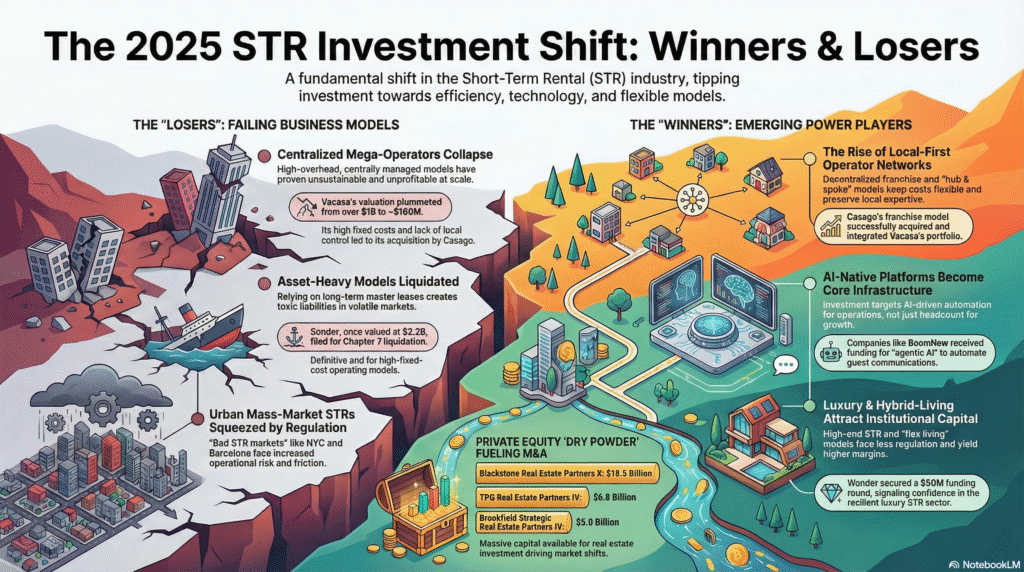

This 2025 Global Short-Term Rental M&A Report provides an analysis of the shifting financial and operational landscape within the flexible accommodation sector. It highlights a major industry transition from centralised, high-overhead management models toward decentralised, asset-light franchise structures, exemplified by the collapse of Sonder and the acquisition of Vacasa by Casago.

DOWNLOAD THE FULL REPORT HERE (PDF)

Investors are increasingly prioritising AI-driven technology stacks and automated property management systems to enhance efficiency and mitigate rising labour costs. The report also emphasises that regulatory pressure in urban centres is pushing institutional capital toward luxury segments and mid-term rental models that offer greater stability.

Geographically, while the Middle East sees growth backed by sovereign wealth funds, Western markets are undergoing a period of private equity-led consolidation. The document serves as a strategic guide for navigating the fragmentation of hospitality into diverse, tech-enabled asset classes.

DOWNLOAD THE FULL REPORT HERE (PDF)

The video below is a summary of the transition from asset-heavy to nimble, asset-light, tech-first, with local knowledge. Created by Google Notebooklm automatically.

Similarly, this infographic was also created using Notebooklm

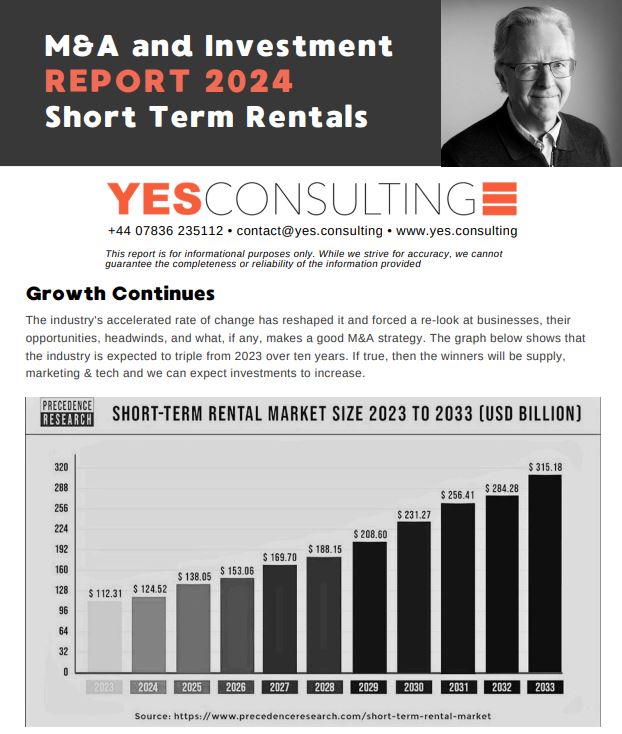

The Future of M&A and investment in the Vacation Rental Sector

The Quiet Revolution that is Redefining the Vacation Rental Industry in 2025

Booking a vacation rental online feels simple. A few clicks, a credit card number, and you’re set. But behind that seamless transaction, a quiet revolution—and in some cases, a brutal shakeup—has been raging. The year 2025 will be remembered as the moment the ground fundamentally shifted beneath the short-term rental industry. It was a year of reckoning.

While you were planning your getaway, titans of the industry, once valued in the billions, were collapsing into liquidation. The “growth at all costs” mantra that defined the last decade finally met its match in simple economics. What emerged from the rubble wasn’t just a leaner industry, but a smarter, more resilient one. The models that are winning today look nothing like the ones that dominated just a few years ago. Here are the five truths that redefined the entire landscape.

The landscape of vacation rentals is increasingly influenced by m&a activities, shaping the future of investment in the sector.

1. The “Bigger is Better” Myth Died Spectacularly

For years, the industry playbook was simple: grow fast, capture market share, and worry about profits later. In 2025, that playbook was thrown onto a bonfire. High-fixed-cost, centralised business models didn’t just stumble; they failed catastrophically, proving that sheer scale offers no protection against a flawed structure.

The most stunning example was the collapse of Sonder. Once valued at a staggering $2.2 billion, its asset-heavy master-lease model—signing long-term, fixed-cost leases on properties in expensive urban cores—crumbled under its own weight. This structure was fatally vulnerable when its variable revenue fluctuated due to regulatory changes and market downturns. The fixed costs remained, leading to a Chapter 7 liquidation of its U.S. operations.

Similarly, Vacasa, another industry giant, saw its valuation plummet from over $1 billion to approximately $160 million. Its centralised, high-overhead structure, reliant on salaried staff, became completely unsustainable when labour costs and regulatory complexity escalated. This fragility wasn’t isolated; the shutdown of Homelike, a prominent MTR startup, proved that even adjacent sectors were vulnerable to the same pressures. The lesson was clear: a business model built on heavy liabilities is a house of cards, no matter how big it gets.

2. The Future is Local (and Powered by a Central Brain)

The strategic importance of m&a cannot be overstated, as it allows companies to consolidate resources and enhance operational efficiency.

The collapse of centralised giants created a vacuum, and a new, counter-intuitive model rose to take its place: decentralised, “local-first” networks. The most consequential transaction of the year was Casago’s acquisition of Vacasa’s sprawling portfolio. But this wasn’t just a simple buyout; it was a strategic dismantling.

Casago, built on an asset-light franchise model, acquired Vacasa’s scale but immediately began dissolving the bloated central office to empower local partners who have “skin in the game.” This “Hub + Spoke” strategy is the new winning formula. It preserves invaluable local operating knowledge and owner relationships (the spokes) while centralising the heavy-lifting of technology, marketing, and support (the hub). This model is being replicated by other successful consolidators like the UK’s Sykes Cottages and Travel Chapter, and PE-backed roll-ups like Awayday, all built on the same core principle:

…avoid the “big corporate bloat” that sank Vacasa.

Crucially, this decentralised operational model is only viable because of the sophisticated technology powering the hub, which leads directly to the next major shift.

3. Forget Properties—Investors Are Now Buying AI-Powered Brains

Investors are closely monitoring m&a trends to identify potential growth opportunities within the vacation rental market.

The evolving dynamics of m&a are set to redefine how businesses approach growth and scalability in the coming years.

The flow of capital tells the real story of an industry’s priorities. In 2025, the smart money stopped chasing property counts and started chasing defensible technology. Specifically, investors began buying the AI-powered “brains” that enable the efficient “Hub + Spoke” model.

This explains Casago’s strategy perfectly. Immediately after the Vacasa acquisition, it partnered with specialised PropTech firms like Breezeway for operations and Wheelhouse for revenue management. The source is clear: for this model to work, “standardisation through specialised PropTech is not optional but a critical requirement.”

Artificial Intelligence is no longer a buzzword; it’s foundational. We saw precision investments, such as the $12.7 million in funding for Boom, a company building “agentic AI tools that automate 80% of guest and operational communications.” This isn’t about adding a chatbot; it’s about reducing labour costs and creating an intelligent, 24/7 data source. The ultimate validation came when Hostaway achieved a $1 billion valuation, confirming that the Property Management System (PMS) is now the industry’s defensible “core operating system.”

As we look ahead, the role of m&a in shaping competitive advantage will be pivotal for established and emerging players alike.

4. Regulation is the New Kingmaker

As the vacation rental market evolves, m&a will play a crucial role in determining which companies thrive and which do not.

For years, operators battled over technology and branding. Today, the most important battle is fought in city halls, and it directly influences which business models survive. As we saw with Vacasa, escalating regulatory complexity can break a centralised operation. The regulatory environment has become the single most dominant factor in determining success, effectively splitting the world into two distinct market types.

• Good STR Markets: These are typically leisure-focused and pro-business, including US Sunbelt leisure markets, UK/European rural & coastal destinations, Mexican leisure markets, and hyper-regulated but pro-business hubs like Dubai.

• Bad STR Markets: These are often large urban cores with intense housing politics, such as NYC, SF, Barcelona, and Amsterdam, as well as highly political housing markets like Australia and Hawaii.

This divergence dictates everything: where private equity deploys capital, which companies can scale, and whether centralised or decentralised models can survive. The market has spoken, and the message is clear.

Regulation is now the No.1 determinant of who can scale, not capital, not tech, not brand.

Interestingly, the luxury segment has become a resilient frontier, thriving in leisure markets with less hostile regulation, providing more predictable cash flow for investors.

5. The Term “Short-Term Rental” Is Becoming Obsolete

The final truth of 2025 is that the industry is outgrowing its own name. The lines that once separated Short-Term Rentals (STR), Mid-Term Rentals (MTR), multifamily housing, and serviced apartments are rapidly dissolving, partly as a strategic response to the regulatory pressures crippling pure-play STRs in urban cores.

The future of the industry is “Flexible Living”—a world of hybrid operating models that blend living, working, and travel. This shift is attracting a new, more serious class of investor. The capital flowing into the space is no longer just from tourism funds; it’s from institutional real estate and infrastructure investors who see flexible accommodation as a mature, legitimate part of a larger portfolio. The industry is undergoing the same institutionalisation process that transformed self-storage in the 2000s and student housing in the 2010s.

This means the vacation rental world is growing. It’s moving beyond its niche origins to become a sophisticated, institutionalised asset class, integrated into the very fabric of how and where we choose to live.

Conclusion: A Flight to Quality

The chaos of 2025 was, in reality, a necessary market correction—a “flight to quality.” The era of “growth at all costs” is definitively over, replaced by a disciplined focus on efficiency, profitability (EBITDA), and resilient, tech-enabled operations. The key valuation drivers heading into 2026 are no longer property counts, but EBITDA quality, owner retention, and regulatory risk.

As technology and institutional capital continue to reshape the spaces we inhabit, the line between where we live, work, and travel will only get blurrier. The question is no longer ‘Where will we go on vacation?’, but ‘How will we choose to live?’

Receive the 2026 “Short-Term Rental M&A Playbook. Founders Guide to Maximising Exit Value”

Click here to add your name to receive the playbook.