Welcome to the fifth Yes Consulting vacation rentals newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

Welcome to the fifth Yes Consulting vacation rentals newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

SECTIONS – Market Trends – Data – Tips & Tricks – Buy/Sell a Company

MAJOR MARKET TRENDS

This month I have made a decision to cover “Big Market Trends” due to COVID-19 and the lack of global uncertainty, which is raising questions on the future of our industry at all levels. Airbnb and Booking.com 4th quarter summary reports are also shown below which reveal the volume trends.

There are increasing numbers of companies pumping out data and advice daily and for anyone wanting close granular scrutiny of these many specialist topics that power rentals, there are many sources available (see Data links below).

COVID-19 has blurred the future in so many ways and from recent conversations with professional managers and owners, it is clear that not all trends apply everywhere. No single market however has been completely exempt from the effects of this global pandemic.

OTAs are wounded animals

We know how challenging and frustrating OTAs can be for small businesses who have established their own practices when system and policy changes are made up the line. From an OTAs perspective, the current situation has destroyed income statements, staffing levels and growth opportunities and we could be looking at a rewrite of the rules over the next few years. This will affect all suppliers to the large listing sites.

We know how challenging and frustrating OTAs can be for small businesses who have established their own practices when system and policy changes are made up the line. From an OTAs perspective, the current situation has destroyed income statements, staffing levels and growth opportunities and we could be looking at a rewrite of the rules over the next few years. This will affect all suppliers to the large listing sites.

Covid has highlighted extreme cancellation policies and the no refund approach. OTAs want leniency and now they have Covid to help accelerate it through guest demands.

Airbnb and despite its significant valuation (+$100bn), also demonstrated some of the danger factors that will affect OTAs going forward. Their S1 filing prospectus as reported by The Independent newspaper highlights this.

“We believe that our SEO [search engine optimisation] results have been adversely affected by the launch of Google Travel and Google Vacation Rental Ads, which reduce the prominence of our platform in organic search results for travel-related terms and placement on Google.” Airbnb also warns of the threat posed by “listing and metasearch websites, such as TripAdvisor” and headlines Booking.com, Expedia and Trip.com – which includes the comparison site Skyscanner. Our competitors are adopting aspects of our business model, which could affect our ability to differentiate our offerings from competitors,” says Airbnb. “Increased competition could result in reduced demand for our platform from hosts and guests, slow our growth, and materially adversely affect our business, results of operations, and financial condition.

More recently Expedia has indicated its position on Google Travel too. VRMIntel has an excellent report on the latest CEO interview after the publication of their quarterly results.

Booking.com is back after delisting (on Google VR Travel) for a period of time. It makes sense for the top home-rental providers to shun Google to keep consumers from finding large supply listed on its meta platform. The consumer experience still has a long way to go with rate display, location pins, and nonsensical filtering options related to features and amenities. When asked to provide a little more insight into the decision to remove listings from, Kern said, “Google VR was not particularly significant, and we concluded that it was not additive, which is why we made the move that we made.”

If you wish to see how wounded the large OTAs are in the USA, watch this Phocuswright video:

Temporary or permanent changes?

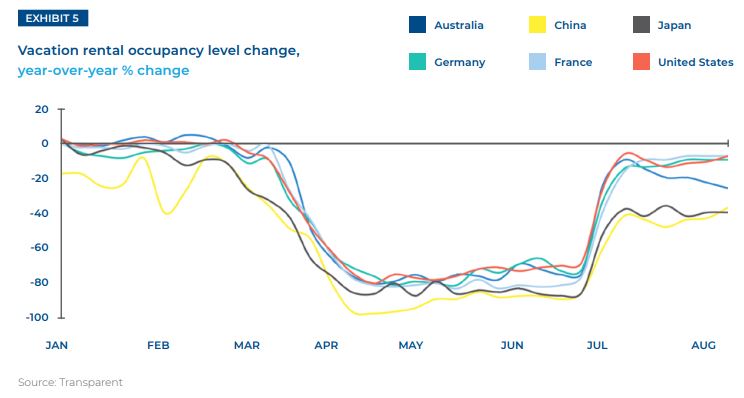

Without diving into graphs and numbers in detail, we all know bookings are down over 50% YoY and up to 80% in specific urban destinations. The whole hospitality sector has been in a meltdown since last year. This Mckinsey report pages 11 to 16 is hard reading and published in late 2020. By now we are all familiar with the summer breakout and anticipation for the same this year 2021.

The graph below from Transparent demonstrates the massive decline and the flood of bookings as the dam burst when the lockdown was released in the summer.

Pivoting to longer-term rentals and accommodation for health care workers and those aligned to the pandemic has made great sense for urban businesses. Digital nomads are a buzzword, except that few can actually travel and online meetings will challenge office space and city hotels and their apartment counterparts when this is all over.

So what is going to happen? Data seldom extrapolates forward in times of crisis, it rewrites history. So a few predictions:

- Office spaces will not be needed as much globally in urban centres. Bill Gates is correct. To what degree remains to be seen. Remote working is an accelerating trend for services and data business jobs. This leaves office buildings available for more transitional use and potentially residential and urban rentals. Oversupply has been developing pre-Covid in some areas and this would add to the inventory, with less custom. Others such as Barcelona are under threat of significant reductions in available accommodation. Other regions such as Scotland are trying to rewrite licensing rules.

- We are likely to see much more transitional and periodic office visits and buildings becoming more flexible in lease use. The net effect will be a more competitive rental environment and pre-booked accommodation perhaps once a week or twice a month that is fixed price and if not used also made available for the increasing number of rentals booked much closer to arrival.

- The current urban inventory being used for less financially rewarding schemes will want to revert to maximising income if licensing laws allow. This means a change of approach on the booking process for business people and increased awareness of guest demands in a working environment.

- OTAs will struggle with any type of commitment made by companies on term lease agreements or deals for guaranteed periodic accommodation use. There may well be less inventory to book and closer to arrival time opportunities only.

- Serviced accommodation has benefited from 80% occupancy in recent years but is now crippled. As an example, Bridgestreet has collapsed and the whole business model has been questioned. Phone calls between accommodation providers and companies, with emails and paperwork to sign, is a thing of the past. These costs will be removed and automated online.

- 1-5 has all been urban commentary. As we all now the regional vacation rentals are experiencing unparalleled advance bookings in many regions. It shows the absolute desire to travel. This will continue to accelerate the development of this business sector. Investors see it, new guests experience it. COVID has killed out of season business as the virus matched the seasonal changes. International destinations that rely on non-domestic travellers have had to hibernate or shut up shop, paralleling the meltdown of airlines.

- The net effect of absent city travellers is that OTAs and urban brands are hunting vacation rentals as the big earner and to add weight to their brands. Inventory polarises into owners (Airbnb style) and managers (Sykes, Vacasa etc). The low hanging fruit for an OTA would appear to be channel fed professional managers as owners are naturally harder to reach and synchronise unless they can be committed to the OTA admin system only. The former professional supply approach is exceptionally challenging however as in-season properties are easy to book direct and this year, many holidays have been credited from 2020, so there is an even greater lack of inventory. In addition, OTAs channels are commonly blocked in peak season through PMS systems to avoid losing margins.

- The PMS fed properties to all OTAs are a problem as can be seen by Airbnb’s S1 risk assessment. These increasingly large managers in particular use technology to game systems and distribute intelligently. There is no marketplace loyalty and this is becoming an urban issue to a degree as hotels (think Marriott) push loyalty members to their preferred inventory.

- People are rediscovering nature and more products and information services are becoming available such as Komoot, hiking, cycling, route planning and data connections to make it easy. Expect more experiences to be pushed into marketing channels. Notoriously difficult to manage and monetise though (ask Airbnb).

Hunt the Owner

This could be a new board game. All marketing businesses are chasing owners and will be for the foreseeable future. Managers need new owners to grow and accommodate demand. OTAs have to make a decision for the future, who do they align as their preferred source of real estate, managers with single-source supply or owners who they would wish to have “exclusively”. Even the Airbnb startups, “Aireverything” who use channel software now distribute to Booking.com and 40 other+ platforms. Their loyalty has diminished as their sales messages require USPs too in an ever-crowded startup market.

This could be a new board game. All marketing businesses are chasing owners and will be for the foreseeable future. Managers need new owners to grow and accommodate demand. OTAs have to make a decision for the future, who do they align as their preferred source of real estate, managers with single-source supply or owners who they would wish to have “exclusively”. Even the Airbnb startups, “Aireverything” who use channel software now distribute to Booking.com and 40 other+ platforms. Their loyalty has diminished as their sales messages require USPs too in an ever-crowded startup market.

OTAs have a complex task at hand and no one is sure where they will place their loyalties in this balancing act of volume vs availability.

The demise of many master lease businesses such as Airbnb backed Lyric (new businesses will come back remodelled) is an example of a herd mentality as landlords commanded increasing lease income, prior to the collapse.

Owners of quality properties can now start making their own demands with acquisitive managers, the question is: Will OTAs fees parallel a manager’s terms in the future? Will we see managers at 20% and OTAs the same? At this level, if an owner has to forgo 40% and operational costs, then either accommodation becomes more expensive or properties will reduce in numbers. Large managers are akin to OTAs and can avoid significant external commissions and explains why, in the UK, the acquisition of smaller companies has been a popular approach to growth..

From the many newer owners spoken to, it is clear that a new world order of owners is appearing. They are unaware of the history and friction, they are aware of OTAs and they understand that there is a cost implication for marketing, unlike many from the true cottage industry days, where £89 per year was the maximum needed for a successful listing. There is an initial accepted “reasonable” threshold value. It’s also apparent the acceptance of this fee declines after experiencing the contrast between obtaining a booking and actually doing all the hard work. This limits the income opportunity for all players if there is a ceiling price on the accommodation.

The Guest

Long gone are the days of metered electricity and bring your own bed linen (some still exist!) and expectations are aligning to that of hotels in proficiency, booking policies, quality and even greater demand for amenities. These expectations are all one of the biggest challenges in vacation rentals and require a mindset attuned to hospitality and a changing backdrop of frictionless commerce. Guests are not always welcome and the drive to remote entry and management means that a minority will take advantage. In this article on RentalScaleup, we can see how Airbnb is trying to clamp down on abuse by introducing a series of measures aimed at preventing parties and gatherings. Airbnb has a poor reputation in the traditional sector for exactly this reason, but the market sector they want to adopt more aggressively.

OTAs would love to see free cancellation, no damage deposits, removal of extra taxes or cleaning fees and have been pushing this hard for years. There is no doubt that times have changed and we are seeing damage waivers, embedded insurances and more liberal cancellation policies. Millions of micro-businesses with limited product sales opportunity struggle to align with the OTAs best booking opportunities and is generally only acceptable in high traffic urban destinations, which currently are hard to find. New products such as those from SuperHog which undertake guest vetting offer a reduction to marketplaces and inventory controllers to reduce booking friction by offering alternatives to a damage deposit.

New Markets Evolving

Just to add to the OTA challenges, new models are emerging with funding and these come in three formats.

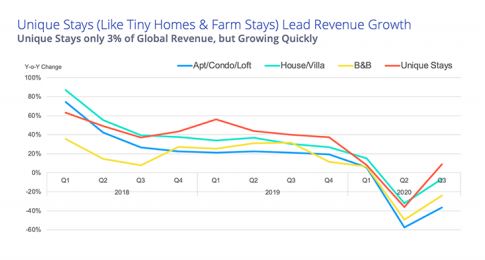

a) resale brands under a specialist focus such as eco, or pets, or property types such as yurts, tiny spaces (see graph from AirDNA below) or language focus etc

b) exclusive arrangements under these new business models which is difficult to adopt with zero market exposure and rely on investment to scale quickly.

c) hospitality companies that have loyalty programs or website traffic from parallel businesses (hotels, attractions, events etc). Marriott Homes & Villas being the most public. In late December we also saw Accor revitalise their focus on this market again. These businesses all demand a fee of some description to bring a booking which will vary depending on the country, but values are set at OTA level for all supply to see and becoming standardised.

d) The Digital Nomad, the Flexi-business-traveller and the holiday-business relocation mean inventory needs opening up for multi-period use. This means different marketing channels, terms and payments. Technology is the answer and will have to adapt too. This interview with Mike Liverton of JetStream a rapidly growing business highlights this trend

Google Travel

As we witnessed above from the OTA comments and their desire to avoid Google VR Travel, that this space is opening up for inventory to connect via the larger listing sites and channel managers. Still, in its infancy, the opportunity is limited until direct PMS connections at scale are implemented. This link shows a property landing page generated by Rentals United for a small local property manager. Not a great experience when seeking to compare and contrast many properties, and other supply companies but these are all stepping stones. Can the major OTAs avoid being in this channel, especially with Google places and reviews underpinning quality and background activity? A company like Google with its suite of tools can look at the underlying traffic, traction and actions. Acting as a meta-search Google can also compare and contrast prices. The best result is the one that Google’s search users are seeking and is not always on an OTA.

Google controls the sales funnel

No one can dispute Google’s position at the top of the sales funnel, with up to 90% of searches in the US and EU markets, Google holds a powerful position. Big brands such as Booking and Airbnb want their apps to lead the way and no doubt for short trips, lower value bookings are increasingly more valuable. Big brands however are few and far between, so Google search is a major part of the overall eco-system, especially in the higher value and traditional markets and increasingly flooded with alternative platforms.

Google has been making strenuous efforts over a few years to educate and direct all website owners to up their game for mobile-first access, improve load times, ensure a stable and accessible environment for all guests to enjoy their search experience. Google’s single mantra is to provide its users with the best results and without a great gateway to bookings, This cannot happen without investment in websites and a frictionless booking process which Google has been promoting strenuously with a voluminous amount of advice over the last two years. See links on “Tips and Tricks”

Professonalisation & Certification

Has been talked about for years as the industry has evolved and is moving in this direction, albeit slowly. Unlike hotels, which are structured, have fractional sales opportunities, legal structures and well-defined governance, rentals are still a little “wild west” in approach. Understandable, when the majority of properties are owned by individuals with no standardisation and even less local rules.

COVID has exposed operational management, its importance and processes. The industry has known for years, without operations (cleaning, management etc) that there would be no rentals, but has been the hidden friend of a great rental business. Airing and qualifying practices, ensuring properties are safe, qualified, legal and presented well, will bring greater opportunities. Although it is hard to compare properties side by side a system of checks and measures, reviews pulled from many sources and inspection by a third party can create a certification. We have to assume that the OTAs would pull this through otherwise they will be hanging on the coattails of the companies who bring this to the table first. It’s hard for everyone to agree globally on standards, but it’s not hard to agree nationally, or even locally and create a compliant network that guests can access for validation.

With guest awareness and expectations increasing, the need for some form of visible governance is increasingly necessary. Properties that have third party certification and/or appraisals and continual checks and measures will naturally be preferred by guests. OTAs know this but have no control, being distant from the actual ownership controls. Airbnb has made half-hearted, PR focused attempts, but asking owners to mark their own homework is not rational. The only way to achieve this at scale is via software, remote workers, plus licenses and franchised operations globally.

Changing Global Economics

These are two extracts from The Economist and well worth reading:-

The urge to travel is unlikely to be permanently dimmed by covid-19 even if the means to do it suffers a long-lasting hit and some destinations take years to recover. All forecasts reckon on travel and tourism returning to pre-pandemic levels over the next few years and then continuing on a path of growth. Looking back, there will appear to have been a “blip in demand but no impact over 20 years,” says Michael Khan of Oliver Wyman, a consultancy. Underlying motives and the longer-term factors of growing wealth and increasing leisure time seem certain to reassert themselves. The rapid growth of Chinese tourism shows the importance that the newly wealthy place on taking a well-earned break. A growing global middle class will see the Chinese joined by Indians, Malaysians and Indonesians. This could bring significant shifts. Asia’s burgeoning middle class and the preference for regional travel could mean that South-East Asia overhauls the Mediterranean as the world’s preferred holiday destination.

In 1950 the top 15 destinations—with America, France, Italy and Spain the most visited—claimed 97% of tourist arrivals. By 2015 that share had dropped to just over half. Europe, with its historic cities, countryside and beaches, still rules, taking just over half of all international travellers. That is twice the share of the Asia-Pacific region, the next most popular area. Europe rakes in the most receipts, around 37% of the global total, worth some $619bn in 2019. France and Spain are the most popular countries for a visit. The top spots may not have changed, but their arrivals have. Chinese visits overseas have grown from just 9m trips in 1999 to 150m in 2018.

Booking and Airbnb Trend Evidence

With both companies reporting in this period. Thanks to Cleveland Research

Bookings 4th quarter showed the following and key points are highlighted.

- 4Q booked room nights declined 60% (3Q was down 43%).

- October was down 58%, the first week of November was down 70% (worse month of the quarter)

- Domestic represented 85% of 4Q room nights (up significantly vs. 40% in 2019).

- Europe declines worsened in 4Q vs. 3Q, while Asia improved.

- Mobile bookings (particularly the app) represented over 2/3 of 4Q room nights and about 2/3 of 2020 room nights. Over 50% of room nights continue to come through direct channels.

- Western Europe (UK & Germany) as showing strong summer booking trends vs. the global picture..

- Alternative accommodations represented 30% of room nights in 2020, up slightly vs. the mix in 2019. This suggests alternative accommodation room nights of 107M (vs. total 355M) were down roughly 50% vs. an estimated 211M in 2019. For comparison, we calculate BKNG’s traditional hotel nights of 247M in 2020, down 60% yr/yr. The company emphasized its focus on growing alternative accommodations in the US, where priorities include product improvement, supply acquisition (particularly in the single property category), and growing customer awareness.

Airbnb’s 4th quarter showed the following and two key points are highlighted.

- 4Q nights & experiences down -39% (3Q was -28%), while gross bookings declined to -30% (3Q was -17%).

- A 13% ADR growth was driven by a mix shift to N America, entire homes, and non-urban markets.

- Revenue, which reflects stays in the quarter, was down 22% (was Q -18%).

- Airbnb’s particular strength in travel distances below 50 miles.

- Active listings were stable in 4Q vs. 3Q near 5.6mm.

- Notably, Airbnb indicated 90%+ of traffic was direct in 4Q (similar to 3Q).

- Airbnb continues to deliver the message that individual hosts are the ‘core’ of the business, with some comments from Airbnb:-

- Airbnb is a community of four million hosts. 90% are individuals. And they are who we prioritize. Our guests want something that’s one of a kind, and this is typically offered by our individual host

- Again, we don’t want anyone to come to Airbnb and lease because they couldn’t find a place to stay.”

- Fundamentally… we’re in a bit of a different space than our competitors… we are focused primarily on individual hosts. They comprise 90% of our 4 million hosts. OTAs are primarily focused on professional hosts. And

- But we think individual hosts are less likely to want to list on multiple platforms. We’re the only platform now that is a custom-built platform designed specifically for an individual host. We solve a lot of the really hard problems that individual host needs, like the system of trust.

- When we look at our fees, we want to make sure that those fees are of great value to both guests and to host. In some cases, we have a mix of a low host fee and a higher guest fee. And then for some of our professional hosts, we’ll have a host-only fee, and all of it is on the host’s side. The mix could change over time. We continue to test and evolve to see what works best for our guests or our hosts.

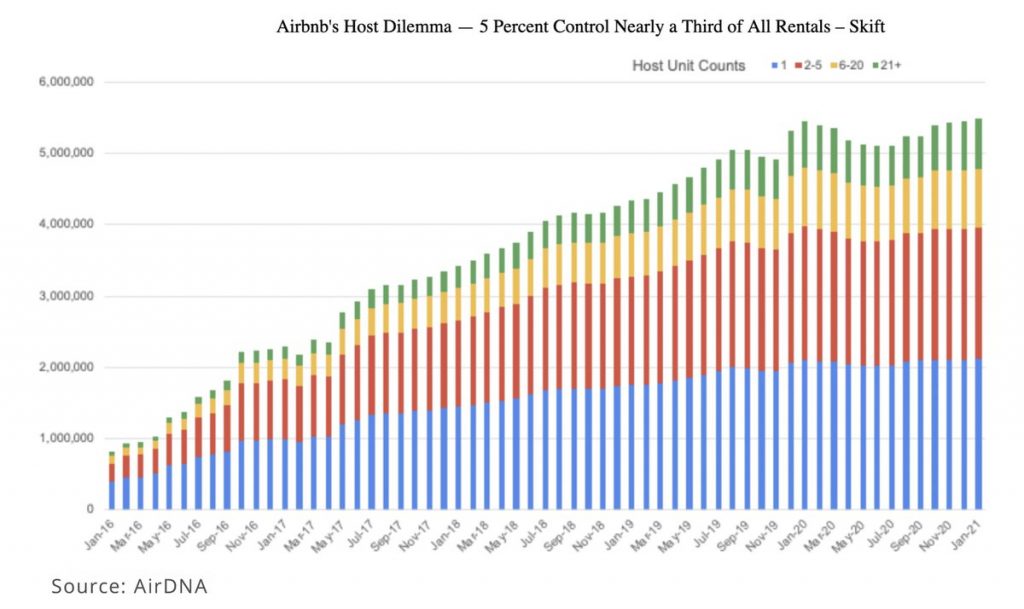

Skift however posted an AirDNA analysis which may counter some of the hyperbole, which Airbnb does not reveal in its reports, that nearly a third of all rentals are controlled by 5% of the inventory holders.

Where is it all going in the next few months?

COVID-19 is a global inflexion point for many industries. Crystal ball gazing can be fruitless, but the virus has influence and despite that the human species has a short memory, many small changes are happening already. If we thought fast internet was important before, its even more important now for work and play. With online ordering now quite normal, make sure your rental has a decent microwave to warm up those takeaways. Damage deposits may become a thing of the past, cancellation terms will become more lenient and multi-priced terms offered to guests. Packaged insurances aka OTA style will bleed in via PMS systems and web bookings.

It is clear that Airbnb is heading back to “host love ups” and will be trying to woo them and avoid multi-distribution plus focus on app bookings. Booking.com is a hotel booking machine but weak in the US, so we can expect two things from their commentary: Add more alternative accommodation and focus on breaking into its main challenge market, the US. Booking is also app focussed and with Google Travel a big browser challenge makes sense.

Direct bookings are increasing in some sectors of the hotel industry and with changes to websites according to Google’s demands, will see these businesses benefit from increased direct bookings and brand development, the rest will be left behind as Google serves to de-rank them over the next year or two. The battles of apps vs search are just beginning.

The big trend for 2021/22/23 is professionalization and compliance. Any industry that increases in size in the public sector requires controls and governance. Hotels have it and as this sector accelerates guests will demand it. Expect certification, inspections, qualification to become more important and adopting these will increase bookings. OTAs have to support and adopt this focus too, for fear of damage by association.

Until the end of this year however its a prizefight of any Urban Short Term vs Domestic Regional Vacation Rentals. The latter wins by a knockout in the first round!

No company has paid us to write or list any links, products, or references!

No company has paid us to write or list any links, products, or references!