Welcome to the fourth Yes Consulting newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

Welcome to the fourth Yes Consulting newsletter. The Lighthouse is for hosts, managers, agencies, and operators in the short term rental sector.

SECTIONS – Big Business – Blockchain – Data – Tips & Tricks – Investments – Network News

BIG BUSINESS: (Airbnb and Booking)

Despite COVID’s best attempts, Big Business is not dead yet (quite) and of course, the big news, we have been waiting for (and hence our late newsletter) this month is Airbnb’s planned IPO and its filing. The latter has been awaited with bated breath, so the analysis can begin despite delays to avoid a clash with the Trump/Biden battle for the Presidential race.

Key Points on IPO (kindly provided by Cleveland Research and in particular Matt Varabkanich)

- Nights & Experiences booked YTD are down 41% (3Q was down 28%) vs 31% growth in 2019. Airbnb expects 4Q declines to worsen from 3Q.

- Revenue of $2.5bb YTD is down 32% (3Q was down 18%) vs 32% growth in 2019

- ADR has grown 20% y/y since May, partially due to faster recovery in higher ADR markets (N. Am) and mix shift toward non-urban entire-home listings

- Planning 2021 sales & marketing costs to be lower than 2019 (in dollars and as a percentage of revenue)

- Brand & performance marketing costs were 24% of sales in 2019 and 18% in 2018

- 91% of traffic YTD was through direct/unpaid channels, up from 77% in 2019 – This one is worth noting and should maybe in the Risk section too

- Airbnb generated $38bb in 2019 gross booking volume, with $32B (82%) in host earnings and $5.3B (14%) in service fees (host + guest fees)

- Long-term growth strategy includes: adding hosts, expanding use cases (long-term stays, remote working), engaging guest community, investing in Airbnb brand (marketing, product launches), and expanding in low-penetrated markets (China, India, LatAm, SE Asia)

In the Risks section of the document are historic numbers: We have incurred net losses each year since inception, and we may not be able to achieve profitability. We incurred net losses of $70.0 million, $16.9 million, $674.3 million, and $696.9 million for the years ended December 31, 2017, 2018, and 2019, and nine months ended September 30, 2020, respectively. Our accumulated deficit was $1.4 billion and $2.1 billion as of December 31, 2019, and September 30, 2020, respectively.

A lot left unsaid and questions unanswered on various statistics that will influence their future. Two immediate takeaways and further reading that highlight industry thoughts.

Airbnb BRAND:

There is one big take from all these numbers and it’s this:- Direct/unpaid channels represented 77% of traffic in 2019.

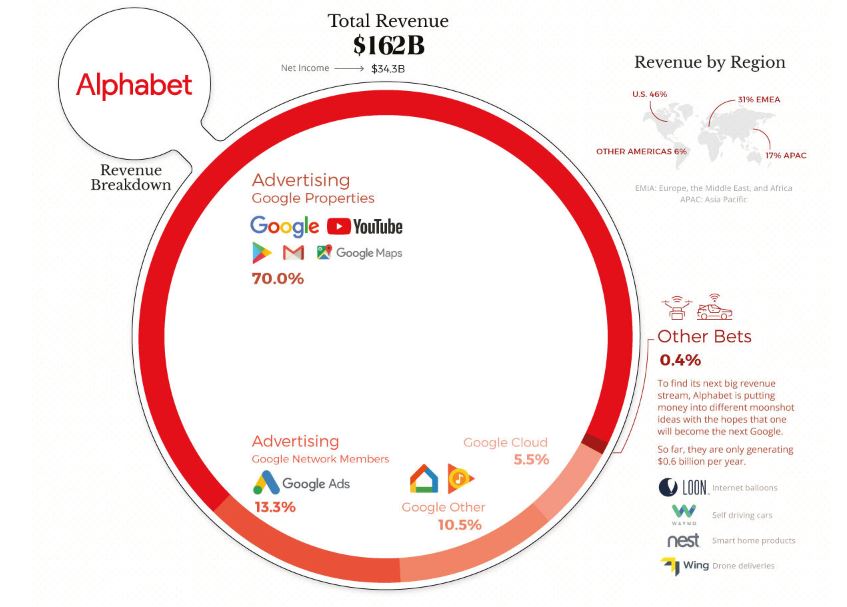

We have conjectured for a while on brand strength and the power behind the margins. No wonder Google is seen as a big threat, it still holds the funnel reigns of Chrome and Android. It also reinforces our conviction that mobile and app investments will accelerate as these navigate (to a degree) the search PPC trap.

- Apple, however, had other ideas on Airbnb experiences and wants a cut!

- Skift has some thoughts on this brand booking capacity and comparisons with Booking and Expedia marketing. spend.

One thing is very clear, the Internet and hardware gatekeepers can throttle a companies success. Another question is around the model of invest, scale, invest, lose money all the way through to an IPO and investor exit. With WeWork and the Softbank issues, the Master Lease company pain (Domio being the latest) and we now have some clarity on Airbnb’s business and there must be questions on the lips of investors and shareholders.

Whether you consider Airbnb as a good investment or not, the PR machine is in full flow, despite a class action based on their refund policies in Covid. Add in challenges by the EU digital services act, and its gatekeeper challenge, it’s constant technical challenges (youtube video) and it’s not all plain sailing. Airbnb has offered investment sweeteners and a Host Advisory Board to help align their direction but the announcement lacks real clarity.

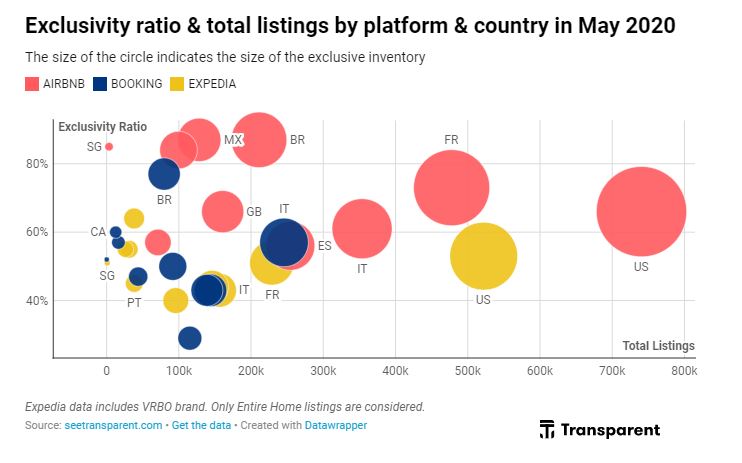

A lot of industry experts have also been adding their thoughts and with big data (see below) in vogue and increasingly necessary for next year there are some interesting reports, this one is quite extensive on “brand” from SeeTransparent that you can compare to actual numbers now.

With Airbnb, Expedia and Booking Group all as public companies the analysis will leave a lot less to speculation but don’t expect real clarity in reporting at a granular booking level from mixed-income businesses.

BOOKING IN THE NEWS

This probably needs highlighting particularly as it’s Airbnb’s big week of news. This link will take you to VRMIntel who have highlighted a number of comments made in the document. This one, in particular, caught our eye:

Regarding safety, Airbnb stated, “In addition, we have not in the past and may not in the future undertake to independently verify the safety, suitability, location, quality, compliance with Airbnb policies or standards, and legal compliance, such as fire code compliance or the presence of carbon monoxide detectors, of all our hosts’ listings or experiences.”

A day later and Booking.com announces its “Minimum, Cleanliness Score requirement, partnering with Properly to roll out an app-based approach. As the article says: “The partnership with Properly serves to coach its rental providers as they work to improve and maintain their cleanliness score using detailed guidance which includes Properly’s best-practice cleaning protocols. These custom checklists are designed to give rental managers and  owners easy-to-implement directions to meet Booking’s guest expectations for cleanliness and create actionable guides to help improve guest experiences.

owners easy-to-implement directions to meet Booking’s guest expectations for cleanliness and create actionable guides to help improve guest experiences.

Looks like Booking stole a march on Airbnb.

MORE BUSINESS

If like me you are pretty much fed up with the Airbnb juggernaut, the other big business headline these last 45 days are shown below. Some of these may not seem big news, but they are trends that we can expect to see affecting the industry as it becomes more automated, professional and diverse. Note: The Lighthouse newsletter focus is on change and how this affects the supply chain rather than all-encompassing news across all zones and business developments.

SHORTTERMRENTALZ REPLACES SKIFT NOW COMPETING WITH SKIFT ON RENTAL NEWS As an avid reader of the rental world press and its fluid eco-system, SKIFT (in our opinion) has lost its position as a news focus for everyone involved in the rental sector. Skift has a wide hospitality coverage, does some decent analysis and recently moved to a subscription model. The diverse coverage, the fee (no one like to pay for news unless it actually makes them money) plus the same go-to personalities on commentary sees Skift being challenged. Shorttermrentalz, with its wide coverage and not just major corps, plays to every element of the industry. If they add in some financial analysis and strategic conjecture, then it will grow even faster. Congratulations, onwards and upwards.

AIRLINES LOOK WITH ENVY AT THE VR WORLD – JetBlue plans to offer short-term rentals with the help of a partner not named yet, possibly by the end of the year. The airline plans on offering the accommodations under its own brand and would handle the customer service in-house instead of leaving that to the partner. This makes sense. The Marriott has adopted a route to extend its offering. Airlines are dead in the water currently and urban accommodation is suffering. Airlines tend to fly to cities too. We can expect to see more of this traffic and loyalty points redirection, however, the comment that they may partner with OTAs for supply is a long term mistake as the margins and controls will be less.

SAUDI ARABIA GETS INTO RENTALS – This may not seem like big news, but having spent 6 years in Saudi in the ’80s and several years travelling the Middle East, this is a trend that all tech supply companies should look at. Dubai and the more “liberal” destinations are a few years ahead, but with oil becoming less important as we move to alternative energies over the next 30 years, the ME will accelerate its travel destination opportunities.

LIGHT AT THE END OF THE TUNNEL – A vaccine or two are on the horizon and now is the time to plan. There is huge pent up demand to travel as this report shows from the WTTC. This is the USA and Canadian report only, but we witnessed unparalleled demand at every unleashing of lockdowns globally, so 2021 will see the same. It is more likely that this will be post-Easter, but preparations are needed now on price, management, cleaning protocols, insurances etc.

ALTERNATIVE ACCOMMODATION MEETS COVID – This caught our eye in Scotland and from the BBC and is a global trend. Sales of recreational vehicles (RV’s, not my initials) have been unprecedented as have caravans and mobile homes. The investment witnessed here (RVshare) is substantial, a hard market as has been shown by boat ownership, but has commercial opportunity supply too. As quoted in the article it’s a hot space:

“Peer-to-peer RV rental company Outdoorsy recently secured $88 million in venture funding, camper van and caravan rental agency startup, Cabana [which launched earlier this year], has raised more than $3.5 million from investors, and Kibbo, another newly-launched startup, offers rental vans, a network of home bases and more for a monthly fee for adventurous nomads.”

Back to Top

CRYPTO AND BLOCKCHAIN MEETS STR

For a few years, we have been involved to varying degrees in the Blockchain world and its volatile currency and token ecosystem. Few have succeeded in making a mainstream impact in the travel world, but that does not mean it will not happen. Other parts of the hospitality industry have made impressions and are using an immutable ledger for exactly that reason, the Airlines Reporting Corporation (ARC) in partnership with Blockskye is making this happening right now.

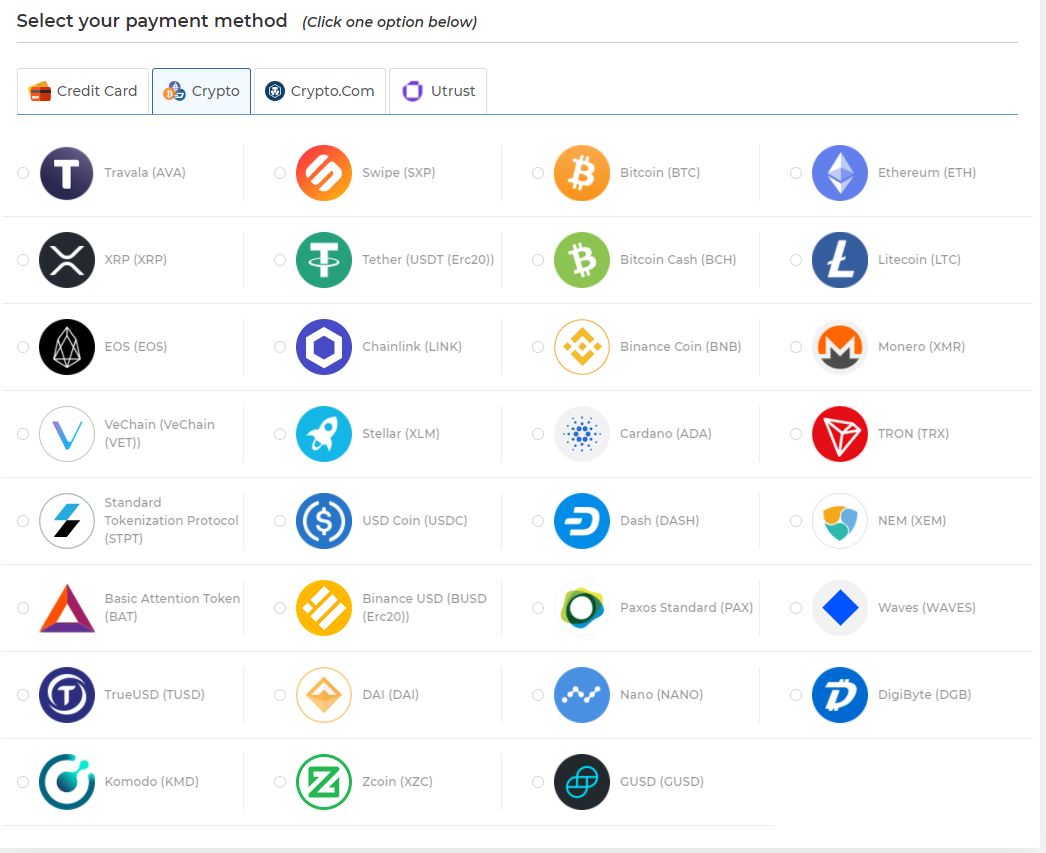

As an actual example of a booking platform, there is Travala.com. TBH a pretty good attempt at an OTA site, initially, but check the huge investments below on mainstream marketplaces and the challenge to get traction, which is dependent on many things, costs a lot money (fiat). Plenty of promises on best price too. Booking.com is fractionally cheaper but direct is 10%+ cheaper on properties I am familiar with from a previous management life (even after logging in and becoming a member). The real difference is checkout and payments, where payment is possible via a number of coins.

Another major problem in this site on rental space is the hotel format results, which offers the same apartment, 4 times, same dates, same terms, with 4 different prices ranging from £600 to £1000. A perfect example of how complex integrations and presentation of data across industries is. Paying with Crypto (VET, BNB, ETH) adds a further £200, hardly an incentive to book in a world of legal crypto! Summary: It’s not going to fly and the industry needs time to adapt.

We have also tracked Winding Tree for some time, from its airline enthusiasm days to the more recent “build a travel agency” open source approach. Commendable in its approach and we hope all those entrepreneurs now jump on the dev bandwagon and get ahead of the competition by getting better rates directly from suppliers”. The suppliers will however follow the bookings and any friction that is involved will stop this happening. This still requires the current tech companies, mainly PMS systems or channel managers to engage and this will not happen unless there is a booking flow. We already witness API fatigue and companies being more discerning on how they distribute and connect. We still consider this a great idea and ahead of its time and probably needs a standardised API framework.

Overall this industry needs to adopt Blockchain and Cryptocurrency in a way that avoids confusion, complexity and without deep knowledge of what is happening below the proverbial hood. If we look at the industries that can truly benefit they are the ones that need to create a chain of custody, traceability, fixed data, multiple discreet and distributed partners who need the same reliable information. If this can be combined with increased trading value as a financial incentive (reduce cost, increase efficiency, receive a reward or reduce risk) then this is a winning formula.

TRIPS COMMUNITY

This is why we love Trips! After 3 years of evangelisation in the STR market, Trips Community has reached a good position in the minds of the top industry players. Whenever “Blockchain” is discussed in this sector TRIPS comes up, this is no short measure to Luca de Giglio who has presented numerous times across the globe on the subject. A recognised expert in STR and the crypto world, he leads the charge on TRIPS. After a tough COVID enhanced summer in which Defi (Decentralized Finance) has proven a first real use case for blockchain and its disruptive powers, TRIPS is now moving in two directions:

a) Creating open protocols to be embedded in Direct Bookings sites: payments, escrow, dispute management and reviews. They are also now experimenting with direct tokenised marketing, which basically means, skip Facebook and Google and pay people directly, in Trips tokens, for sharing content. The protocol development snipes at those already challenging rental issues that can leverage long term developments.

b) As mentioned above the business of a decentralized OTA, takes time and will be the last leg of a multi-year journey.

The Trips tokens are now on the market and can be bought and sold in a few seconds!

NO CHANCE OF FRAUD

Trips Community is in the process of moving the Trips token to a treasury managed by a group of people elected by the Community, totally out of the control of Luca De Giglio, the founder. Amongst them myself, Richard Vaughton, Chris Maughan and the two founders of Origin Protocol Matthew Liu and Josh Fraser. This is to ensure complete security and no token fraud. To read more about how this election works see this link. For anybody who wants to dive into this (be ready it’s not easy) then head to their Discord (https://discord.gg/JAxeeDp) to witness first-hand how they were able to double their user base in two weeks.

Remember the crash in the early 2000’s when the Internet was overblown? Now consider where we are. We have had the crypto boom and bust and to show where the world is headed, this is an article this week on digital currencies and the transformation of the ancient banking systems. Mobile, decentralised and involving massive corporations, the whole article is written by Asheesh Birla is the SVP of Product and Corporate Development at Ripple. Guess what Ripple is?

DATA USE

Without doubt, data is the big thing for 2021 and the rest of the century. Who controls the data and the analysis has an edge and control over those who don’t. So a few interesting links below:-

This week coming (25th and 26th November) is

This week coming (25th and 26th November) is

Paola Van den Brande

Paola Van den Brande

BUILDING A FUTURE: This short term rental warhorse who has been a little more quiet than usual. Whilst we have all gone Zoom crazy

BUILDING A FUTURE: This short term rental warhorse who has been a little more quiet than usual. Whilst we have all gone Zoom crazy

No company has paid us to write or list any links, products, or references!

No company has paid us to write or list any links, products, or references!