are on for all, but as yet there is no definitive outcome.

The thinking caps are on for all, but as yet there is no definitive outcome.

Human nature is what it is: Instant gratification and dopamine hits are embedded in all the big businesses that bring pressure waves to any business, but there are signs that restructuring and governance may be happening on an industrial scale.

This graph from Statista about Amazon made me wonder whether there were comparisons with the way rentals have developed and the fact that this graph is plateauing.

Quote: “Third-party sales are a popular strategy for sellers to make up for certain primary Amazon sales disadvantages, namely improved margins through better pricing control, more favorable payment terms, and less reliance on the relationship with Amazon. According to a 2018 survey of Amazon sellers, almost half of all businesses generated 81 to 100 percent of their revenues from Amazon sales.”

Disruption is due in this sector and all others and technology can deliver a competitive edge.

Back to Top

SECTIONS – 1. Big Business – 2. Trends – 3. Data – 4. Tips & Tricks – 5. Technology

Disclaimer:

No company has paid us to write or list any links, products, or references! The Editor is a director of Yes Consulting and Rentivo Group Ltd